- XRP is trading at $2.33 and gaining traction after a 340% yearly surge, with $2.50 seen as the next key breakout level.

- On-chain data shows holders are sensitive to market swings, but momentum is building after a period of consolidation.

- XRP’s decentralized design and fast, low-cost transactions are fueling renewed institutional interest in its payment tech.

XRP, launched in 2012, was designed to streamline global payments with lightning-fast settlement times—usually around 3 to 5 seconds—and ultra-low energy usage. It’s long been seen as a scalable and efficient alternative to Bitcoin, especially for cross-border transactions.

Price Action Update

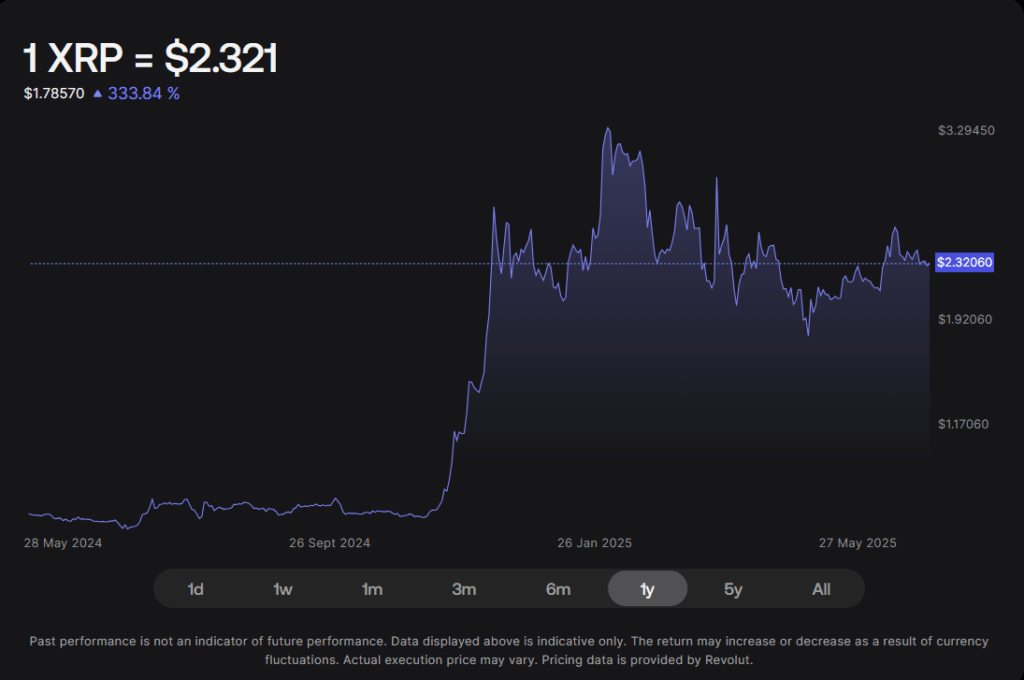

Currently priced at $2.33 with a market cap of $137.2 billion, XRP has surged nearly 340% over the past year. It topped out at $3.30 before cooling alongside the broader market. Lately though, it’s found strong support and has been consolidating, with price action showing signs of heating up again.

Key Resistance Ahead

XRP is pressing up against resistance at $2.35, and analysts are keeping a close eye on the $2.50 level. That’s the breakout trigger everyone’s talking about—clearing it could spark a fresh wave higher. But with many holders entering during the latest run, the asset could still be a bit jumpy in the short term.

Growing Confidence in XRP

Sentiment has been steadily improving thanks to fresh ecosystem news. XRP’s CTO recently addressed decentralization concerns, pointing out that XRP has no central issuer and runs independently of Ripple’s execs. The XRP Ledger’s design helps guard against centralized control, which is a hot topic in today’s crypto world.

The Road Ahead

XRP is regaining momentum under the radar. With strong fundamentals like speed, scalability, and regulatory sturdiness, it’s well-positioned to attract more institutional attention as blockchain-based payment systems continue to evolve.