- PEPE token is showing strong bullish signals, with price forecasts predicting a 41.85% gain by September and steady growth through the summer months.

- Technical analysis supports the potential breakout, as PEPE holds above key support with rising volume and EMA compression — often a sign of incoming price movement.

- Accumulating 500M PEPE tokens now is considered strategic, offering high upside potential before September, though staged buying is advised due to ongoing market volatility.

The PEPE token is stirring up fresh hype again, and if the charts are right — now might be a pretty solid time to pay attention. At the moment, PEPE is sitting around $0.00001395, but there’s chatter suggesting it could climb by over 40% in the next few months. Yeah, that’s a bold call, but the technicals aren’t just pulling it out of thin air.

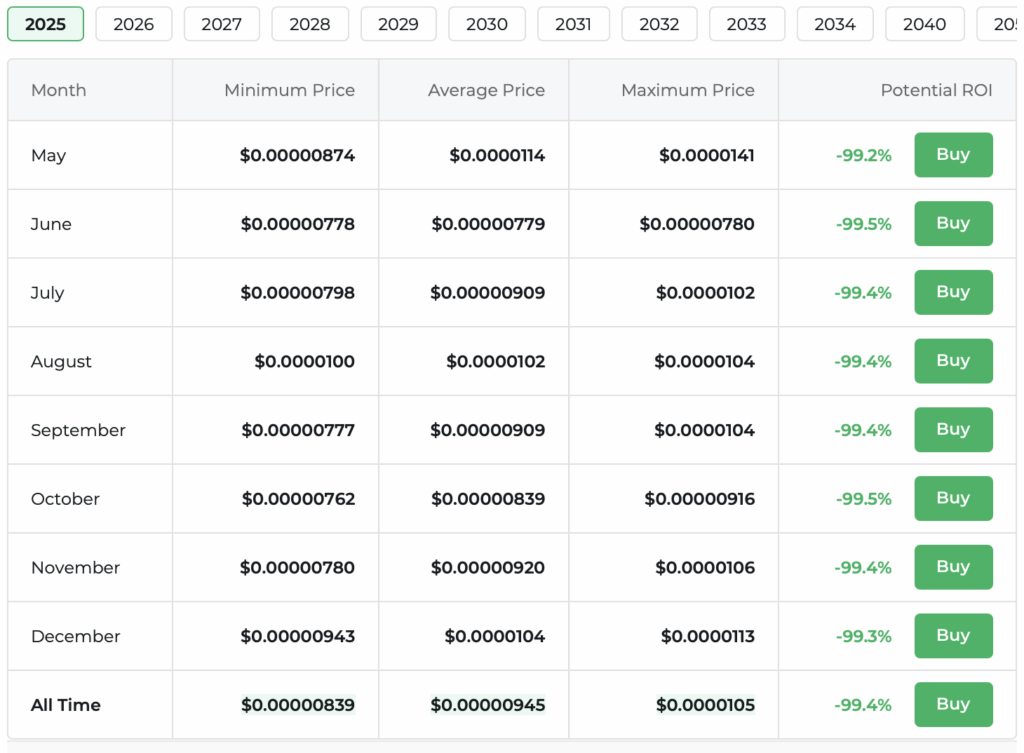

Forecasts for September are hinting at an average of $0.00007726, and even June looks promising with a 32% upside. The price models show a steady increase month-over-month, and while the whole memecoin space can be… chaotic, the setup for PEPE looks unusually tidy.

Technicals Back the Buzz (But Keep Your Helmet On)

The token is riding a rising support line, and that’s helped it recover from some recent dips. What’s interesting is how the 50, 100, and 200-day EMAs are all starting to bunch together. That kind of compression tends to come before a bigger move, and with volume ticking upward, it could mean PEPE is gearing up for a breakout.

Still, it’s not without risk. The token’s been known to swing hard both ways, and predictions for December range from $0.00005568 to $0.00005862 — a reminder that while the upside’s juicy, there’s always a chance of a dip, especially if regulatory noise picks up.

500M PEPE: Why Size Matters (In This Case)

So here’s the deal. The call to stack 500 million PEPE tokens isn’t just about getting rich quick. It’s about maximizing exposure during a potential breakout window while the Fear & Greed Index is leaning into “Greed” territory and RSI sits comfortably around 57. The idea is that this kind of accumulation — done smartly, in stages, not all at once — could position holders ahead of a run that technicals suggest might carry into the fall.

Just don’t expect it to be a smooth ride. You’ll want to keep a close eye on those resistance levels and watch for volume confirmation before going all-in. But if the trend keeps up and that September push plays out, those 500M tokens could end up looking real nice in your wallet.