- XRP is rebounding after a period of consolidation, currently trading around $2.34 and pushing up against the key resistance level at $2.42, which has proven tough to break.

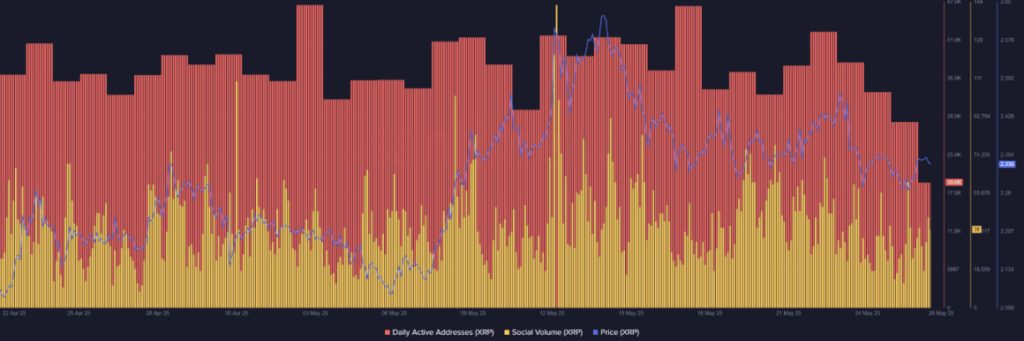

- Technical indicators like RSI and MACD are showing mixed signals, while on-chain metrics (like active addresses and social volume) suggest growing user engagement and investor interest.

- If XRP breaks past $2.42, it could rally toward $2.60, but repeated rejection might lead to a pullback to the $2.20–$2.25 range. Overall, XRP looks poised for a breakout — if it can clear that resistance.

XRP’s stirring again. After chilling in a consolidation phase for a bit, the token seems to be waking up — and so is investor interest. It’s bouncing back nicely, and the buzz is growing louder that a bigger move might be just around the corner.

Holding Steady… But $2.42 Still a Wall

At the time of writing, XRP was changing hands at $2.34, not far off from the local bottom of $2.22 it hit earlier this week. May started off strong for the coin, with a quick pump past $2.50 before it slammed into some resistance around $2.60.

That $2.42 level? It’s acting like a stubborn gatekeeper. The chart shows several candles knocking on that door, but none really breaking through. This resistance has been tested more than once, which might actually be a good thing — pressure’s building.

RSI’s hanging just over 50, so not much to scream about there. MACD crossed bearish recently, though it’s kind of flattening out now — not screaming “bullish” yet, but not totally bearish either. All this points to a market that’s waiting on something big to happen.

Why Everyone’s Watching $2.42

So yeah, $2.42 has become the level to watch. It used to be a support — now it’s flipped into resistance. That kind of thing usually sticks in traders’ minds, and the more times a level gets tested, the more explosive the breakout tends to be… if it happens.

If XRP breaks past $2.42 with some real momentum, we might see a push toward $2.60. If it gets rejected again though? We could see it pull back down to that $2.20–$2.25 range. It’s a classic make-or-break setup.

On-Chain Activity’s Still Looking Good

Now, let’s talk about what’s happening behind the scenes. On-chain data’s been showing a nice uptick in daily active addresses. That means people are using the network — a good sign.

Social chatter around XRP has also been pretty active. That spike in mentions earlier this month? Yeah, it came right before the last price pop. So community interest seems to be moving in step with the price, which is bullish.

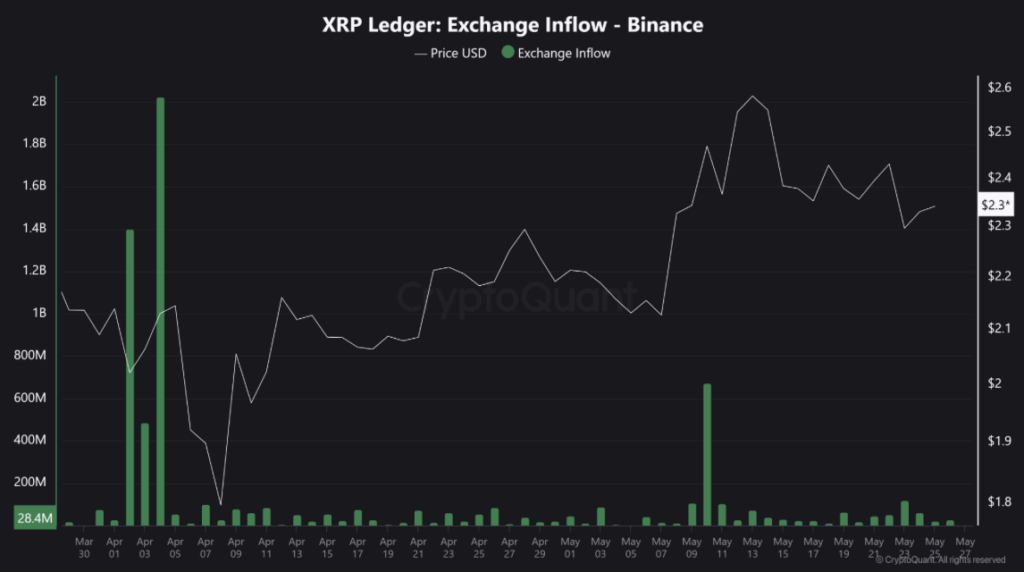

Also, exchange inflows jumped around May 9. That’s usually a sign that traders are either stacking bags for the long haul or maybe setting up to take some quick profits. Either way, there’s demand — and that’s what keeps the engine running.

Final Thought

XRP’s sitting in a tight spot. The volume’s there, the community’s talking, and the on-chain data is humming along. All eyes are on $2.42. Break above that with conviction? The bulls might just run it back to $2.60. But if it stumbles again… yeah, get ready for another round of sideways.