- XRP has been stuck between $2.05 and $2.33 due to declining network activity, weakening open interest, and strong resistance from moving averages.

- New addresses and daily activity on the XRP Ledger have plummeted, while open interest has dropped 30%, indicating fading trader confidence.

- If XRP loses the $2 support zone, analysts warn of a drop to $1.20, though long-term consolidation could still spark a major breakout.

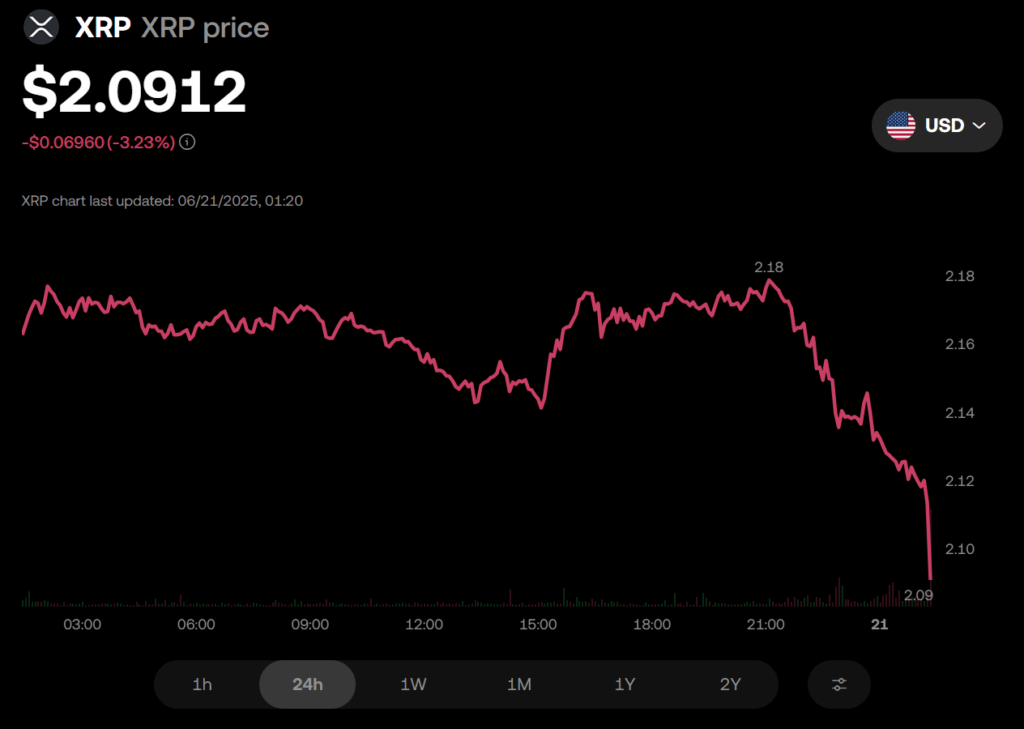

XRP is trading at $2.11 and has been rangebound between $2.05 and $2.33 for the past month, unable to break past the $3 mark. While investors watch closely for a breakout, key data points show why XRP remains locked in consolidation — including falling activity on the XRP Ledger, declining open interest, and lackluster technicals.

XRP Ledger Network Activity Slows Significantly

Network activity on the XRP Ledger has dropped sharply. According to data from Glassnode, new daily addresses have plunged from a January peak of 15,823 to just 3,500. Daily active addresses are also down to 34,360 after briefly spiking to 577,000 over the weekend. This slump points to fading user interest and reduced onchain momentum.

Historically, this kind of slowdown often signals either price stagnation or a downturn, as lower transaction activity tends to dampen liquidity and suppress buying pressure.

Falling Open Interest Signals Bearish Expectations

Open interest (OI) in XRP has also dropped off significantly. Data from CoinGlass shows a 30% decline in OI — from $5.53 billion to $3.89 billion. This indicates that many investors are exiting positions, anticipating weaker price action in the near term.

A similar trend unfolded earlier this year: after a drop in OI in January, XRP saw a 53% price correction, falling to $1.61 from a multi-year high of $3.40.

Technicals Suggest More Sideways Action — Or Worse

XRP is currently trading beneath major resistance between $2.22 and $2.40, where all key moving averages are bunched together. If bulls can’t push the price above those trendlines, XRP may stay in this tight range for several more weeks. Previous breakdowns below these averages led to prolonged consolidation and eventual drops before any recovery.

Trader CasiTrades noted, “XRP price continues to struggle with the $2.25 level… as long as this remains resistance, the chances of dipping to $2.01, $1.90, or even $1.55 grow.” A descending triangle pattern even hints at a possible 45% drop to $1.20 if XRP loses support at $2.

Still, some analysts say this months-long consolidation might be laying the groundwork for a big upward breakout, much like XRP’s rally to $3 in 2017 — and perhaps even toward $10.