- The U.S. has hiked tariffs on Chinese imports to 145%, intensifying trade tensions with Beijing.

- Trump defended the move, calling it a necessary step to end China’s “free ride” on U.S. market access.

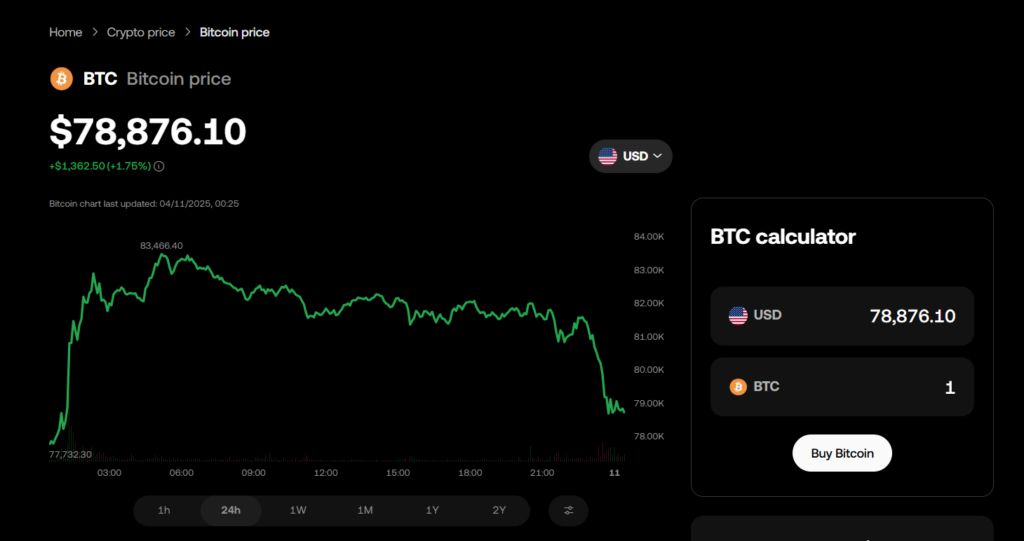

- Crypto markets stayed strong despite the chaos, with Bitcoin near $81,800 and XRP jumping 12%.

In a bold move that cranks up the pressure on Beijing, the U.S. has officially raised tariffs on Chinese goods to a jaw-dropping 145%, according to CNBC. It’s the latest—and most aggressive—step yet in President Donald Trump’s second-term trade blitz.

Just last week, the rate climbed from 104% to 125%. Now? It’s shot up again. And China’s not sitting still—Beijing hit back with 84% tariffs on U.S. exports, setting the stage for what’s now a full-blown trade showdown.

Trump Doubles Down

On Wednesday, Trump jumped on Truth Social to defend the move, writing: “The era of China enjoying U.S. market access with no consequence is over.” The White House says the goal here is rebalancing decades of, in their words, “unfair trade practices.” They’re also pushing hard for reshoring U.S. manufacturing, locking down national security concerns, and rewriting the rules of global trade—on their own terms.

Ripple Effects, Strategic Moves

This new 145% rate? It’s not just symbolic. It could completely shut the door on a bunch of Chinese imports, which—no surprise—has global supply chains bracing for more shocks. That said, there’s some nuance: Trump recently offered a 90-day pause on new tariffs for countries that haven’t retaliated. Allies get a break; adversaries, not so much.

Crypto Steady Amid Turbulence

Meanwhile, crypto’s holding firm. Bitcoin is floating near $81,810, and Ethereum’s hovering just above $1,590. Some altcoins are thriving in the chaos—XRP popped 12%, while Solana climbed 8.9% in the past day alone.