- XRP’s richest whales just bought $2B worth of XRP, adding 1 billion tokens in two weeks despite broader market fears tied to the U.S. trade war.

- Whale accumulation is fueled by three catalysts: XRP spot ETF filings progressing, Trump’s crypto reserve proposal including XRP, and Ripple’s $1.25B acquisition of prime broker Hidden Road.

- With XRP holding steady near $1.83, traders are eyeing April 10 inflation data from the U.S. and China as the next big trigger for crypto momentum.

Ripple’s XRP has been hovering around the $2 mark for the past month, give or take a few sharp swings. And while the broader crypto market’s been struggling to regain its footing, XRP’s been quietly doing something interesting — pulling in serious institutional money.

With spot ETF filings in motion and Ripple’s long-running battle with the SEC inching toward closure, corporate and high-net-worth interest in XRP has been climbing fast.

So the big question is: what does it take to join the richest XRP holders right now?

Want to Be an XRP Whale in 2025? Bring $1.8 Billion

According to fresh on-chain data, if you wanted to buy your way into XRP’s top whale class, you’d need to cough up $1.8 billion — yep, billion with a “B.” That would get you around 1 billion XRP, officially landing you in the same league as Ripple’s most loaded holders.

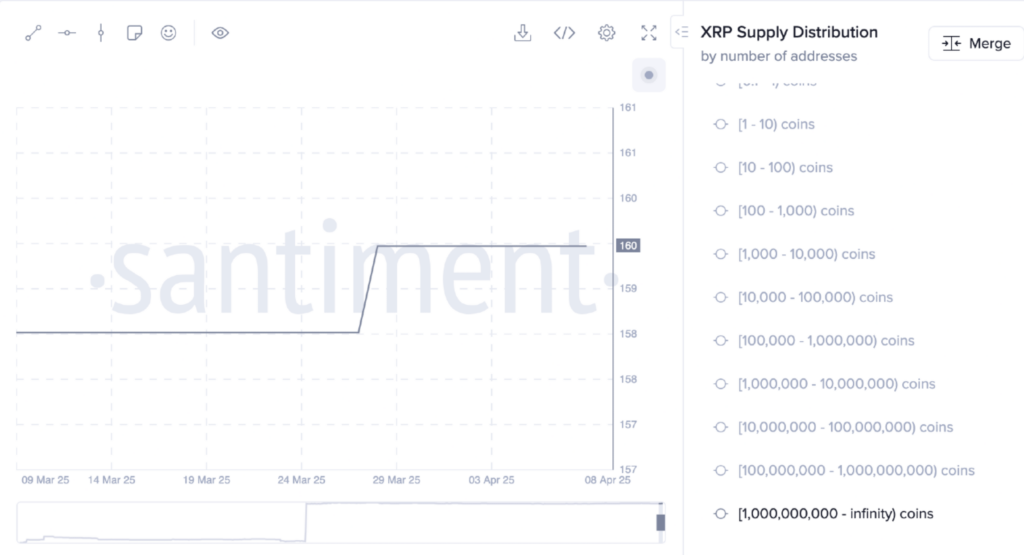

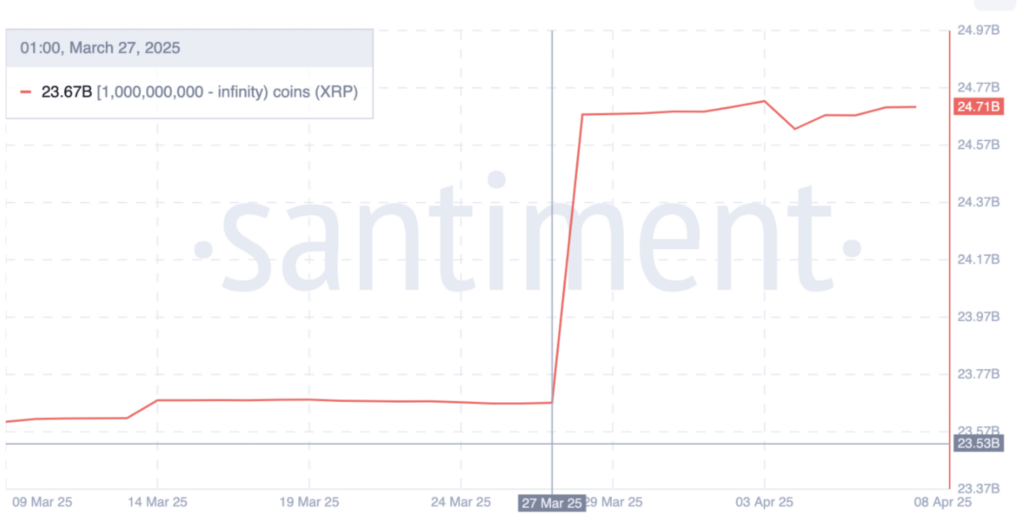

Right now, there are only 160 wallets in that club, and together they hold a whopping 24.7 billion XRP.

And here’s the kicker — just two weeks ago, they held 23.7 billion. So in just 14 days, this elite group accumulated another billion XRP, even as the rest of the market was reeling from the U.S. trade war drama. That’s around $2 billion in whale buying — during a dip.

That’s not panic behavior. That’s positioning.

Why Are Billionaires Still Buying XRP in a Bearish Market?

Even with macro pressure from all sides — inflation, trade war talk, equities rattled — XRP’s biggest players are leaning in. Why? There are three major catalysts:

1. Spot ETF Filings Are Quietly Gaining Momentum

While most of the buzz has been around Bitcoin and Ethereum ETFs, XRP spot ETF applications are quietly progressing. Multiple asset managers are preparing to file, and with Ripple’s recent legal clarity, the path looks a whole lot smoother now.

