- Standard Chartered predicts Bitcoin could hit $120K this quarter, urging investors to buy now.

- Rising treasury premiums, whale accumulation, and ETF shifts are fueling Bitcoin’s momentum.

- Bitcoin’s strong rally could continue through summer 2025, with a year-end target of $200K.

Standard Chartered — yep, the big British bank — is telling investors: if you’re thinking about getting into Bitcoin, now’s the time. They’re predicting BTC will hit a brand new all-time high of $120,000 sometime this quarter.

Geoffrey Kendrick, the bank’s head of global digital assets, dropped this pretty bold forecast today in an email report that’s already making waves.

What’s Supposed to Push Bitcoin Up?

Kendrick laid out a few reasons why he’s so bullish. Both on-chain data and broader market trends are flashing green signals, according to him. Here’s what he’s seeing:

US Treasury Term Premium Is Poppin’ Off

First off, Kendrick pointed at the rising U.S. treasury term premium — it just hit a 12-year high. Crazy, right? This metric apparently moves pretty closely with Bitcoin’s price. So with it shooting up, the idea is that investors might start shifting their money into assets with bigger returns… like Bitcoin.

Basically: treasuries go up → Bitcoin looks juicier → more money flows into BTC.

Americans Are Moving Their Money Around

Another piece of the puzzle? U.S. investors seem to be steering away from dollar-based stuff and into non-U.S. assets — and Bitcoin is a major winner there. Kendrick even mentioned that Asian investors are catching the vibe too.

And get this: a lot of this shift started after President Trump hit pause on his tariff hikes (except for China, who still got the short end of the stick). That break apparently gave Bitcoin a boost over other investments, including tech stocks.

Whales Are Gobbling Up Bitcoin

There’s also some serious whale action happening. Kendrick highlighted that big players — the ones holding more than 1,000 BTC — have been on a buying spree. Especially during Bitcoin’s little dip earlier this month.

These heavyweights seem to be loading up, and according to Kendrick, that’s another reason why we might see Bitcoin race toward $120K.

ETFs Tell an Interesting Story Too

Finally, Kendrick pointed out that ETF flows are shifting. Investors have been pulling money outta gold funds and stuffing it into Bitcoin. That’s a pretty strong signal that folks now see BTC as the better safe haven when the economy looks shaky.

What Happens Next?

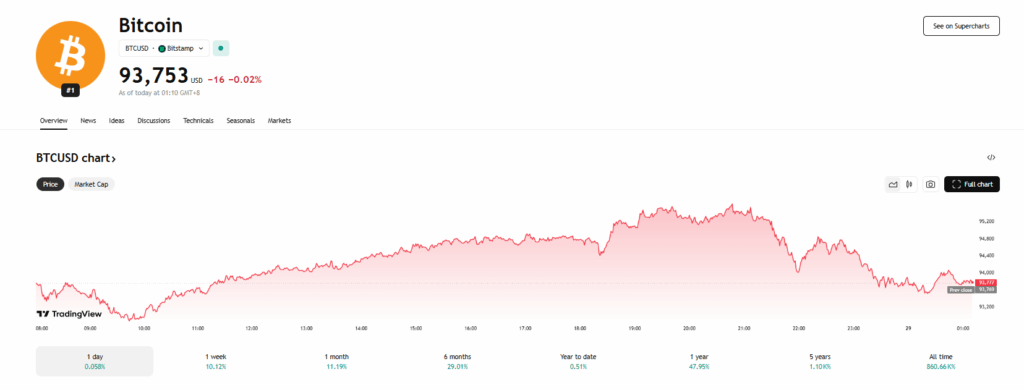

If Kendrick’s right (big if, but still), Bitcoin would jump 26.9% from where it sits right now — about $94,560 — and even beat its previous record high of $109,114 set back on January 20.

But wait, there’s more: Kendrick still thinks Bitcoin could reach $200,000 by the end of 2025. If BTC does climb to $120K in the next couple months, he expects the momentum to carry through the summer and beyond.

That said, he did admit that timing Bitcoin’s breakouts is tricky business. So, his advice? Don’t wait around — now’s the time to get in before the next big move.