- Trump Media raised $2.44 billion to fund a major Bitcoin treasury initiative and corporate expansion.

- The company plans to hold over $3 billion in liquid assets, including a large BTC reserve.

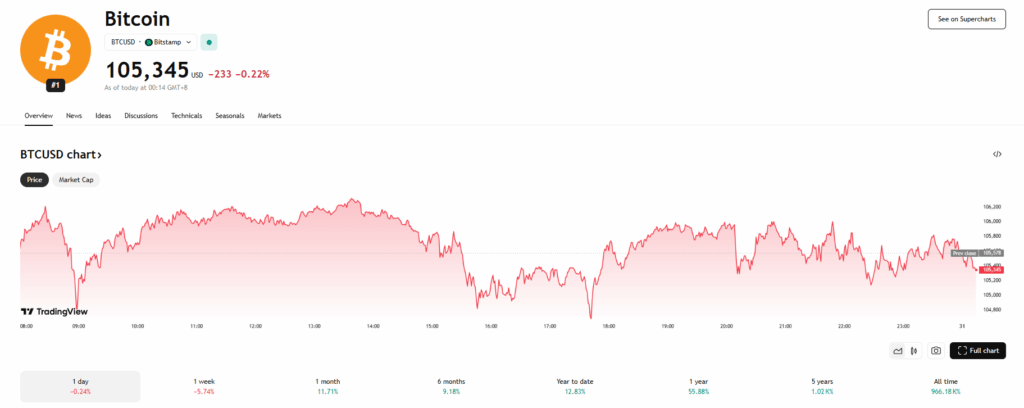

- DJT shares dipped after the initial Bitcoin news but rebounded slightly following the official deal.

Trump Media and Technology Group just locked in a massive $2.44 billion funding round—part of a bold push to become one of the largest corporate holders of Bitcoin. The deal, which included a mix of common stock and convertible notes, aims to fund the company’s new Bitcoin treasury and support its broader growth strategy.

The breakdown? Roughly 55.8 million shares were sold at $25.72 apiece, generating about $1.44 billion. On top of that, the company issued $1 billion in 0.0% convertible notes, priced at a $34.72 conversion point. All in, net proceeds came to around $2.32 billion—most of which is now earmarked for stacking BTC and covering general corporate needs.

Trump Media—best known for Truth Social and the Truth.Fi fintech platform—saw some choppy trading around the announcement. Shares of DJT dropped 10% after the Bitcoin plans were first revealed on Tuesday, but bounced back with a 3.3% uptick Friday, landing at $21.52. That said, the stock’s still down over 36% on the year.

“More Than $3 Billion in Liquidity” — And Exposure to Bitcoin

CEO Devin Nunes painted the deal as a game-changer. “Trump Media is focused on acquiring great assets,” he said in a release. “This deal gives us the financial freedom to execute the rest of our strategy. With more than $3 billion in liquid assets, our shareholders will also gain exposure to Bitcoin.”

According to the company, this is one of the largest Bitcoin treasury deals ever pulled off by a U.S.-listed firm. As of Q1, Trump Media was already sitting on $759 million in cash, equivalents, and short-term investments. Now, with this injection, it plans to join the ranks of top Bitcoin-holding public companies—right behind Strategy (formerly MicroStrategy), which has become the gold standard for corporate BTC reserves with over 580,000 BTC on its books.

This move positions Trump Media not just as a social and fintech brand, but as a growing force in the Bitcoin narrative. Whether the market rewards that shift—or punishes it—remains to be seen. But for now, it’s clear they’re going all in.