- Bitcoin mining at home in 2025 ranges from low-cost lottery setups to full-blown ASIC rigs.

- Most home miners join pools for steady payouts instead of chasing rare solo rewards.

- Cloud mining offers convenience but comes with risk, low returns, and limited control.

The past year’s been kind of wild—big companies like Strategy are gobbling up Bitcoin like it’s going out of style, and Metaplanet over in Japan even decided to start holding BTC in their treasury. Meanwhile, U.S. politics might be swinging back toward crypto-friendliness with Trump possibly dialing down the SEC’s grip and talking up U.S.-based mining. Across the pond, the EU’s MiCA rules kicked in, finally giving miners and investors a clearer rulebook to follow.

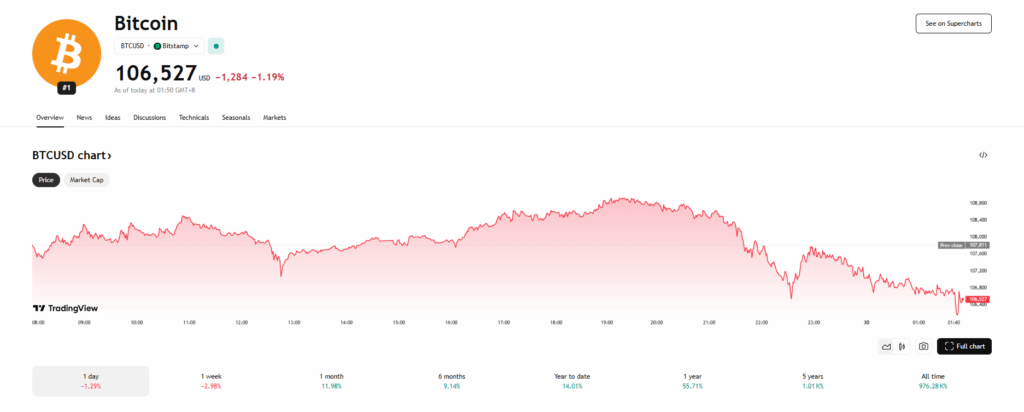

And then there’s the price—Bitcoin finally cracked the $100K ceiling in early 2025, thanks to a halving-induced supply crunch and a whole lot of ETF action. Institutions are pouring in. Supply’s tighter than ever. People are once again asking: how do I get in? Well, for some, that means mining—right from home. It’s not exactly plug-and-play, but it’s doable.

Here’s a breakdown of four ways you can mine Bitcoin at home this year. We’ll talk gear, costs, what kind of returns to expect, and yeah—whether it’s actually worth it.

Lottery Mining – The Just-for-Fun, Maybe-You-Get-Lucky Method

This is kinda like buying scratch tickets, but nerdier. Back in July 2024, someone actually mined a full Bitcoin block using just 3 TH/s of hashpower. That’s roughly the kind of output you’d get from two USB miners duct-taped to a Raspberry Pi. That person walked away with over 3 BTC—worth more than $200K at the time. It’s rare. Like, “thousands-of-years” rare… but still, it happened.

Most folks use gear like the Bitaxe HEX or the GekkoScience R909. These aren’t profit machines—they’re more like little blinking trophies. But they support the Bitcoin network and help you learn how mining works. And, who knows? You might win the digital lottery.

Why do it? Some say it’s like restoring an old radio or building a mechanical keyboard. It’s not about making bank. It’s about being part of something bigger—and yeah, maybe flexing your setup a bit on Reddit.

ASIC Solo Mining – Big Hardware, Bigger Dreams

Okay, let’s get serious. ASICs are the real-deal mining machines, custom-built to crunch Bitcoin’s algorithm. The Antminer S21 Hydro, for example, clocks in at 400 TH/s and sips power compared to older models. But here’s the rub—even with that kind of hashpower, your odds of finding a block solo are still, uh, not great.

To have a real shot, you’d need like 20 of these beasts running nonstop. That’s a major investment—money, space, cooling, and electricity. But if you do find a block, it’s all yours. Every sat. Every transaction fee.

Still, even with cheaper hardware prices these days (around $16 per TH now vs. $80 a few years ago), it’s not easy money. It’s more like—expensive hope. Worth it for some, maybe. For most? Pool mining makes more sense.

Pool Mining – Playing the Odds, the Smart Way

Let’s be honest. Pool mining is what most home miners actually do. You connect your ASIC to a bigger group, and when the pool hits a block, everyone gets a slice based on how much they contributed. Less drama, more consistency.

You’ll earn less per day than the dream of a full block, but you’ll earn something every single day. Big pools like Foundry USA, Antpool, and F2Pool are pretty much printing blocks constantly. You just plug in, point your machine to their servers, and watch your payouts roll in. It’s not passive income magic, but it’s manageable.

Most of these pools offer different payout styles—FPPS if you like steady, reliable earnings; PPLNS if you’re okay with some ups and downs for potentially higher long-term gain. Pick what matches your vibe.

Cloud Mining – No Machines, No Hassle (But Also… Meh)

Cloud mining sounds good on paper: rent someone else’s machines, sit back, collect Bitcoin. But in reality, it’s kinda tricky. A lot of sketchy stuff has happened in this space over the years—empty promises, hidden fees, even outright scams. That said, some platforms like NiceHash or BitDeer are still around and fairly legit.

You won’t get rich, and you won’t get hands-on experience. But if you just want a low-effort way to dip your toe into mining—or you’re short on space or cheap electricity—it’s an option. A risky one, but an option.

Final Thoughts

There’s no “best” way to mine Bitcoin at home in 2025. It depends on what you want. Are you in it for the fun? The tech? The thrill of maybe hitting a block? Or do you want regular returns? Lottery mining is cheap and chill. ASIC solo mining is bold. Pool mining is steady. Cloud mining is… a gamble.

Whatever path you pick, make sure you know why you’re doing it. Stack sats wisely.