- XRP dropped 3.7%, facing resistance near $2.33 amid falling recovery volume.

- Technical pattern signals potential downside if $2.25 support breaks.

- ETF speculation and Dubai stablecoin approval drive background volatility.

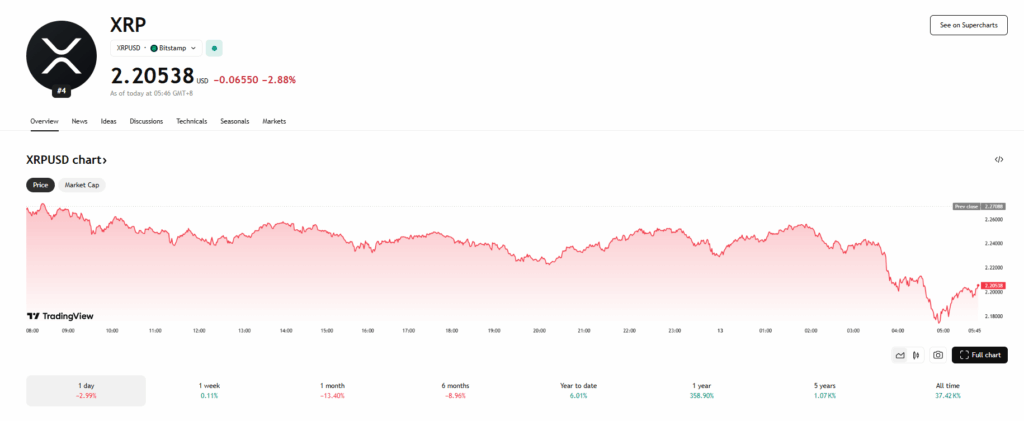

XRP dropped 3.7% over the past 24 hours, falling from a high of $2.288 to around $2.260 after repeatedly hitting resistance near $2.33. Despite forming a short-term double bottom around $2.25, declining volume on recovery attempts signals continued bearish pressure. Technical indicators, including a head-and-shoulders pattern and fading momentum, suggest traders remain cautious amid volatility.

The pullback comes amid rising anticipation over a possible spot XRP ETF decision from Franklin Templeton and Ripple’s recent stablecoin approval in Dubai. However, repeated rejections at the $2.33 level have cooled bullish sentiment, with traders watching closely to see if the $2.25 support can hold. Broader partnerships in Asia and the Middle East still offer long-term promise, but short-term technicals now dominate price action.

Momentum may shift if XRP fails to hold the $2.25 mark, with a downside target around $2.234. For now, eyes remain on volume trends and regulatory developments as key catalysts for the next move.