- XRP is seeing explosive growth in active wallets, new partnerships, and upcoming smart contract support.

- Institutional money is flowing in, thanks to native compliance features.

- Ethereum still owns DeFi, but it’s stuck waiting on upgrades and regulatory clarity.

Alright—picture this: someone hands you $5,000 and says, “Pick one crypto. Only one.” Do you go with XRP, the chain that’s slowly winning over Wall Street with its regulatory-friendly rails? Or do you bet on Ethereum, the OG platform still powering half the decentralized finance universe? It’s not a simple choice. These two play very different games—but both have a shot at serious long-term returns.

That said… one of them looks like the better move right now. Let’s unpack it.

XRP: Real-World Momentum Is Hard to Ignore

XRP’s been heating up in ways that are honestly hard to brush off. According to Ripple’s latest data, the number of active wallets on the XRP Ledger jumped 142% quarter over quarter, hitting a two-year high of 134,600. That kind of growth doesn’t happen unless there’s real interest—and clearly, people are showing up to use the chain.

The big difference here? XRP’s user base leans heavily institutional. We’re talking about entities with actual capital to move, not just retail FOMO. Ripple’s been lining up partnerships that matter—like its new cross-border payment corridor in the UAE with Zand Bank and Mamo, embedding XRP into one of the busiest remittance networks on the planet.

And it’s not stopping there. More stablecoins are launching on XRP Ledger, and perhaps even more important, there’s an EVM-compatible sidechain rolling out this quarter. That’ll open up the chain to smart contract functionality—the same kind Ethereum is known for. Think of it as pulling some of ETH’s dev energy right into the XRP ecosystem.

Even if you don’t know what an EVM or sidechain is, here’s the takeaway: XRP’s about to get a lot more flexible, and that means more devs, more apps, and potentially more value.

Institutional Money’s Taking Notice

According to Ripple’s markets report, XRP-based investment products pulled in $37.7 million in net inflows in Q1—almost rivaling Ethereum, despite ETH having a market cap more than double XRP’s. That kind of momentum says something.

And here’s what XRP’s doing that Ethereum isn’t: it’s baking KYC and AML compliance directly into its protocol. No third-party widgets, no messy smart contracts. For institutions? That’s a massive win. And as more money goes on-chain, this kind of baked-in compliance is gonna matter. A lot.

If Ripple delivers on its roadmap—sidechain, new corridors, more adoption—then XRP’s setup looks downright bullish right now.

Ethereum: Still a Giant, But Slower to Move

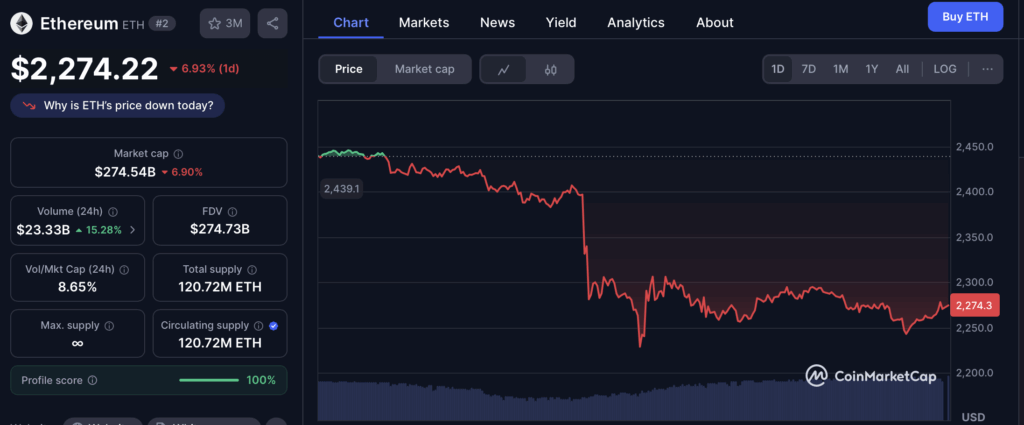

Let’s be clear—Ethereum’s not out of the race. Not by a long shot. But it’s been in kind of a funk. Price-wise, it’s down 29% over the last year. Developer and user interest has waned. The vibes? Meh.

Still, there are signs of life. The recent Pectra upgrade, which went live in early May, added smoother identity features, lower gas fees, and a bit more scalability. It’s a solid step forward. And despite the slump, Ethereum still commands 55% of all value locked in DeFi. That’s not nothing.

What’s holding it back? Regulation. Ethereum’s compliance framework is fragmented. KYC? Depends on the dApp. Token standards? All over the place. If Ethereum wants serious institutional capital, it needs more consistency. And fast.

The bull case for ETH hinges on two big “ifs”:

- If upgrades like Pectra lead to a smoother, cheaper, faster ecosystem…

- And if it nails standardized, regulation-friendly tooling…

If both hit, ETH could easily 2x or more in a few years. But it’s not guaranteed. And it’s definitely not immediate.

Verdict: XRP Gets the Edge (For Now)

If you’re making a bet today, with $5,000 on the line, XRP looks like the stronger play. Real-world usage? ✅ Growing institutional traction? ✅ Regulatory alignment? ✅ It’s all lining up—and fast.

Ethereum still matters. It’s the backbone of DeFi. But right now, it’s moving slower. And in this market, speed matters.