- Institutions and whales are heavily accumulating HYPE, with one wallet buying $29M worth of tokens.

- Retail traders are cautious on spot but very active in the futures market, expecting further upside.

- Indicators like Stoch RSI and DMI suggest short-term momentum might be weakening, with a possible pullback to $38.50.

Hyperliquid (HYPE) has had a solid run lately. After holding the line at $33, it popped to a new all-time high of $43.90 just three days ago. This latest jump adds to a growing two-month uptrend that’s been grabbing the attention of big players across the board—from whales to institutions. Now, it’s looking more and more like HYPE is being viewed as a serious altcoin contender.

Major Buys Signal Institutional Confidence

The recent wave of accumulation is hard to miss. First off, Tony G Co-Investment Holdings Ltd, a Canadian investment firm, scooped up over 10,000 HYPE tokens—worth just shy of $440K—at around $42.24 each. That’s not pocket change. This was part of their longer-term DeFi game plan, which shows they’re not in this for a quick flip.

But that wasn’t the only whale sighting. Onchain Lens spotted a massive buy from another big wallet—this one picked up more than 715,000 tokens, totaling nearly $30 million. The price? Roughly $41.16 per token. Moves like these often get the rest of the market buzzing, especially retailers who see these buys as vote-of-confidence signals from the “smart money” crowd.

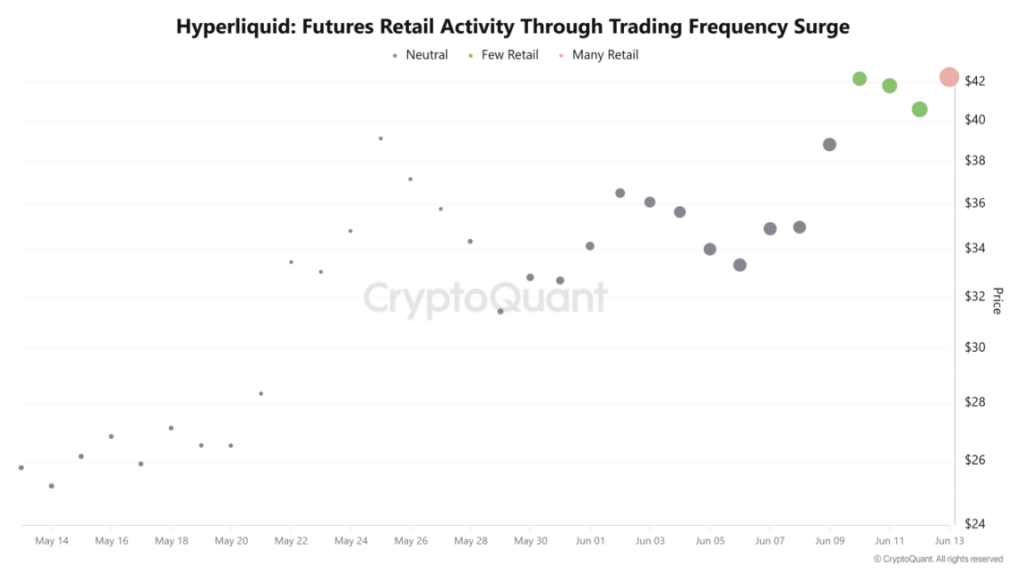

Retail Traders Lean Into Futures, Not Spot

Interestingly, retail traders aren’t diving in the same way—at least not on the spot market. Spot trading activity has actually been on the decline for a few days now. It’s not total disinterest, just… neutrality. The data shows retail is watching but not rushing.

Futures, though? That’s where things get hot. Retail traders seem way more active there, taking long positions and basically betting on HYPE’s next breakout. It’s a mixed message: cautious on one front, aggressive on the other.

Is a Pullback Brewing, or Just a Pause?

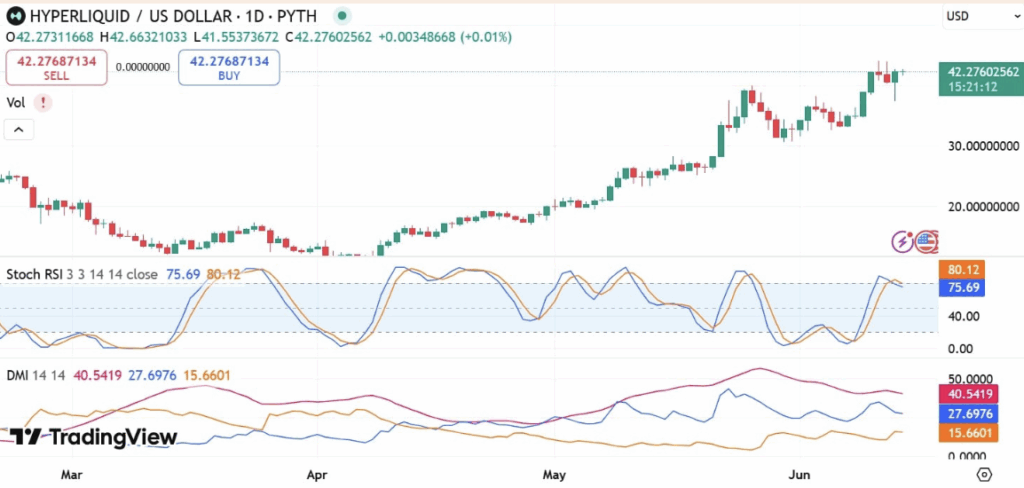

At the moment, HYPE is trading around $42.32, up about 6% in the past 24 hours. Zooming out, that’s a 70% gain in a month and 25% in just the past week. Momentum’s been strong—but it might be starting to wobble a bit. The Stoch RSI flashed a bearish crossover in the overbought zone, which usually hints at short-term selling pressure.

DMI levels tell a similar story. The +DI dropped below the -DI, signaling that downside momentum is quietly building. If things keep tilting this way, a pullback to around $38.50 could be next. But if whales and institutions keep stacking, HYPE might just hold strong and make another run at $44 or even higher.