A spot ETF could mean big money from institutions — pension funds, wealth managers, and the like — who’ve historically sat on the sidelines.

Analysts believe ETF approval could boost XRP liquidity and stabilize price action, while putting XRP in the same tier as ETH and BTC in the eyes of the mainstream.

2. Trump’s Strategic Reserve Includes XRP

Yep, you read that right. In a surprise March 2 announcement, Donald Trump proposed a U.S. crypto reserve, and XRP was on the list — alongside Bitcoin, Ethereum, Solana, and Cardano.

The reserve is part of a proposed economic relief initiative, aimed at strengthening U.S. financial infrastructure and — somehow — reducing national debt.

Why XRP? Probably because of its low transaction fees and real-world remittance use cases. Whatever the reason, that kind of endorsement brings XRP even closer to institutional legitimacy.

And politically aligned investors? They noticed.

3. Ripple Just Bought Prime Broker Hidden Road for $1.25 Billion

In what might be Ripple’s biggest strategic move yet, they’ve acquired digital asset prime broker Hidden Road for a cool $1.25 billion.

That’s a big deal — not just because of the price tag, but because Hidden Road gives Ripple access to institutional-grade custody, stablecoin liquidity, and deeper global integrations.

When the deal wraps, Ripple will become the largest non-bank prime broker for digital assets in the world.

Analysts are calling this a potential game-changer, with Ripple now gunning to rival big boys like Goldman Sachs, but in the crypto-native space.

TL;DR: Whales Aren’t Waiting Around

Whether it’s for the ETF, the Trump boost, or the Hidden Road play — XRP’s top holders just threw $2 billion at the market, even as everything else was sliding.

And here’s the twist: as a decentralized asset with no physical supply chains, Ripple might actually start to look like a safe haven if things get even rougher for traditional assets.

What Comes Next?

All eyes now turn to April 10, when the U.S. and China are set to release new inflation reports. The results could stir fresh volatility — or finally decouple crypto from the bleeding equities and commodities sectors.

For now, XRP is holding around $1.83, down a bit from last week’s high — but if the whales are right, this might just be the calm before the storm.