- Tron Group is planning to go public in the U.S. via a reverse merger with SRM, backed by $210M in TRX tokens.

- The network saw $1.38B in stablecoin inflows this week, signaling rising investor interest and activity.

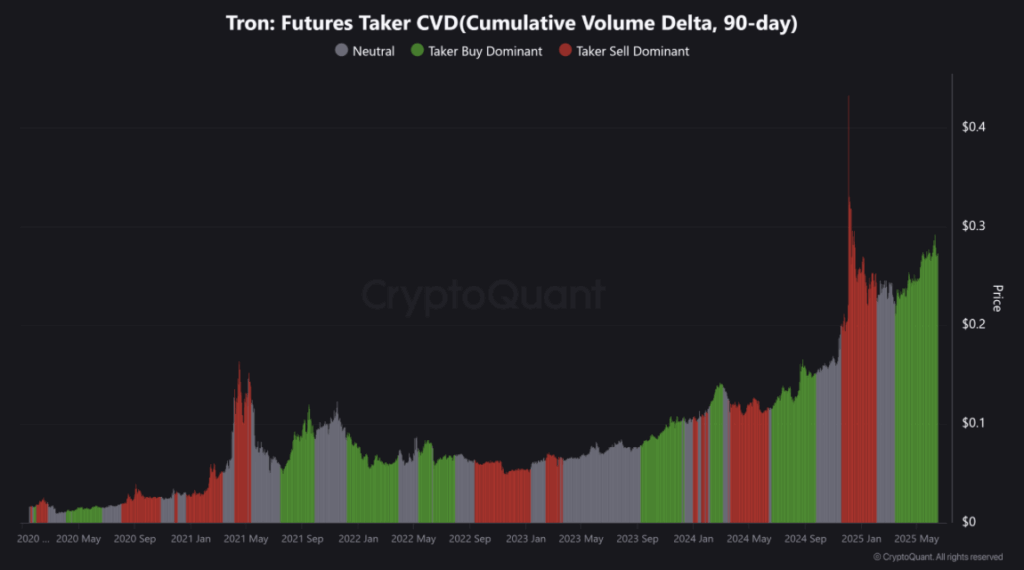

- Buyers still dominate TRX markets, and the IPO move could pull more traditional investors into the Tron ecosystem.

Looks like Justin Sun and his Tron Group are making a big move—one that could shake up the crypto landscape a bit. The group’s aiming to go public in the U.S. via a reverse merger with SRM Entertainment, which is already listed on Nasdaq. Yep, Tron’s not going the traditional IPO route—this one’s a shortcut, but a strategic one.

What’s fueling this push? About $210 million in TRX tokens, which are being lined up to bankroll Tron Inc.’s upcoming operations. That’s according to a well-known analyst on X (formerly Twitter). And here’s a little twist—Dominari Securities is involved too. That name might ring a bell if you’ve followed financial firms linked to Donald Trump’s circle. Wild, right?

The whole move feels like an effort to boost TRX’s position and put Tron on the same playing field as Ethereum or Solana—maybe even edge past them. It’s big talk, but the numbers say Tron might actually have some legs.

Stablecoins Pour In—And That’s a Good Sign

Over the past week, Tron’s seen a fat inflow of $1.38 billion in stablecoins—mainly USDT and USDC. That’s a pretty big deal, especially since it’s enough to outpace Avalanche in terms of trade activity.

Even more telling? On-chain metrics are pointing up. IntoTheBlock data shows the number of active addresses per dollar has been climbing steadily. Nothing crazy, but enough to prove that users—both retail and institutional—are waking up to what Tron’s doing.

And it doesn’t stop there.

Bulls Still Holding the Wheel

Tron’s spot market still leans bullish. One stat that jumps out is the 90-day Cumulative Volume Delta—it’s clearly showing that buyers are still running the show. That’s a good sign for anyone betting on a TRX upswing.

Basically, the market’s acting like it expects more gains. Traders aren’t backing off yet, and that usually means they think something bigger’s coming.

So, What’s Next for Tron?

Well, all eyes are on this IPO play. If the reverse merger with SRM goes through without hiccups, Tron could be one of the first major blockchain networks to bridge into traditional finance in a big way. That opens the doors for a wave of new investors who aren’t typically in the crypto weeds.

With rising stablecoin flows, bullish market behavior, and a high-profile public listing in the works, Tron’s looking more and more like a heavyweight contender. Whether it sticks the landing, though—that’s what the market’s waiting to see.