- TRON’s USDT Surge: TRON has reached a new milestone with over $71 billion worth of USDT circulating on its network, positioning it just $4 billion shy of Ethereum’s USDT holdings as the network continues to attract stablecoin users through its low fees and fast transactions.

- On-Chain Activity Decline: Despite the USDT milestone, other network metrics like gas usage and wallet creation have been trending downward, suggesting that TRON may be entering a consolidation phase, potentially the calm before a significant market move.

- Potential Bullish Outlook: If TRON can leverage its growing USDT reserves to drive broader network participation, it could spark another growth phase, though the current dip in activity raises questions about whether the network is merely pausing or signaling a deeper shift.

TRON just hit a major milestone, with over $71 billion worth of Tether (USDT) now circulating on its network. That’s a new all-time high, a bullish signal that underscores TRON’s growing footprint in the crypto ecosystem. But while USDT adoption is on the rise, other metrics are hinting at a slowdown. Is TRON gearing up for its next big move, or is it taking a breather?

TRON Emerges as USDT Powerhouse

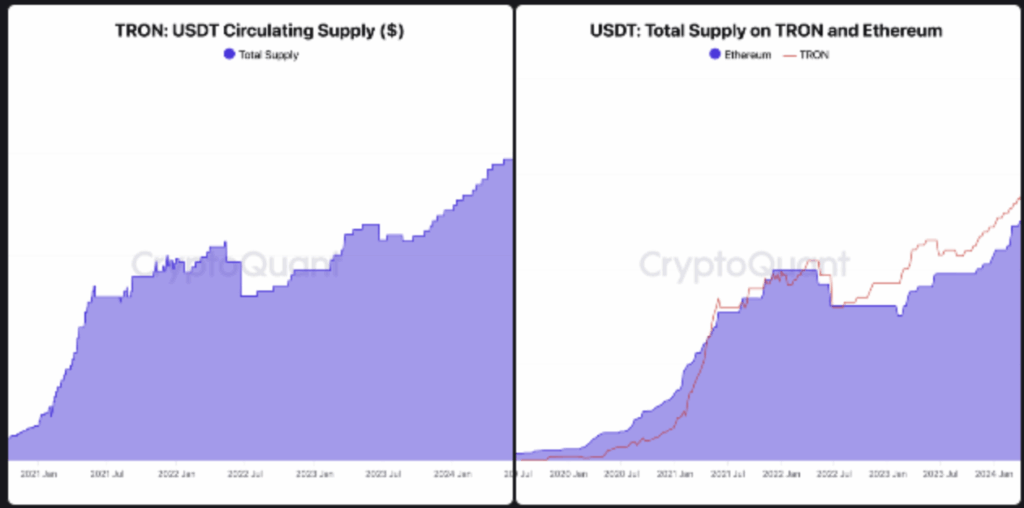

TRON’s reputation for fast transactions and rock-bottom fees has made it a go-to network for stablecoin transfers. That’s why the surge in USDT supply on TRON isn’t exactly surprising. CryptoQuant’s latest report shows that TRON now holds over $71 billion in USDT — just $4 billion shy of Ethereum, which hosts around $75 billion.

The cost-effectiveness of moving USDT on TRON has lured investors away from Ethereum, and it’s paying off. TRON is closing the gap, solidifying its status as a USDT stronghold.

Declining On-Chain Activity: A Red Flag or Strategic Accumulation?

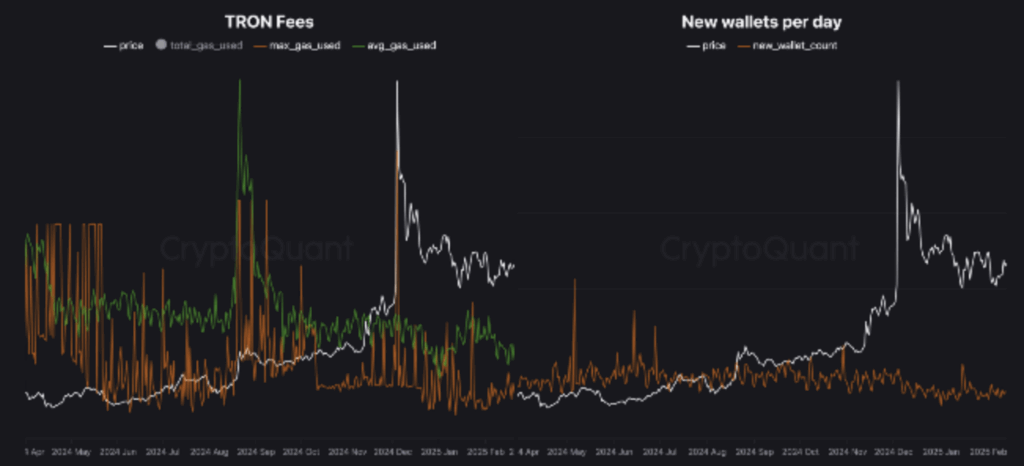

Despite the milestone with USDT, other on-chain metrics tell a different story. Over the past few weeks, TRON has seen a noticeable decline in gas usage and new wallet creation. During the USDT all-time high, there was a spike in complex transactions and gas usage — a sign of heightened activity. But now, both metrics are trending downward.

This could mean one of two things. On one hand, it could indicate that TRON is entering a consolidation phase — the so-called “calm before the storm.” Accumulation phases often precede significant price movements, suggesting that traders might be quietly positioning themselves for a larger breakout.

On the other hand, the dip could signal waning interest in TRON’s network activity, especially if the USDT surge doesn’t translate to broader network usage.

What’s Next for TRON?

Historically, crypto networks go through cycles — periods of intense activity followed by lulls, then bursts of renewed interest. TRON may be following that script. With $71 billion in USDT now on its network, it’s clear that TRON has become more than just a playground for memecoins or niche dApps. The network has established itself as a major player in the stablecoin economy.

If TRON can leverage its USDT reserves to boost network participation, it could spark a new wave of growth. However, the recent decline in gas usage and wallet creation suggests that the network might be pausing to catch its breath. Whether that’s a temporary cooldown or the start of a larger move remains to be seen.

For now, the stage is set. With USDT dominance on the rise and signs of potential accumulation, the next few weeks could be pivotal for TRON’s trajectory. Stay tuned — this could get interesting.