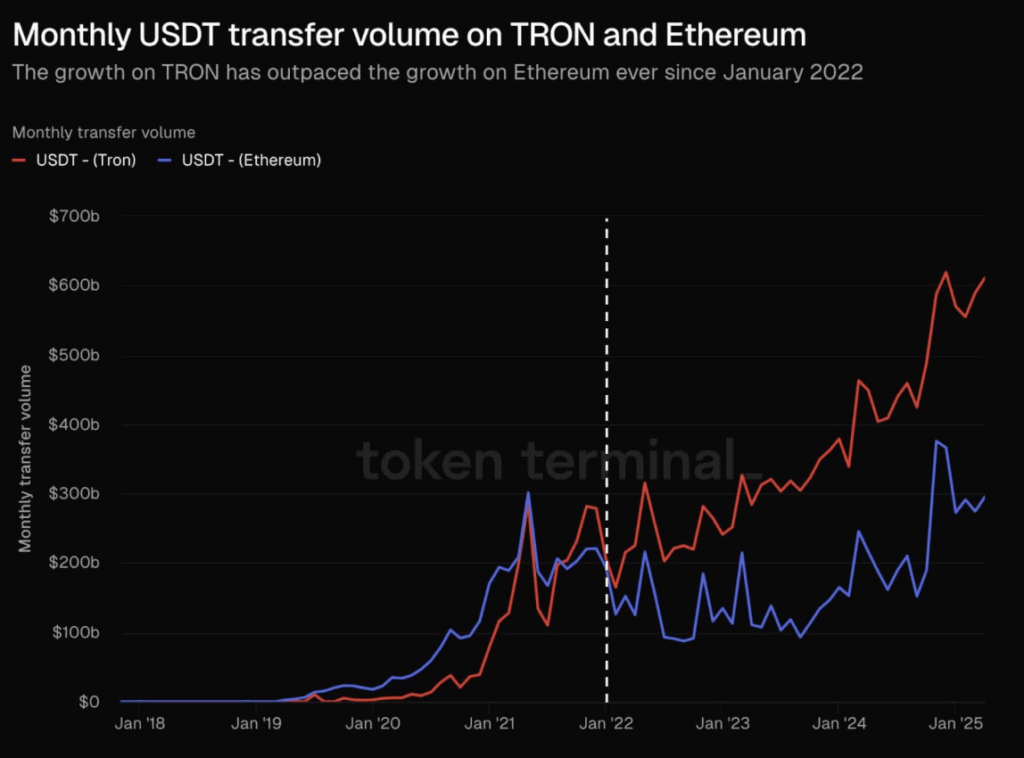

- TRON Hits $600B in USDT Transfers: TRON’s network just passed a huge milestone, processing over $600 billion in USDT transactions, outperforming Ethereum since early 2022 in stablecoin volume thanks to lower fees and faster speeds.

- Real Network Usage Fuels Momentum: Rising on-chain activity and whale accumulation suggest growing demand, with analysts eyeing a breakout above $0.2755 as a possible trigger for a bullish TRX rally.

- Quiet But Strong Fundamentals: While not flashy like Solana or Ethereum, TRON’s consistent growth in stablecoin settlement and quiet whale involvement hint at a slow, utility-driven resurgence in the works.

Tether (USDT) transactions on the TRON network just crossed a massive $600 billion. Yeah, that’s not a typo. This record cements TRON as a real force when it comes to fast and cheap stablecoin transfers—especially compared to its heavyweight rival, Ethereum.

Honestly, TRON has been quietly outpacing Ethereum in USDT volume since way back in Jan 2022. While Ethereum still rules the roost when it comes to NFTs and DeFi playgrounds, TRON is carving out its turf in the stablecoin settlement game.

Why TRON’s Edging Ahead

It comes down to fees and speed, mostly. Ethereum’s gas fees? Still painful. TRON, on the other hand, offers a far smoother ride for the average user. People—especially in lower-income regions—aren’t going to throw money at fees just to move money.

And that’s showing. The daily gap between TRON and Ethereum’s USDT traffic is getting wider. TRON’s handling way more volume and it doesn’t look like it’s slowing anytime soon.

Could All This Activity Wake TRX From Its Nap?

TRON isn’t usually in the same breath as the shiny new Layer-1s like Solana, but the numbers tell a different story. The recent explosion in USDT activity shows there’s demand under the hood.

Some top analysts are already suggesting this could be the spark TRX needs. If price action breaks past $0.2755, we might see some fireworks. Momentum driven by real usage (and not just hype)? That’s the kind of thing long-term traders love to see.

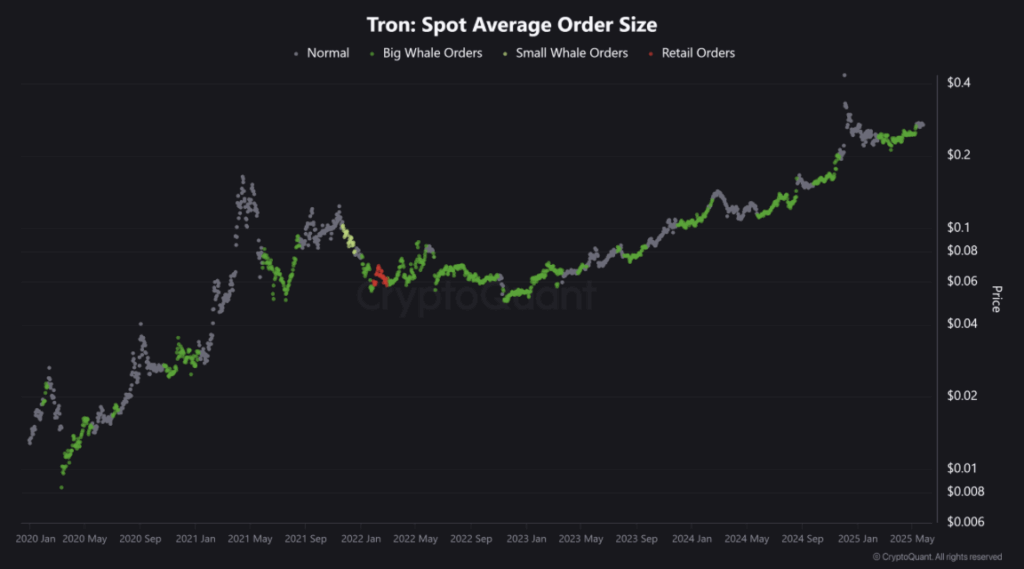

Whales Are Lurking

And here’s where it gets even more interesting—big wallets, aka whales, are scooping up TRX like they know something the rest of us don’t. These aren’t just quick flips either. Historically, when whales buy into a growing network, it’s because they’re betting on the long game.

Right now, TRX is sitting in a zone that whales seem comfortable with. That kind of steady accumulation usually signals confidence, not just a pump-and-dump.

A Quiet Comeback in the Making?

TRON isn’t the loudest project out there. You’re not gonna see it leading every news cycle. But quietly, behind the noise of meme coins and flashy Layer-2s, it’s laying down some serious infrastructure.

Between the record-setting USDT volume and strategic whale moves, TRON might just be setting itself up for a solid comeback. And if it keeps doing what it’s doing? TRX could find its way back into the spotlight—slowly, steadily, and on its own terms.