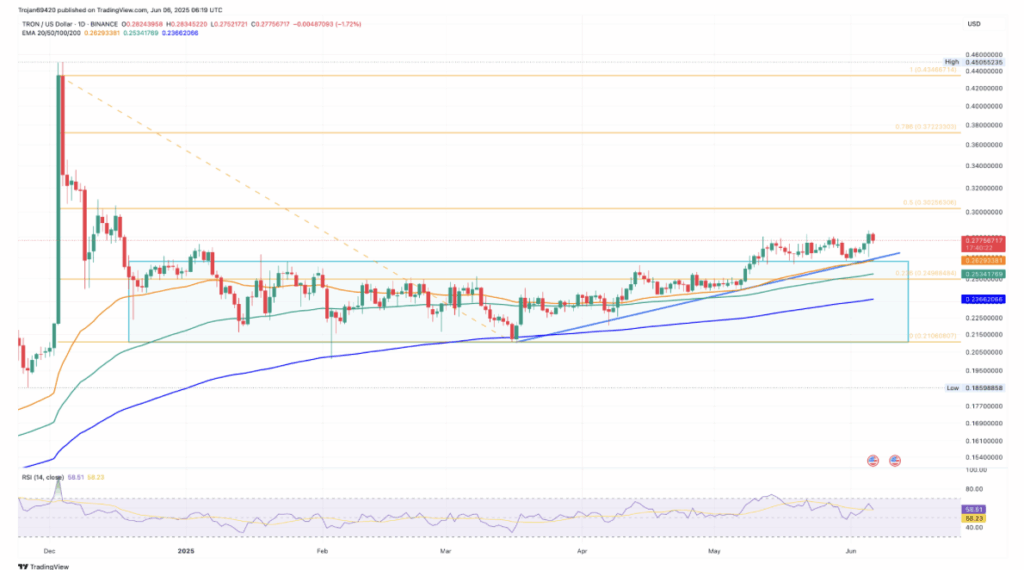

- TRX is under pressure again, falling 1.65% and hovering near key support at the 50-day EMA around $0.2629.

- Despite stacked EMAs suggesting long-term bullishness, RSI and price action hint at short-term weakness.

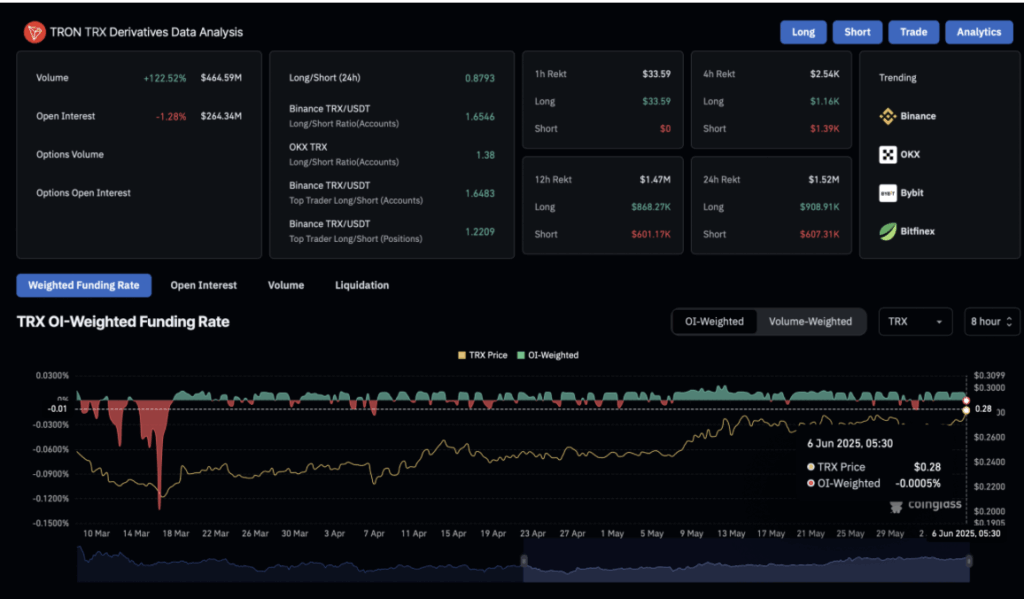

- Derivatives data shows bearish sentiment growing, with a negative funding rate and rising short positions.

Tron’s been feeling the heat lately. As markets cooled off heading into Friday, TRX dropped about 1.65%, with traders now eyeing the 50-day EMA at $0.2629 as the next support zone. Thursday’s 2.5% rally didn’t hold for long, fading fast under mounting bearish pressure. That three-day green streak? Looks like it hit a wall.

Now trading around $0.2775, Tron is sliding back toward a key support trend line. There was some hope for a breakout from its consolidation phase, but the latest dip says otherwise. RSI’s been sagging too, showing some divergence that hints at more downside ahead. Unless something flips, we’re looking at a possible tumble toward that $0.26 zone.

Technicals Hold… for Now

Technically speaking, TRX still has some guardrails. The 50-, 100-, and 200-day EMAs are stacked in a bullish order, which usually means longer-term strength isn’t broken yet. But this drop is testing nerves. If price holds above $0.2628 and reverses, a climb back toward $0.2806—or even the 50% Fib level at $0.30—isn’t off the table.

Still, let’s not sugarcoat it. The rejection near $0.28 plus the fading momentum means bulls need to show up now if they want to shift the mood.

Derivatives Market Flips Bearish

On the derivatives side, the mood’s taken a hit. Open interest is down to $264 million, a 1.28% dip, and long traders took most of the hit with $908K in liquidations. Shorts? They saw $607K wiped, but they’re gaining steam fast. That’s why the funding rate flipped negative (-0.0005%), showing bears are now willing to pay to keep short positions open.

The long/short ratio sits at 0.8793—more shorts than longs—and that’s never a great look in a market already wobbling. Add in the broader volatility across altcoins, and it paints a cautious, maybe even pessimistic, near-term outlook for Tron.