- TRX finds strong support between $0.26 and $0.27 with over 14B tokens held in that range.

- IPO plans and rumored Trump ties are stirring political and financial buzz.

- If support holds, analysts eye a potential move toward $0.30 or higher.

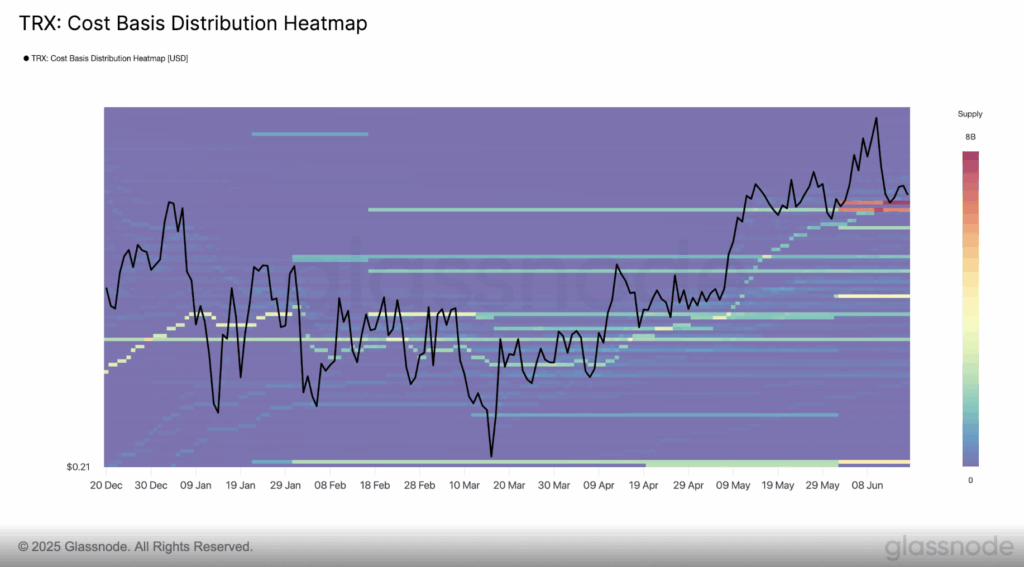

Tron (TRX) is making waves again—and it’s not just price chatter. According to new data from Glassnode, a key support zone is forming right under everyone’s nose. The TRX Cost Basis Distribution chart dropped some serious insight, and now traders are watching closely. A rebound might be on deck.

The big story? Strong buyer confidence showing up between $0.26 and $0.27. That range is stacked with TRX holders. We’re talking over 14 billion tokens bought at those levels. It’s become the strongest accumulation zone on the chart, and honestly, it’s looking like a launchpad if momentum shows up.

Buyers Dig In Around $0.26—That Could Be the Spark

So here’s what the chart shows: a fat cluster of buys in that $0.26 to $0.27 range. Most TRX holders have their cost basis right there. That means they’re already in the green—or close enough—and less likely to dump unless things get ugly. It creates a sort of cushion. A psychological floor.

What’s more, the supply above this level is thin. That’s a good thing. It suggests there might not be a wall of sellers waiting to unload if TRX pushes higher. When that happens, price tends to move fast. Thin air up top, thick support below. You get the idea.

The bulls? They’re hanging on. Volume’s been decent, sentiment’s not bad, and technically—it’s not the worst setup out there.

IPO Buzz, Political Ties, and a Whole New Narrative

This isn’t just about charts though. Tron’s pivot into traditional finance is giving people something new to talk about. That IPO plan? It’s tied to a merger with SRM Entertainment. Kind of an odd pairing at first glance, but analysts are calling it a smart move.

There’s also Dominari Securities steering the deal—and yeah, they’ve got links to the Trump circle. Eric Trump’s name has even been floated for a board seat. Nothing confirmed yet, but even that suggestion is stirring the pot.

This isn’t just noise. Political proximity, real or rumored, tends to shift perception. Add that to the fact that the SEC has closed its investigation into Justin Sun’s companies, and TRX suddenly looks… less sketchy. More “legit,” for lack of a better word.

TRX Price Outlook: Watching That $0.26 Mark Closely

At the moment, TRX is sitting at $0.2704, down about 0.55% in the last 24 hours. Not exactly exciting, but it’s holding the line. Analysts say if that $0.26 support sticks, a run toward $0.30—or even past it—is definitely on the table.

And honestly, the story’s changing. TRX isn’t just about burn mechanics or transaction fees anymore. It’s leaning into something bigger. Regulation. Traditional finance. Even Wall Street. That shift is re-shaping how people are valuing this coin.

For now, all eyes are locked on that cost basis support zone. If it holds, this could be the start of a very different chapter for TRX.