- SUI price climbed 4.23% and is testing key resistance around $2.2271; a breakout could lead to a 130% rally toward $5.10.

- Bullish momentum is building, with strong buying signals from the Bull Bear Power indicator and MFI reading at 64.49.

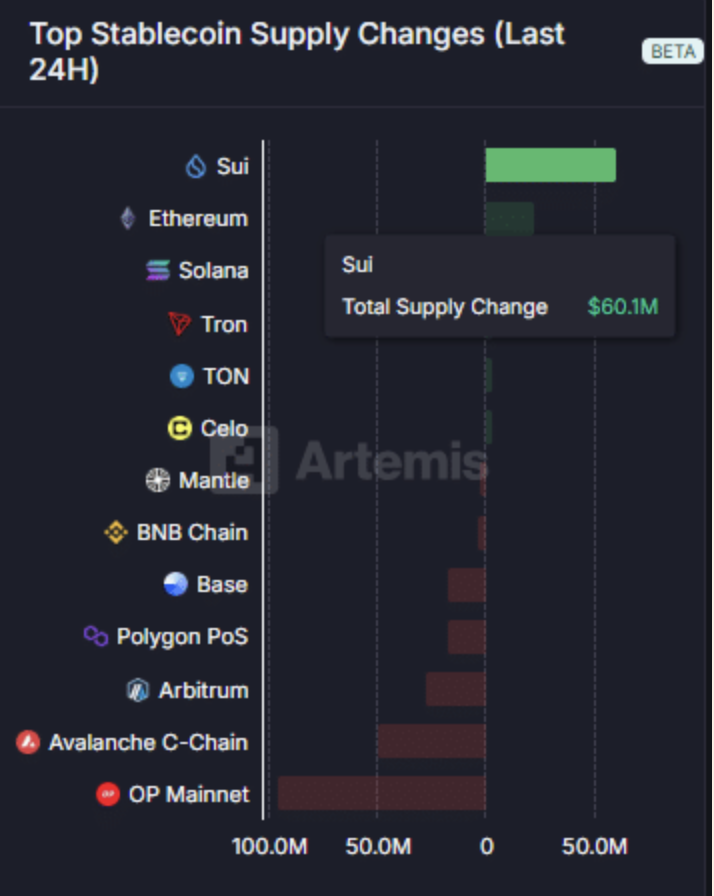

- Network activity is rising, with 1.3M new daily addresses and $60M in stablecoin inflows signaling growing user adoption.

After a pretty rough stretch on the charts, it looks like SUI might finally be shaking off the dust. Over the past 24 hours, it’s nudged its way up by 4.23%—nothing mind-blowing, but definitely a sign of life.

Now, whether that turns into a full-blown rally? That’s the real question. A lot’s gonna hinge on whether SUI can push past some stubborn resistance levels. Let’s break down what’s going on.

Is SUI Warming Up for a Breakout?

Okay, so technically speaking, SUI’s shaping up nicely. It’s forming this bullish-looking price pattern—one that’s usually tied to solid uptrends.

At the moment, SUI is taking a shot at not one, but two key resistance levels: a descending trendline and the horizontal ceiling at $2.2271. If it can manage to bust through both, the upside could be wild. We’re talking potentially a 130% jump all the way to $5.10, which, by the way, is where it was hanging out back in January.

But, and there’s always a “but”—if it fails (like it did last time around, circled in yellow), it could fall back and start sliding sideways again.

That said, this time feels different. The buying pressure looks a lot stronger.

Bulls Back in Charge?

Here’s where things get interesting. The Bull Bear Power (BBP) indicator—yeah, the one that tells us who’s running the show, bulls or bears—says the bulls have taken control again.

That’s after four days where bears were kinda grinding the price down. But even then, SUI didn’t collapse. It just moved sideways, which actually shows there was some hidden strength under the surface.

If those green histogram bars keep building and bulls stay in the driver’s seat, a breakout is totally on the table.

Also, the Money Flow Index (MFI) is sitting at 64.49—squarely in the bullish zone. Basically, that means fresh cash is flowing in. Historically, that kind of action tends to lead to rallies.

On-Chain Data Looks Solid Too

Zooming out a bit—on-chain metrics are also looking pretty great. Both new and returning users are climbing fast.

At the time of writing, 1.3 million new daily active addresses were recorded, with returning addresses up to 299,000. Just a week ago, those numbers were way lower. That kind of growth usually means more usage—and more usage often leads to price strength.

Oh, and here’s another bullish nugget: SUI led all blockchains in stablecoin deployments over the past 24 hours, racking up $60 million. That’s a lot of liquidity getting pushed into the ecosystem.

Bottom Line?

SUI’s showing some serious signs of life right now. With strong buying interest, bullish indicators flashing green, and user activity shooting up—it’s got the momentum it needs. If it can finally break past those resistance levels, the rally to $5.10 might not be so far-fetched after all.

For now, it’s a waiting game. But things are definitely heating up.