- Overhyped Bitcoin sentiment and seasonal trends may delay a breakout, despite prices nearing all-time highs.

- Ethereum is showing signs of strength, rebounding from April lows and attracting renewed investor interest.

- Summer vacations and macro uncertainty could slow down crypto trading volumes, setting up for sideways moves or dips.

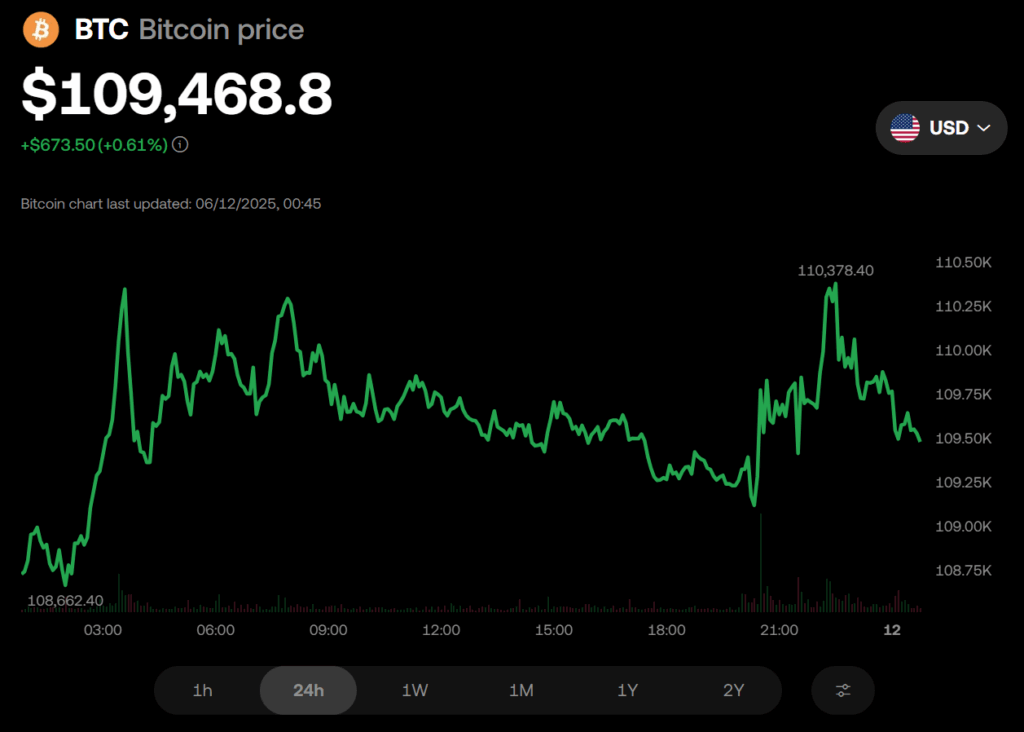

While Bitcoin remains perched just below its all-time high, market analysts are warning that too much bullish hype might actually stall its breakout. In contrast, Ethereum is drawing fresh attention as a potential surprise mover in the weeks ahead.

Sentiment May Be Bitcoin’s Own Worst Enemy

According to Santiment’s Brian Quinlivan, social media chatter is overwhelmingly bullish on Bitcoin right now—perhaps too bullish. Historically, when retail investors grow overly optimistic, prices tend to cool off or correct. Bitcoin has already had a few close calls with its previous high near $112K, which may frustrate traders enough to reset sentiment. Once that happens, a real breakout could follow more organically.

Q3: Bitcoin’s Weakest Season?

Data from CoinGlass shows Q3 has been Bitcoin’s weakest quarter since 2013, averaging just a 6% return. Dr. Sean Dawson of Derive points out that the Fed’s hesitation to cut interest rates could also weigh on Bitcoin’s short-term appeal. Meanwhile, the Crypto Fear & Greed Index currently reads 72—solidly in “Greed” territory—adding to the contrarian case for a pause or pullback before any real surge.

Ether Poised for Catch-Up

While Bitcoin has been hogging the spotlight, Ethereum may be quietly setting up for a run of its own. Ether has rebounded nearly 90% since April lows and is gaining traction among traders who see it as undervalued relative to BTC. Quinlivan suggests ETH has been in catch-up mode since mid-April and is now benefiting from capital rotation within the market.

Summer Slowdown Ahead?

Seasonality might also dampen momentum across the board. Dawson warned that trading volumes could dip as Northern Hemisphere investors take summer breaks, increasing the chances of sideways chop or sharp pullbacks. That said, the lull might give ETH the breathing room it needs to build momentum.