- Legal Setback: Ripple’s request to reduce a $125 million fine to $50 million was denied by a U.S. judge, but market reaction remained muted.

- Technical Rebound: XRP rebounded from $1.65 support, breaking above the 100-day SMA to $2.65, with bullish momentum forming a potential trend reversal pattern.

- Institutional Push: CME Group will launch standard and micro XRP futures on May 19, opening the door for institutional exposure to the asset.

XRP is finding new strength after months of bearish pressure, buoyed by favorable technical setups, a bullish market backdrop, and speculation over institutional interest via CME’s futures platform.

Legal Woes and Resilience

Ripple hit another legal snag in its ongoing battle with the SEC. On Thursday, U.S. District Judge Analisa Torres rejected a joint motion from Ripple and the SEC to reduce the civil fine from $125 million to $50 million, citing insufficient grounds under Rule 60. Despite the legal setback, investor sentiment appears to be stabilizing, with the market showing limited reaction to the ruling.

XRP Rebounds Off Key Support

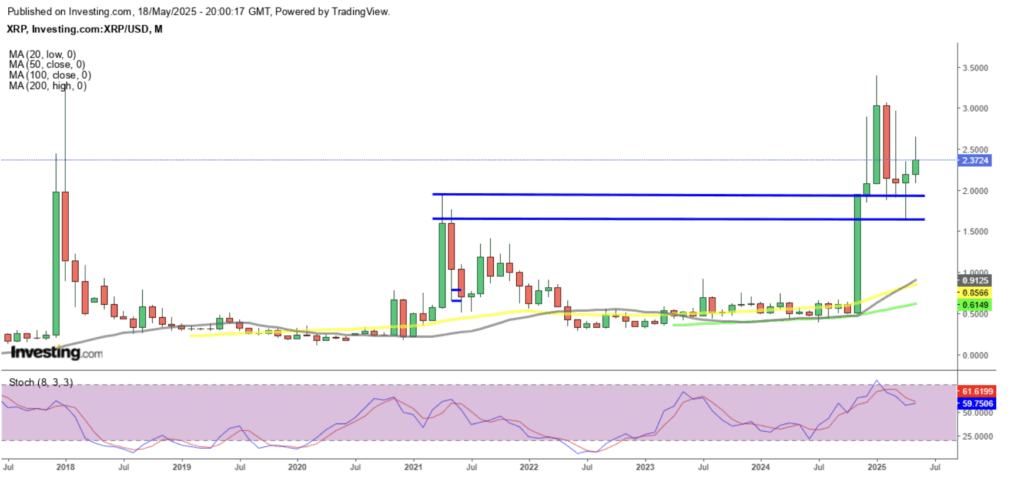

After a 50% drop from its January peak of $3.40 to $1.65, XRP is making a comeback. The $1.65 to $2 zone has proven to be a strong support area, with April’s monthly candle forming a bullish hammer pattern — a signal often seen ahead of trend reversals. Since then, XRP has surged to $2.65, breaking above the 100-day SMA, a level that had previously capped its upside since March.

Institutional Boost: CME Futures Launch

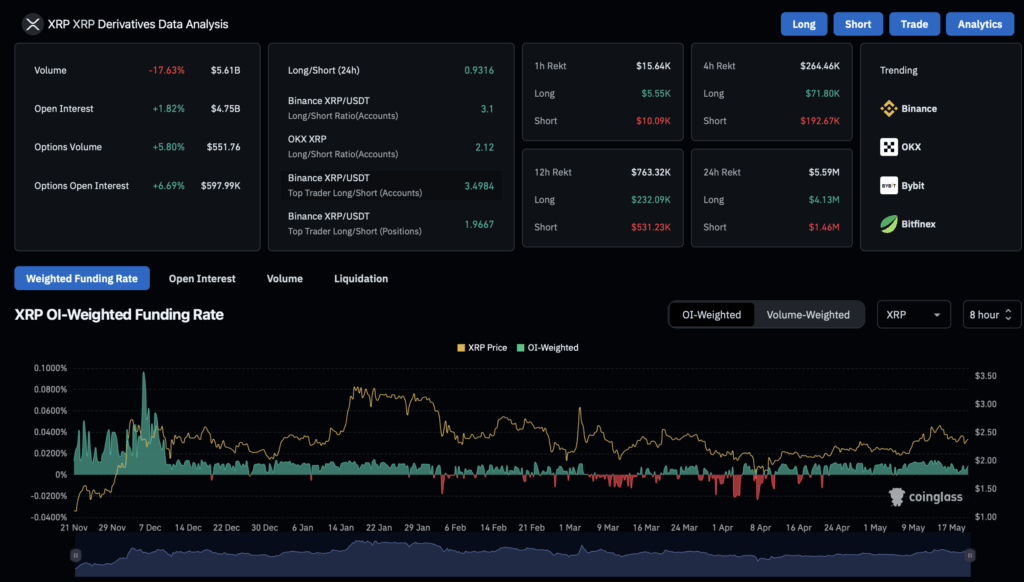

Adding fuel to the rally, CME Group will launch standard and micro XRP futures contracts on May 19, with early access starting May 18 via CME Globex. Institutional investors will now have regulated exposure to XRP, with full contracts covering 50,000 XRP and micro contracts representing 2,500 XRP — both cash-settled against the CME CF XRP-Dollar Reference Rate.

Broader Market Tailwinds

XRP’s bounce aligns with a broader market resurgence, led by Bitcoin’s reclaiming of the $100,000 mark. This renewed momentum has reignited interest in alternative digital assets, with XRP benefiting from the broader bullish sentiment.

Conclusion: Potential for Extended Upside

Despite ongoing regulatory uncertainty, XRP’s rebound from support, bullish reversal patterns, and upcoming CME futures launch suggest the potential for further gains. If positive momentum continues, XRP could be setting up for a broader trend continuation, particularly if regulatory clarity or ETF approval materializes.