- XRP dropped 2% after the SEC delayed the Franklin Templeton ETF decision until June 17, 2025.

- RSI suggests weak momentum, and Bollinger Bands hint at short-term consolidation.

- May 14 might bring new energy with ProShares’ XRP futures ETFs on the horizon.

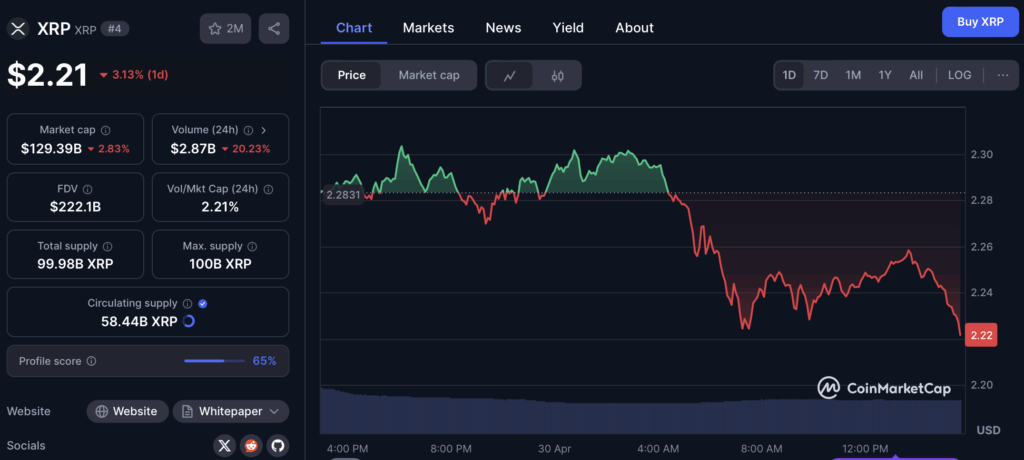

So, XRP’s back in the headlines—but not quite for the reason traders had hoped. As of now, the token’s sitting around $2.25, down about 2% over the past 24 hours. What’s behind the dip? Well, it looks like the U.S. SEC decided to hit the pause button on its review of the Franklin Templeton spot XRP ETF. The original verdict was expected by May 3… but nope—we’re waiting until June 17, 2025 now.

Franklin Templeton Has to Wait a Little Longer

Franklin Templeton’s not some small-time player either—they manage a massive $1.5 trillion+ in assets. Their application, filed via Cboe BZX Exchange, entered the review cycle back on March 19. Now, according to the SEC, they just need more time. Classic SEC move.

And it’s not just Franklin in the waiting room. Grayscale, Bitwise, WisdomTree, and 21Shares also have applications collecting dust as decisions are dragged out.

But let’s not panic—James Seyffart, ETF analyst over at Bloomberg Intelligence, reminded everyone that delays like this? Pretty normal. Doesn’t mean denial. Just… government things.

Oh, and while the spot ETF is on hold, ProShares is still aiming to drop its XRP futures ETFs on May 14, per their latest post-effective filing. So, some action’s still on deck.

What’s the Chart Telling Us Right Now?

Alright, technicals time. The RSI (Relative Strength Index) is hanging out at 52.79. Translation? The market’s kinda indecisive. Buyers and sellers are basically staring each other down, with neither side making a strong move just yet.

Also—keep an eye on those Bollinger Bands. The 20-day SMA is hovering around $2.15, the upper band’s near $2.30, and the lower band’s chilling at $1.99. XRP’s trading in the upper half of the range—not too shabby—but it’s not quite smashing resistance either.

And the bands are narrowing, which tends to hint at—yep—lower volatility ahead, at least in the short term. So don’t expect fireworks just yet.