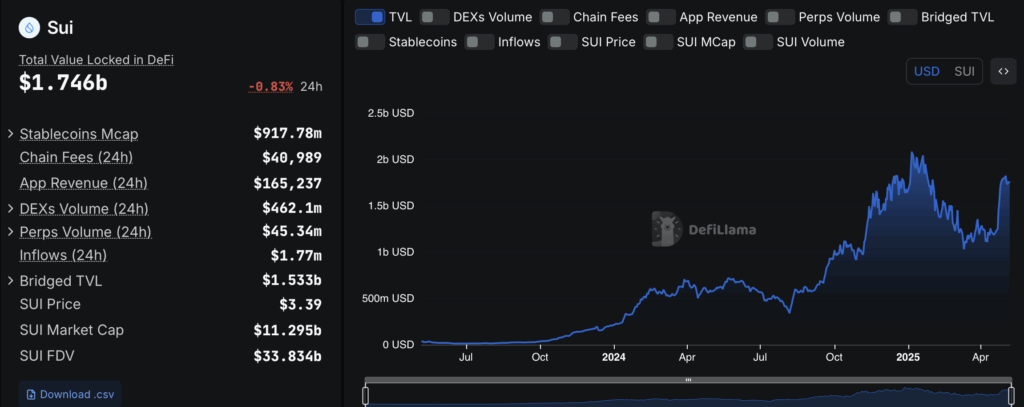

- SUI’s Rapid Ascent: Sui (SUI) is emerging as a serious Layer-1 competitor, with its Total Value Locked (TVL) in DeFi reaching $2.84 billion, a 5% increase in just 24 hours, while Cardano (ADA) has seen a 4% decline to $414.9 million.

- Liquidity and User Growth: SUI’s stablecoin supply has surged to $908 million, approaching the $1 billion mark, supporting staking and transaction activity, while its daily active addresses have jumped by over 1,770% to 1.4 million, compared to Cardano’s 26% decline in user activity.

- Market Sentiment and Investor Focus: SUI’s price is up 51% in the past month, outperforming Cardano’s 5% rise, with traders and investors increasingly viewing SUI as more than just a newcomer but a legitimate Layer-1 contender challenging established networks.

The Layer-1 blockchain arena is heating up, and 2025 is shaping up to be a pivotal year. Sui (SUI), a relatively fresh face, is rapidly positioning itself as a legitimate rival to Cardano (ADA), and the numbers back it up. While some skeptics brush off the SUI buzz as hype, a closer look at the data tells a different story.

Metrics Don’t Lie — SUI Surging Ahead

SUI’s growth isn’t just a bunch of social media chatter. The numbers are painting a clear picture. Its Total Value Locked (TVL) in DeFi has jumped by nearly 5% in just 24 hours, now sitting at $2.84 billion. Compare that to Cardano’s $414.9 million, a figure that’s actually down by almost 4% in the same timeframe.

That’s not just a slight edge — that’s a signal that liquidity is flowing to SUI, and users are piling in. It’s not just a blip, either. Over the past year, SUI’s daily active addresses have exploded by over 1,770%, climbing to 1.4 million. Cardano, meanwhile, has seen its user activity drop by more than 26%, with just 23,500 daily active users hanging on.

From DEX volume to transaction throughput, fee generation, and network revenue, SUI is checking all the boxes — and not just catching up, but pulling ahead.

The Stablecoin Surge

A strong indicator of growth in a Layer-1 network is the supply of stablecoins — the backbone of liquidity in DeFi. SUI’s stablecoin supply just hit a new high, now at $908 million and inching toward the $1 billion milestone.

This isn’t just a cosmetic metric. That liquidity is fueling staking, yield farming, and transaction activity, keeping the network bustling. In contrast, Cardano is still playing catch-up, with a comparatively thin stablecoin presence and slower DeFi traction.

Price Action and Market Sentiment

While the metrics are one thing, market sentiment is another. In the past month, SUI has climbed by 51%, far outpacing Cardano’s modest 5% gain. That kind of rally doesn’t go unnoticed. Traders, both short-term speculators and long-term backers, are starting to pay attention.

Cardano’s still up 116% from its cycle lows, sure. And yes, SUI is still about 40% below its all-time highs. But trajectory matters. SUI’s latest rally has taken it back to levels last seen in mid-February, while Cardano struggles to crack that stubborn $1 psychological level.

What’s Driving Investor Sentiment?

Momentum traders love a good growth story, and right now, SUI is giving them one. But it’s not just short-term hype. Fundamentals-focused investors are also noticing SUI’s rapid structural expansion.

In just two years, SUI has managed to do what Cardano has been trying to pull off for eight. That’s not to say Cardano doesn’t have value — but in a fast-paced market, speed and execution matter. SUI’s being re-rated as a legitimate Layer-1 contender, not just a promising newcomer.

Final Thoughts — SUI No Longer the Underdog

The Layer-1 competition is intensifying, and SUI is no longer just a new kid on the block. With skyrocketing user adoption, swelling liquidity, and a market cap that’s catching attention, SUI is positioning itself as a real threat to established players like Cardano.

If the current trend continues, SUI could soon be more than just a challenger — it could be the one setting the pace in the Layer-1 blockchain race.