- Whales Are Staking Big: A new wallet staked over 19,800 SOL, showing long-term confidence, but the market hasn’t reacted much yet.

- Liquidations and Caution Flags: Long liquidations spiked to $6.1M while shorts stayed low, suggesting that overleveraged bulls are being punished and further downside risk remains.

- Key Resistance at $193: SOL struggles to break past $193; momentum is fading, outflows are outweighing inflows, and unless that level flips, price action is likely to remain choppy or head lower.

A freshly created wallet made waves recently after pulling 20,009 SOL (about $3.53 million) from Binance and staking nearly all of it. Roughly 19,875 SOL was staked immediately, and another 134 SOL got sent to a different staking address, which now holds a total of over 9,270 SOL—roughly $1.6 million. While this kind of heavy staking screams long-term conviction, the market’s been… kinda quiet about it. No major reaction, no fireworks.

Still, the move suggests there’s some under-the-surface belief in SOL’s future. But belief isn’t enough—broader market conditions still need to click into place before bulls get anything to celebrate.

Long Liquidations Surge—A Bull Trap in Disguise?

On May 25, long traders took a nasty hit—about $6.1 million in long liquidations were recorded across major platforms, compared to just $326K on the short side. Ouch. Binance alone accounted for almost half, with $2.76 million in long positions flushed out.

This kind of lopsided action usually pops up in overheated markets or signals a possible correction. It either marks the final shakeout before a bounce… or the start of more pain. Either way, the message is clear: caution is warranted if you’re still holding longs hoping for a rocket ride.

Sentiment Stays Bullish, But At What Cost?

Despite the slap from liquidations, nearly 69% of Binance traders are still long on SOL, with a long/short ratio of 2.22. That’s a lot of hopium.

But high bullish skew like this can actually backfire. If SOL keeps dragging or dips again, more longs could get wiped out. That’s the risk—when optimism isn’t backed by momentum, corrections can be brutal. Right now, trader sentiment might be a little too confident for comfort.

$193: The Line in the Sand

At press time, SOL’s price hovered around $172.34, still shy of the $193 Fib resistance level. The Relative Strength Index (RSI) has dropped to 61.87, showing that momentum is cooling, even though bulls still have a slight edge.

If SOL reclaims $193 with volume, we could see a push toward $229. But if it gets rejected again? The market might just stay stuck—or worse, start heading back down.

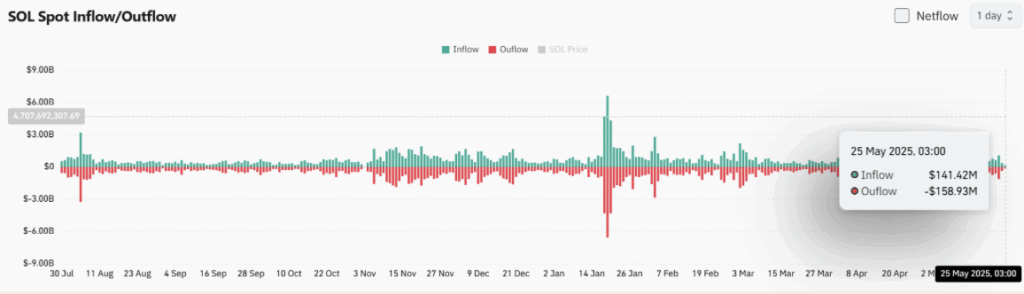

Net Outflows Still Dominate, Raising Red Flags

Even with all the whale staking buzz, spot market data shows outflows outweighing inflows. On May 25, SOL saw $158.93M in outflows vs. $141.42M in inflows—a net negative.

This tells us that, despite some big players doubling down, the broader market is still exiting or trimming positions. Until inflows start to outpace outflows consistently, SOL’s price action might stay under pressure.

Final Thoughts: Is Solana Ready or Not?

Solana’s got some strong long-term signals—like whales staking big and steady development under the hood. But short-term signs are shakier: massive long liquidations, net outflows, and a stubborn resistance wall at $193.

If SOL can flip that resistance with some conviction (and maybe a few fat inflows), the bulls might get their moment. Until then, expect more chop… maybe even more downside if the leveraged longs keep getting squeezed.