- Solana whales are split—one staked 61K+ SOL, while another sold 44K+ for profit, signaling mixed sentiment.

- Dormant tokens moved for the first time in ages, while retail traders show heavy long bias—raising risk of a reversal.

- Key resistance at $155 could stall any rally; if SOL fails to break through, liquidations may drag price lower.

In the last 24 hours, Solana’s whale activity took a weird turn. One whale locked up 61,838 SOL into staking—probably betting on long-term gains. But right after that, another whale pulled out 44,539 SOL and sold, pocketing $649K in profits. Yeah… mixed signals much? This kind of opposing move shows there’s no clear consensus right now. Some are betting big on what’s next, while others are grabbing their gains and stepping back.

Meanwhile, the market’s still looking twitchy. Retail folks tend to follow the big fish, and with whales showing both commitment and exit signs, nobody really knows which direction things might swing.

Dormant SOL Moves, Longs Overheat

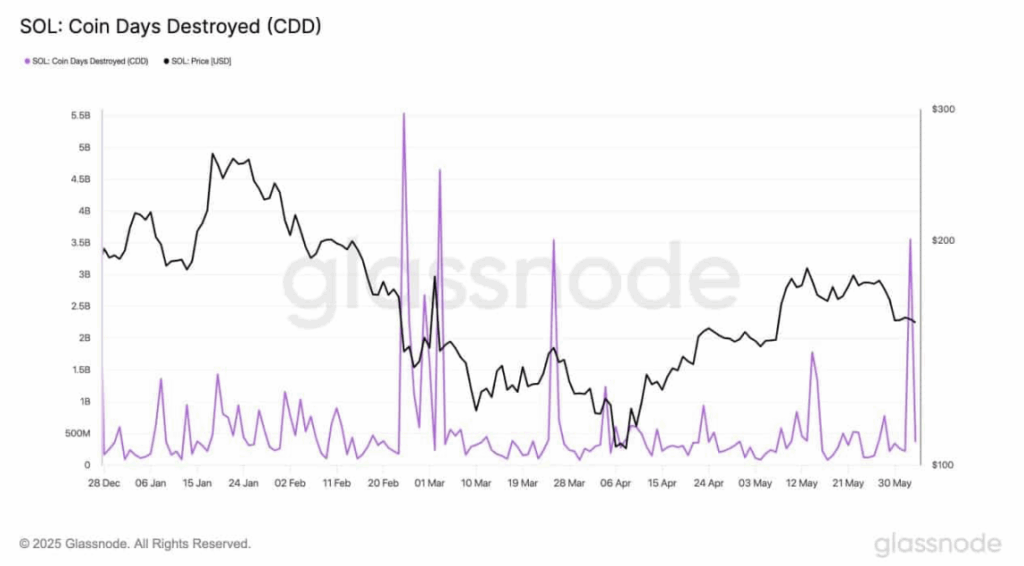

Here’s where it gets interesting—Solana just saw its third-largest Coin Days Destroyed (CDD) spike this year, at 3.55 billion. Basically, long-held SOL that hadn’t moved in ages just came back to life. This usually points to some big wallets moving stuff around—either lining up for a sell or preparing for a shift in strategy.

Add that to the fact that over 75% of Binance traders are in long positions, and you’ve got a recipe for… potential chaos. That long-to-short ratio? It’s sitting at 3.15. Shorts lost $1.73M recently, while longs barely lost $96K. Could be a short squeeze, or just bulls overplaying their hand. But if momentum fades, the reversal could be sharp.

Technicals Looking Fragile, Eyes on $155

Right now, SOL is trading around $148.71—still stuck under its 9- and 21-day moving averages. Those are at $154.91 and $165.31. Not ideal. The RSI is down at 36.84, so yeah, getting close to oversold territory. Until bulls get the price back above those MAs, things look tilted toward the bears. Also, the bearish crossover doesn’t exactly help confidence.

Open Interest on SOL futures dropped 4.26%, now at $380M. That dip shows some folks are backing off leverage, maybe expecting a cooldown. So between all the heavy long positions and dropping Open Interest, you’ve got a lot of uncertainty in the air.

Resistance Zones Could Choke the Rally

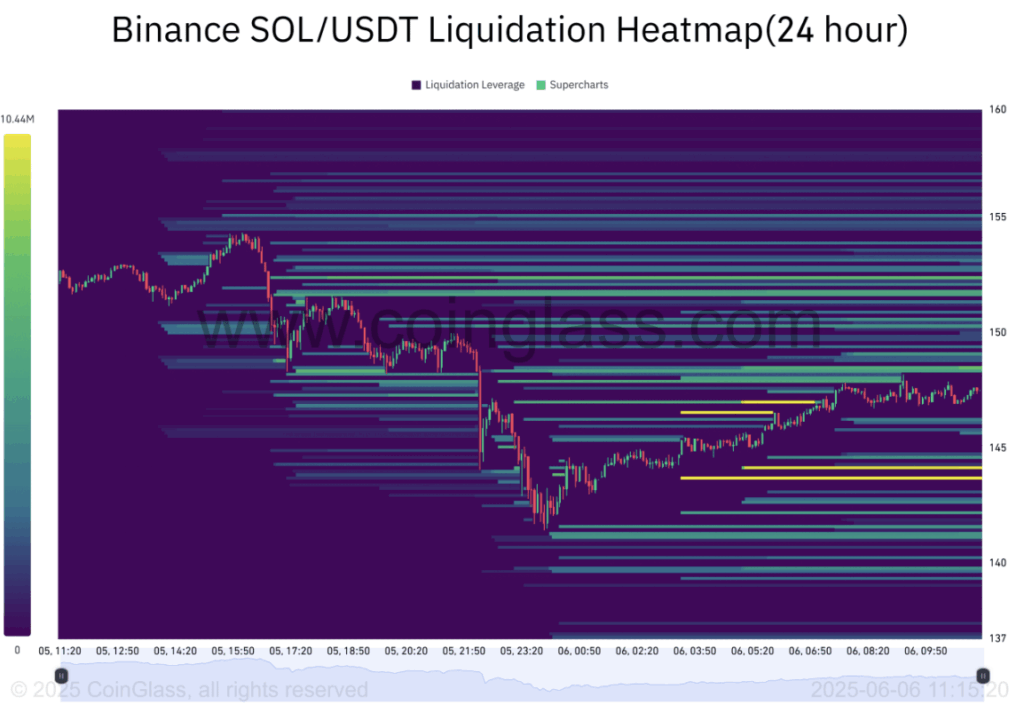

Looking at Binance’s liquidation heatmap, there’s a chunky resistance cluster between $148 and $155. This zone has already slowed the bounce, and unless SOL bulldozes through, it could trap a bunch of leveraged longs. If that happens, cascading liquidations aren’t off the table.

That said, if SOL breaks out above $155 cleanly, there’s a decent shot at a fast climb. But for now, that level looks like the ceiling rather than the floor.