- ETH has struggled below $1,900, with traders cautious after weak ETF demand and policy setbacks.

- Ether’s market cap briefly fell behind major rivals, raising concerns about its competitive edge.

- The upcoming Pectra upgrade on May 7 might spark renewed interest by improving staking and reducing supply.

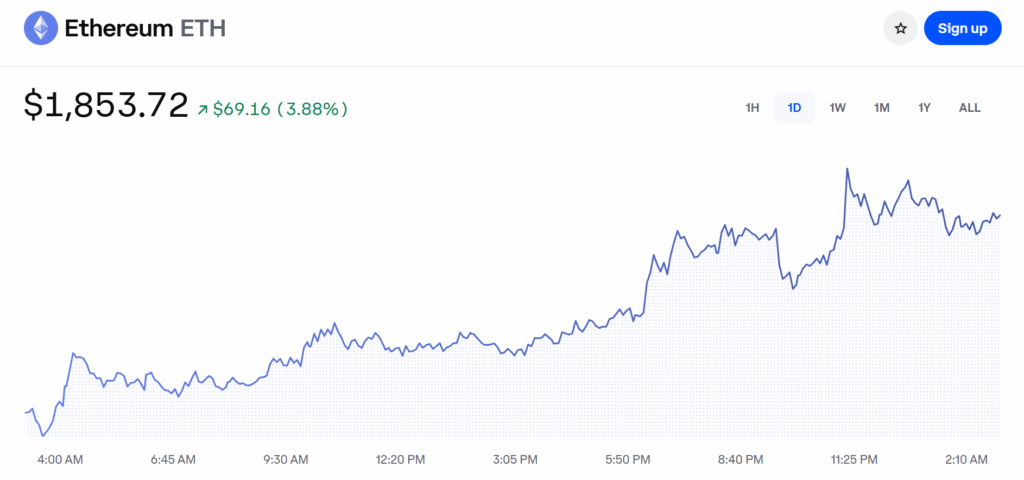

Ether’s been drifting under $1,900 since March—and honestly, it’s making investors a little uneasy. The failed push to retake $4,000 back in December 2024? Yeah, that didn’t help either. Now, some are wondering if that was the last hurrah for the second-biggest crypto out there.

Derivatives data hasn’t exactly calmed nerves. Futures for ETH are supposed to show a premium—like, 5% or more—to account for their longer settlement periods. Right now? That premium’s not even hitting neutral territory. Not great.

U.S. policy hits harder than expected

A chunk of that hesitation might be tied to the whole “Digital Asset Stockpile” mess that dropped in early March. The U.S. government lumped ETH in with a bunch of other altcoins in an executive order, basically saying: Bitcoin gets its own “Strategic Reserve,” and everything else… doesn’t.

Translation? The feds might hang onto the ETH they already have, but don’t expect them to buy more anytime soon. That kind of labeling doesn’t do wonders for investor confidence.

ETH’s market cap slips behind the pack

In April 2025, something wild happened—Ether’s total market cap fell below the combined value of four rivals: Solana, BNB, Cardano, and Tron. First time ever.

It’s bounced back a bit since, sitting around $217 billion now. That’s enough to pull back ahead, but it doesn’t mean the market’s feeling bullish. Unless ETH can consistently outperform the other big players, it’s hard to imagine sentiment flipping anytime soon.

Weak ETF demand adds more pressure

Even when ETH rallied from $2,400 to $4,000 late last year, U.S. demand for a spot ETH ETF stayed pretty meh. Meanwhile, Bitcoin ETFs were blowing up—like, doubling in size from $50 billion to $110 billion. That kind of contrast doesn’t go unnoticed.

ETH’s derivatives markets reflect the same chill vibe. Professional traders just aren’t lining up to go long, which says a lot about where they think things are headed.

Ethereum still leads in TVL… but there’s more to the story

Yep, Ethereum is still king when it comes to total value locked—TVL is solid. But when it comes to user experience? Solana’s smoother. Stablecoin dominance? Tron’s got that on lock.

People just aren’t as excited about Ethereum’s decentralization or security features when they’re constantly moving funds around. Layer-2s help a bit, but for fast-moving activity, the experience still feels clunky.

Traders not panicking, just waiting

One interesting thing? Options markets aren’t showing signs of panic. The cost of puts (sell options) is pretty much in line with calls (buys). That tells us pros aren’t expecting a big crash—they’re just not overly hyped either.

And compared to two weeks ago, they actually seem a bit more chill about downside risks. No huge spike in protective positions. Just… waiting.

Could Pectra be the spark?

So what’s next? Well, the Pectra network upgrade is set for May 7. Some folks think it could shift the vibe a bit—maybe bring ETH back into the spotlight. It’s supposed to bring better staking tools for institutions, which could lead to more ETH getting locked up, shrinking the supply a bit.

Historically, Ethereum upgrades have sparked short-term rallies. So if there’s ever a time for ETH to show signs of life again, Pectra might just be it.