- XRP is pushing for institutional dominance with over 100 financial partners, while Stellar is targeting the underbanked with grassroots financial tools.

- Stellar’s open-source approach and $3B tokenization goal aim to reshape access to global finance from the ground up.

- While XRP leads in adoption and market cap, XLM’s smaller size and mission-driven focus offer high upside for long-term believers.

If you’ve been watching crypto for more than a minute, you already know XRP isn’t just another random token floating around in the altcoin sea. It’s been one of the key contenders in the race to overhaul global finance—and Ripple’s pushing that vision hard. Their goal? Replace the slow, expensive, middleman-heavy system of international banking with something faster, cheaper, and way more modern. XRP, built on the XRP Ledger, acts as the go-between for currencies around the world, cutting down cross-border transfer times from days to literally seconds. And while it’s had its fair share of legal and regulatory headaches, the momentum is starting to swing in its favor again.

Now that we’re in mid-2025, Ripple’s network of partners is huge—over 100 financial institutions across the globe, from banks in Japan to remittance services in South America. The world is finally starting to catch up to what XRP has been quietly building all along. And with new updates, fresh partnerships, and bullish market signals rolling in, XRP isn’t just back in the spotlight—it might be ready to make a serious play for dominance.

XLM Wants to Bank the Unbanked—And It’s Just Getting Started

Stellar’s story is rooted in accessibility. It was co-founded by Jed McCaleb—yep, the same guy who helped launch Ripple—after a philosophical fallout about how blockchain should be used. While Ripple veered toward banks and enterprise-level finance, Stellar went grassroots. The mission? Build infrastructure for people who don’t have access to traditional banking systems. Think developing nations, migrant workers, and underbanked communities. It’s a big vision, and Stellar’s making real moves.

With its own protocol—SCP, or the Stellar Consensus Protocol—Stellar offers blazing-fast transactions for practically no cost. Its native asset, Lumens (XLM), plays a key role in helping money move across borders fast. And it’s not just for crypto nerds: NGOs, government programs, and fintech apps are all using Stellar to move money globally, especially for remittances and micro-transactions. The Stellar Development Foundation is doubling down too, aiming to onboard $3 billion in tokenized assets by the end of 2025.

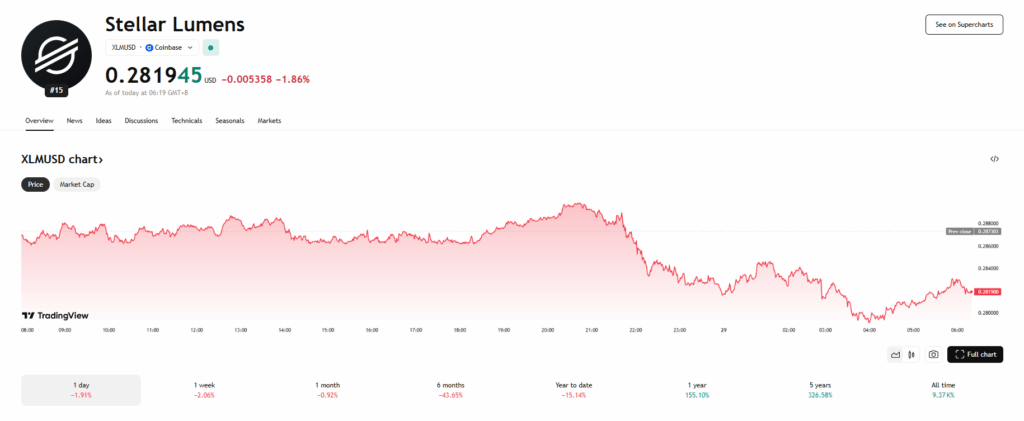

Price-wise? XLM hasn’t blown the roof off lately, sitting at around $0.28 despite Bitcoin ripping higher. But fundamentals don’t always show up in the price right away—and Stellar’s building something that could flip the script when the next adoption wave hits.

Ripple vs. Stellar: Same Roots, Totally Different Paths

To really understand the tension—and potential—between XRP and XLM, you’ve got to look at their shared origin. Jed McCaleb helped launch Ripple but bailed after disagreements about how the company should operate and how XRP should be handled. In 2014, he co-founded Stellar with a new mission: financial inclusion instead of financial overhaul.

