- SUI leads in stablecoin liquidity with $1.13B, surpassing major L1s, and dApp revenue continues climbing.

- Total wallet addresses soared past 208M in June, signaling solid user adoption.

- Price struggles at $3.00 support—holding it could open a path back to $3.50, but losing it risks a slide to $2.50.

Sui Network has been on a tear since late 2023, especially when it comes to blockchain activity. While its price hasn’t quite kept the same rocket pace in 2025, the ecosystem underneath has only gotten stronger. That’s largely thanks to its fast processing, solid DeFi growth, and how it’s been quietly stepping up as a real contender to big names like Solana.

Dominating Stablecoins and dApp Revenue

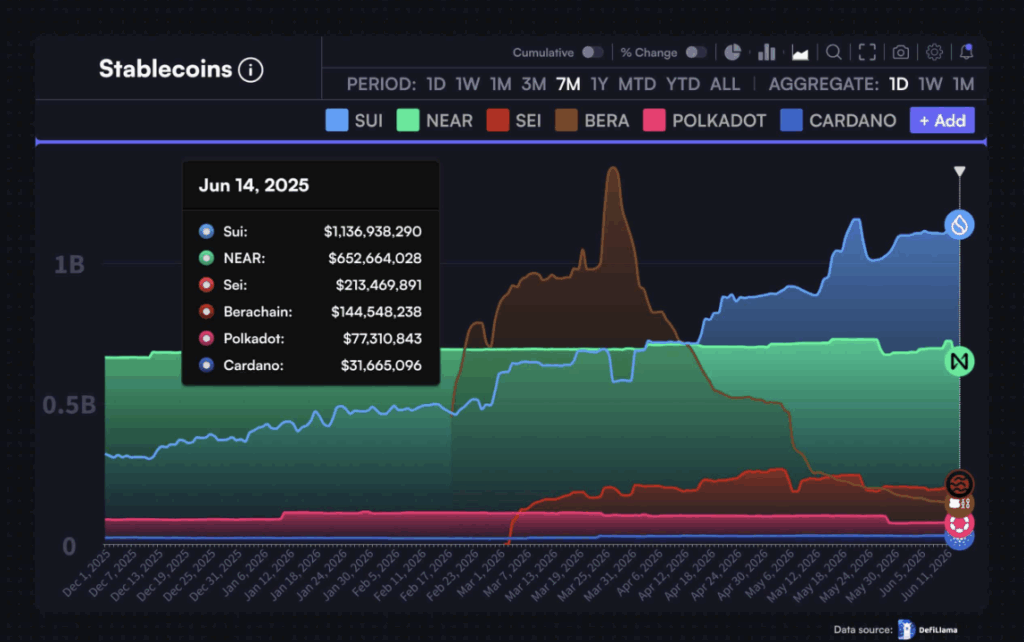

One big flex from SUI right now is its dominance in stablecoin market cap. It’s holding over $1.13 billion—more than Near, Sei, Berachain, Polkadot, and Cardano combined. That kind of liquidity makes SUI a powerhouse when it comes to DeFi transactions.

Beyond that, Sui’s dApp scene is buzzing. Bluefin leads the charge with $23K in revenue in the last 24 hours, with others like Momentum, Navi, Haedal, and Scallop following close behind. Together, the top five dApps pulled in $77K. So yeah, usage is climbing, and that’s not even mentioning total accounts, which jumped from 124M in April to nearly 209M by mid-June. No slowdowns, no dips—just steady growth.

Price Struggles to Match On-Chain Strength

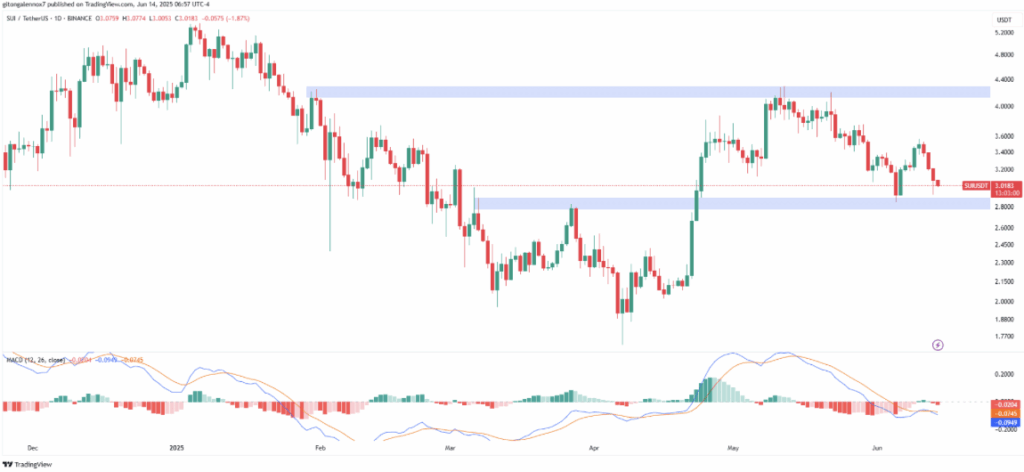

Even with all that momentum under the hood, SUI’s price has slipped a bit lately. After getting smacked down at the $4.00 zone in May, it’s been drifting lower, now testing that key $2.80–$3.00 support range. The charts are throwing mixed signals. MACD’s still negative, and momentum’s shaky, but higher lows are hanging in there—for now.

If bulls can keep things steady above $3.00, a bounce to $3.50 could be back on the table. But if $2.80 doesn’t hold? Well, we might see it sink to the $2.50 support before it finds its footing again.

Will Bulls Regain Control?

For SUI to flip the trend back up, momentum needs to shift—plain and simple. There’s a bit of a bullish divergence on the MACD, which might suggest a bounce is coming. But if sellers keep slamming it at $3.20 and the MACD crossover fails again, it could mean more downside.

Still, with chain growth not slowing and fundamentals staying strong, bulls just might get another shot soon. Patience, though—because SUI’s price won’t turn on a dime.