- CME Group will launch XRP futures on May 19, offering both micro and large contract sizes to broaden crypto derivatives access.

- Robinhood plans to list the XRP futures, making it easier for retail investors to trade regulated crypto products.

- The move highlights growing institutional demand and CME’s expanding crypto offerings, with XRP now joining Bitcoin, Ether, and SOL futures.

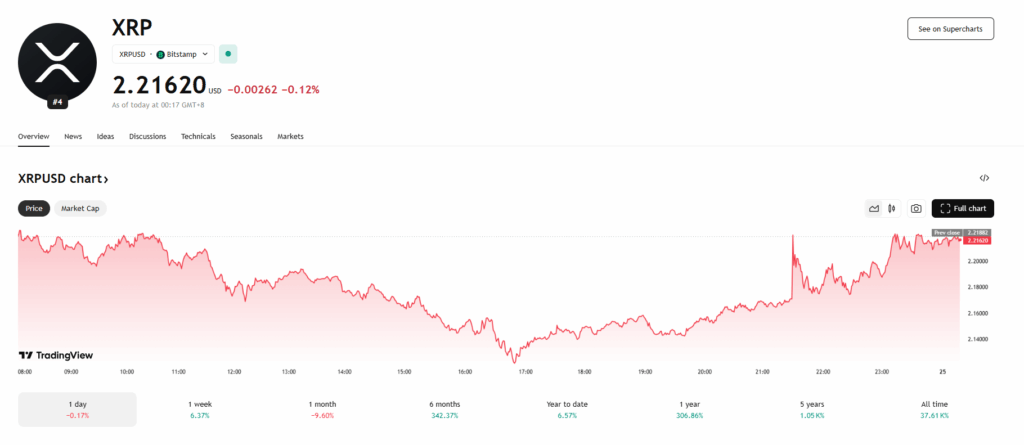

XRP futures are coming to CME Group, and yeah, it’s kind of a big deal. The derivatives giant just announced it’ll roll out XRP futures contracts on May 19, 2025—pending regulatory greenlight, of course. They’ll be offering two sizes: micro contracts of 2,500 XRP and larger ones clocking in at 50,000 XRP. The whole move could open the floodgates for both institutional and regular ol’ retail investors to dip their toes into XRP futures in a legit, regulated way.

Futures for Everyone—Retail, Institutions, You Name It

This launch isn’t just another checkbox for CME’s crypto expansion—it’s another sign that the big players see crypto as more than just digital noise. CME already has Bitcoin, Ether, and recently launched SOL futures, so XRP’s addition makes sense. These contracts will be cash-settled and tied to the CME CF XRP-Dollar Reference Rate (calculated daily at 4PM London time, in case you were wondering).

Giovanni Vicioso, CME’s head of crypto products, put it like this: “As the digital asset world keeps evolving, folks want more ways to manage risk—regulated futures like these help do exactly that.”

And Robinhood? Yep, they’re jumping in too. They’ll offer XRP futures to their users, which could make crypto derivatives way more accessible to retail traders. According to Robinhood exec JB Mackenzie, “This was the natural next step… our users are hungry for more.”

Numbers Don’t Lie

Let’s talk volume. CME’s crypto product performance in Q1 was wild:

- 198,000 contracts traded daily (~$11.3B notional), up 141% from last year

- Open interest averaged 251,000 contracts (~$21.8B), up 83%

- 43,000+ SOL futures traded since March launch—over $700M worth

That’s serious momentum. And it paints a picture of where this is all headed: institutional money is pushing things forward, and the demand for volatility control is skyrocketing.

XRP’s Big Moment?

Despite still being wrapped in some regulatory fog, XRP has held its ground by doing what it was built for—fast, global money transfers via the XRP Ledger. Sal Gilbertie, CEO at Teucrium, pointed out that XRP’s utility is what gives it staying power: “It’s real-world use case stuff.”

He also highlighted that the Teucrium 2x Daily Long XRP ETF (ticker: XXRP) pulled in $35 million AUM in just 10 days. That’s no small feat.

Final Take

The XRP futures launch on CME—backed by CME Clearing—isn’t just a trading update. It’s another step in crypto becoming a fully functional part of the traditional finance world. More access, more structure, less chaos. That’s the hope anyway.

Whether you’re a degenerate trader or a cautious portfolio manager, May 19 might be a date to circle on the calendar. Crypto futures aren’t new—but this time, they’re coming for XRP with some serious force behind them.