While Ripple’s all about playing nice with banks, Stellar’s building the future for people who’ve never even had a bank account. And that fundamental difference is reflected in everything they do—from partnerships to code structure. Ripple’s gone more private and permissioned, making it easier for institutions to plug in. Stellar’s gone full open-source, building a public good that anyone can access. Two visions. Two playbooks. Same end goal: fix the broken global financial system.

What Sets Stellar Apart—And Why It Matters

Ripple and Stellar may have started in the same lab, but today they’re playing very different games. Ripple wants XRP to be the lubricant for the existing financial machine—working with central banks, compliance departments, and legacy infrastructure. Stellar? It’s building an entirely different machine.

Stellar is bottom-up. It partners with fintech startups, humanitarian orgs, and developers who want to create tools for the masses. It’s not about replacing SWIFT—it’s about bypassing it completely. Stellar’s blockchain is public, decentralized, and easy to build on. That’s why it’s been adopted by projects focused on tokenizing real-world assets (RWAs), powering remittances, and creating programmable money that’s fast and cheap.

And don’t sleep on their tokenization game. Their goal to bring $3 billion in RWAs on-chain by year’s end isn’t just ambitious—it’s potentially game-changing. That focus on real utility sets Stellar apart in a market full of hype coins and broken promises.

XRP and XLM Move Together—But They’re Not the Same

In the wild world of crypto charts, XRP and XLM are kind of like shadow twins. When one pumps, the other usually follows. It’s been that way since the early days. Whether it’s investor psychology, shared tech roots, or just habit, they’ve been linked in the minds—and portfolios—of many traders.

Take the 2017 bull run: XRP exploded 35,000% and XLM wasn’t far behind with a 28,000% rally. Even in 2025, when Bitcoin starts to run, XRP and XLM usually catch a piece of the action. Retail traders often treat XLM like a “discount XRP,” betting on it to follow suit.

But let’s be clear—they’re not the same asset. Ripple’s pushing big institutional deals. Stellar’s leaning into humanitarian and fintech use. That gap in strategy is bound to grow wider, and one day soon, it could break their price correlation. So yeah, they still move in sync… for now.

XRP Dominates in Scale—But XLM Still Has Room to Run

If we’re talking raw adoption and visibility, XRP’s clearly out in front. Mid-2025 numbers put its market cap around $55 billion, versus XLM’s $8 billion. That’s a big gap. Ripple has enterprise muscle. It’s signed deals with central banks, helped test digital currencies (CBDCs), and gotten cozy with regulators in key regions like Japan and the Middle East.

XLM? It’s carved a more mission-driven lane. It’s used by NGOs, pilot projects with the UN, and low-fee remittance apps. But it hasn’t seen the same flood of institutional money. Yet.

And that “yet” is important. Smaller market cap = higher upside. If a single killer use case lands for Stellar—like a major government tokenizing billions in assets on-chain—it could send XLM flying. So while XRP has the institutional edge, XLM’s potential isn’t priced in yet.

Which Is the Better Investment—XRP or XLM?

Ah, the million-dollar question: should you go with XRP or XLM? Honestly, it depends on your vibe as an investor. Want institutional exposure, regulatory clarity, and something that’s already proven itself in the real world? XRP’s probably the safer play.

But if you’re the kind of investor who likes asymmetric upside and bets on long-term social impact, XLM has serious appeal. Especially if you believe tokenized assets and financial inclusion are the next big wave. Plus, if XRP gets overheated, some of that money almost always trickles into XLM.

Smart investors? They’re watching both. Holding both. Pivoting as needed. Because this space moves fast—and being early matters more than being perfect.

XRP or XLM? Maybe the Answer Is Both

So, final thoughts: XRP’s the heavy hitter. XLM’s the underdog with a mission. They’ve got shared DNA but totally different outlooks. One wants to work with the system. The other wants to build a new one. Both are legit contenders in the fight to modernize money as we know it.

Which one should you back? Honestly… maybe both. Diversification exists for a reason. And when crypto moves, it moves fast. The key is staying informed, watching the fundamentals, and riding the wave when it comes. And if these two projects keep executing? The wave might be closer than you think.