- Sui’s DEX activity hit a record $304.3M daily volume in Q1, driven mainly by Cetus and Bluefin, showing strong DeFi growth even as the SUI token lagged behind.

- SUI’s market cap plunged 40.3%, with network fees dropping sharply, indicating weaker user demand and reduced validator payouts.

- Despite NFT and institutional momentum, a $223M exploit on Cetus in Q2 disrupted trading, with recovery efforts now hinging on a community vote to unfreeze funds.

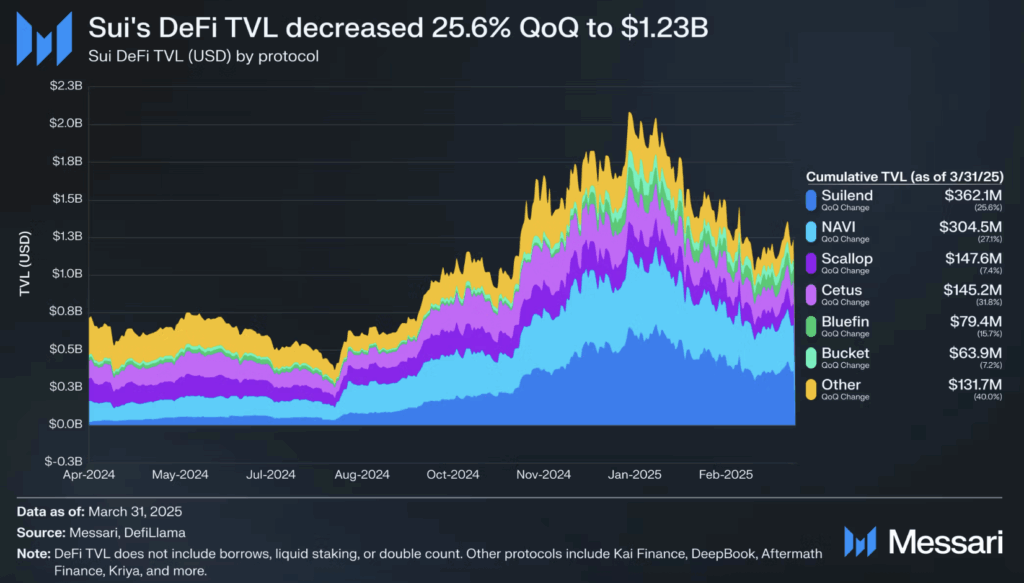

Sui made some noise in Q1, not with its token price—but through booming DEX activity. As per a fresh Messari report, Sui’s daily decentralized exchange volume hit a new all-time high of $304.3 million. That’s a solid 14.6% jump compared to last quarter. Most of that action came from Cetus and Bluefin, pulling in a combined $239.5 million per day, while smaller DEXs like Kriya and DeepBook added some extra liquidity into the mix.

This spike in on-chain trades shows Sui’s DeFi scene is maturing, even though the SUI token didn’t exactly keep up with the broader market.

SUI Token Slumps While DeFi Thrives

Here’s the less fun part—SUI’s circulating market cap dropped 40.3%, landing at $7.2 billion. That’s way worse than the overall crypto market dip of 18.2% during the same time. Still, oddly enough, Sui climbed two ranks and now sits as the 13th biggest crypto by market cap.

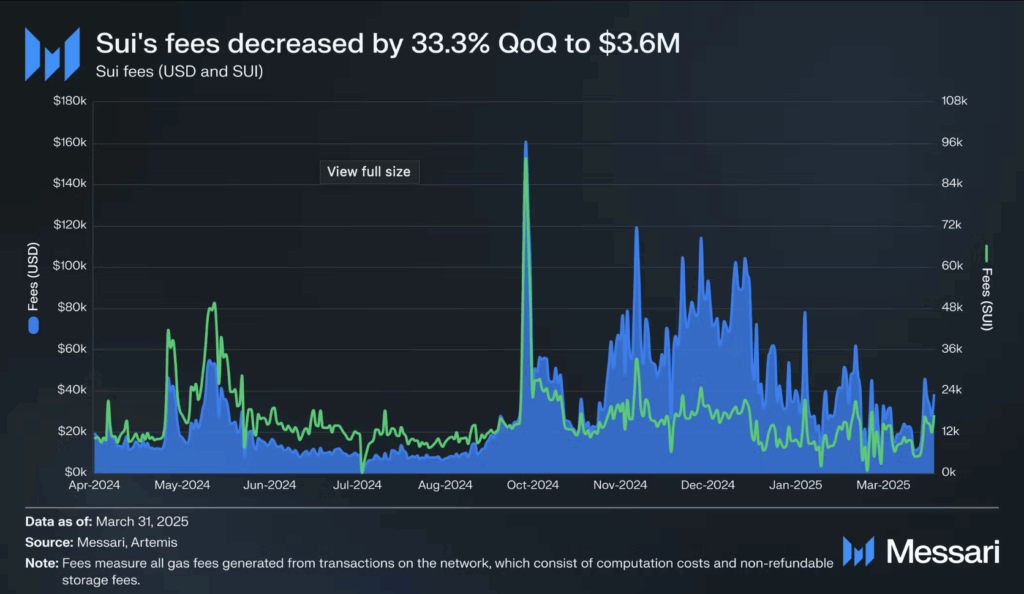

Fees on the network didn’t look much better either. Total network fees fell to $3.6 million—down 33.3% from Q4. And when measured in SUI, the drop was even steeper, around 44.4%. Basically, not only did the token drop in value, but fewer people were making on-chain moves, leading to fewer validator rewards and a dip in engagement.

NFTs, Big Names, and a Major Exploit

Sui’s NFT world stayed alive and kicking though, with 13.2 million SUI traded since the mainnet went live. Platforms like Clutchy, TradePort, and BlueMove kept the NFT traffic buzzing, mostly thanks to collections like Fuddies and SuiFrens: Bullsharks and Capys.

Institutional action also picked up. Grayscale added SUI to its Smart Contract Platform Fund in January, and Libre Capital dropped its gateway in February, giving tokenized access to hedge fund strategies from names like BlackRock. March brought even more buzz with World Liberty Financial hopping on board and Canary Capital filing for the first U.S.-based SUI ETF.

But Q2 hasn’t been all wins. Cetus Protocol got hit hard by a $223 million exploit on May 22nd. Their Concentrated Liquidity Market Maker pools were targeted, slamming trading volumes. They’ve promised to repay users with help from the Sui Foundation and their own treasury, but the recovery depends on a community vote to unlock $162 million in frozen assets.