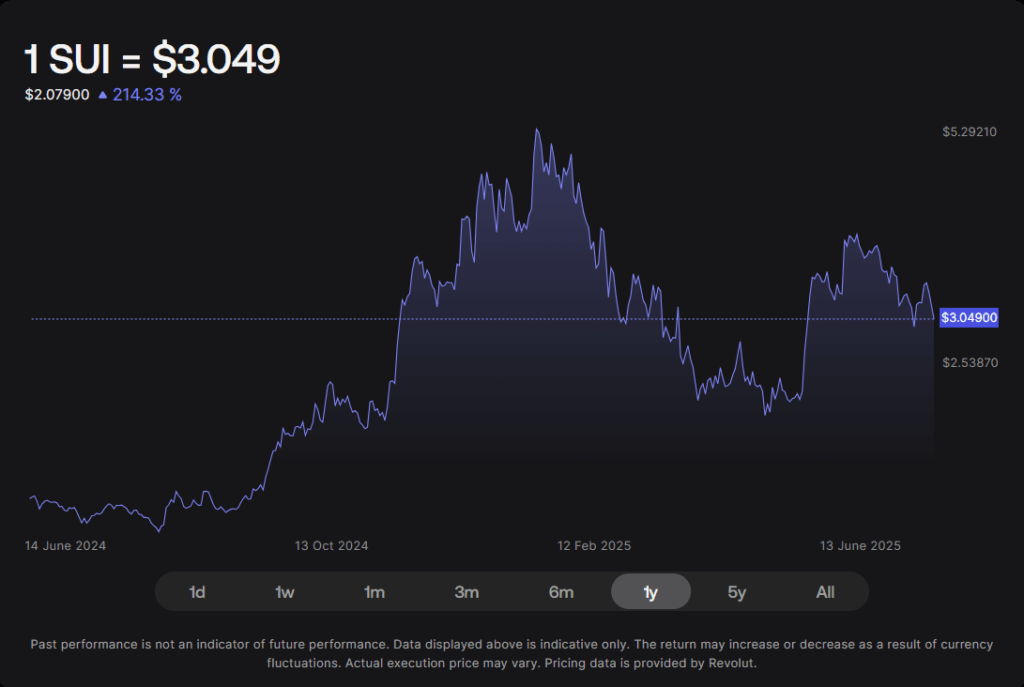

- SUI fell 9.64% after breaking down below the $3.20 support zone, hitting a low of $2.9556.

- Price has stabilized near $3.00, but momentum remains weak with sellers still in control.

- A close above $3.05 is needed to challenge the downtrend and confirm a recovery attempt.

SUI tumbled 9.64% to $3.0211 on June 13 after breaching the crucial $3.20 support level, which triggered a cascade of sell orders and led to a sharp plunge to an intraday low of $2.9556. CoinDesk Research’s technical analysis model flagged the breakdown as a key pivot in short-term market sentiment. Over 50 million tokens changed hands during the selloff, underscoring the severity of the move.

Price Rebounds Near $2.997, But Momentum Still Weak

Despite the initial panic, SUI found a base near $2.997 and has since rebounded slightly, consolidating within a narrow $3.00–$3.05 range. However, technical indicators suggest momentum remains fragile, as lower highs continue to develop and resistance at $3.05 has yet to be convincingly breached. Unless bulls regain control above this level, a sustained recovery appears unlikely.

Broader Crypto Weakness Weighs on Sentiment

The drop in SUI follows wider market weakness, partially triggered by U.S. inflation data and temporary BTC volatility. Still, SUI’s plunge appears more technical in nature. The break below $3.20 caused widespread stop-loss activation and panic selling, while the $3.00 psychological support level has helped slow the decline—for now.

Volume Spike Indicates Cautious Accumulation

A sharp volume spike at 14:00 UTC—where over 1.2 million tokens traded hands—suggests some degree of cautious accumulation near support levels. Still, until the price closes convincingly above $3.05, the current bounce remains vulnerable. Support remains firm at $2.94, with $3.05 acting as the nearest resistance to watch.