- Standard Chartered predicts BNB could reach $2,775 by 2028, nearly 4x its current price.

- The forecast relies on BNB continuing to mirror BTC and ETH trends in returns and volatility.

- ETF filings and global interest, like Kyrgyzstan’s reserve talks, are fueling long-term optimism for BNB.

The digital asset space is shaping up for what could be a massive year in 2025, and with more favorable regulations likely coming, the stage might be set for some serious growth. That momentum is part of what’s driving Standard Chartered’s latest prediction: BNB hitting $2,775 by 2028. Yep, that’d be roughly 4x its current price.

Why this prediction isn’t totally out of left field

In a report dropped earlier this week, Geoff Kendrick—head of digital asset research at Standard Chartered—explained why the bank is bullish on BNB’s long-term trajectory. He pointed to one key detail: BNB has basically moved in sync with an unweighted mix of Bitcoin and Ethereum since mid-2021. In both volatility and returns. If that trend keeps playing out, Kendrick thinks BNB could ride the wave right alongside BTC and ETH… all the way past $2.7K in the next three years.

But there’s a catch—BNB’s future depends heavily on Binance keeping its spot as a top-tier crypto exchange. If that stays steady, Kendrick said, the value drivers behind BNB “aren’t likely to change much.”

ETF buzz and global headlines pushing BNB forward

So far, May’s been busy for BNB. First, VanEck filed for a spot BNB ETF, which raised a few eyebrows. Then Kyrgyzstan floated the idea of using BNB in a potential crypto reserve. Add all that up, and it’s not hard to see why sentiment is shifting toward the bullish side.

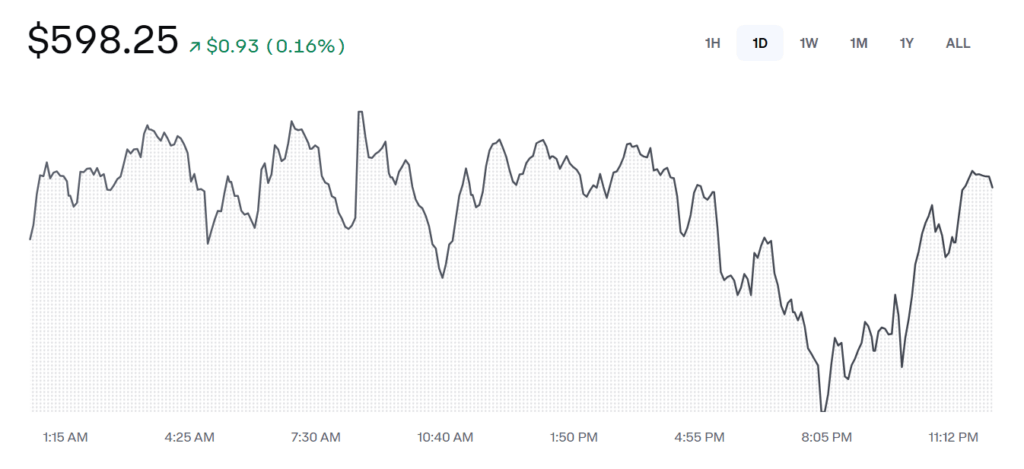

Still, in the short term, BNB hasn’t done much. It’s only up about 1% over the past year. But, according to Kendrick, that’s not the full story—especially if you zoom out. If Binance stays strong and the market keeps pushing toward wider adoption, BNB could be looking at a serious rebound.