- ETF hype is heating up, with Solana and Litecoin front and center after Bitcoin and Ethereum.

- Bloomberg gives both high odds, but Solana has the edge due to stronger demand and cleaner trust metrics.

- SEC’s final call is still pending—investors will need patience as the ETF race plays out.

Crypto markets are still shaky—geopolitical stress, inflation, you name it. But amid the noise, there’s one question buzzing in investor circles: will Solana or Litecoin get that long-awaited ETF approval first? The SEC’s sitting on nearly a hundred crypto ETF filings, and yeah… still no decisions this year. The wait drags on. But now, it’s turning into a showdown: SOL vs LTC.

Why’s Everyone Hyped About These Two?

So far, we’ve only got two spot crypto ETFs—Bitcoin and Ethereum. Both are doing just fine, with inflows climbing and prices holding up. Naturally, investors are hoping Solana and Litecoin will follow the same path. If they get listed, that could mean more demand, more adoption, and a nice price bump. Classic ETF effect.

It’s not just about chasing profits though. Both tokens are big players. And yeah, Ripple fans—your token’s still in the race too, especially after Canada rolled out three XRP spot ETFs. But with the SEC and Ripple still locked in a legal mudfight, SOL and LTC are the safer bets (at least for now).

Approval Odds: Who’s Leading the Race?

ETF chatter’s been around for years, but it’s louder than ever now. Bloomberg analysts recently gave Solana, XRP, and Litecoin a massive 95% chance of approval. Bold, right? They said SEC’s recent engagement was “a very positive sign,” and the markets jumped on that instantly.

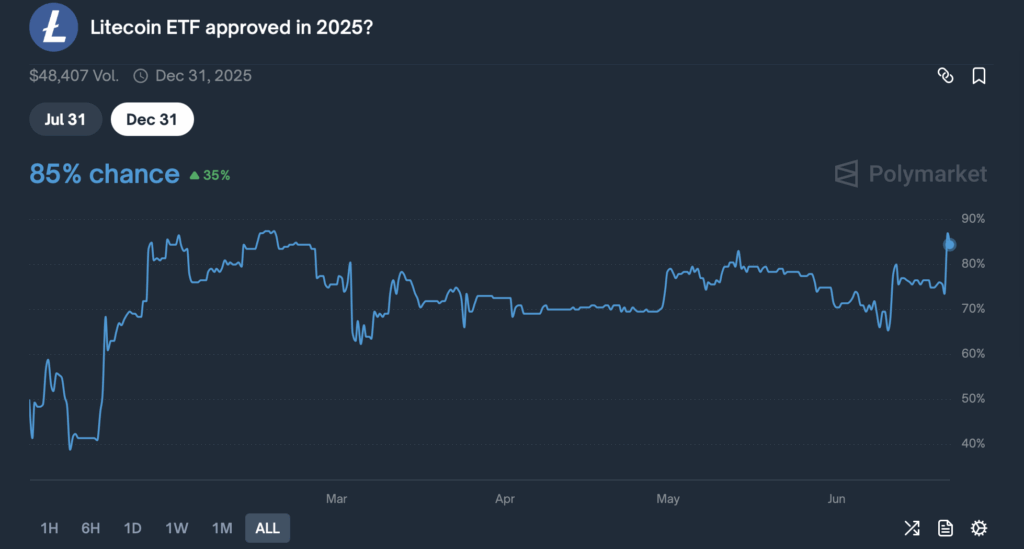

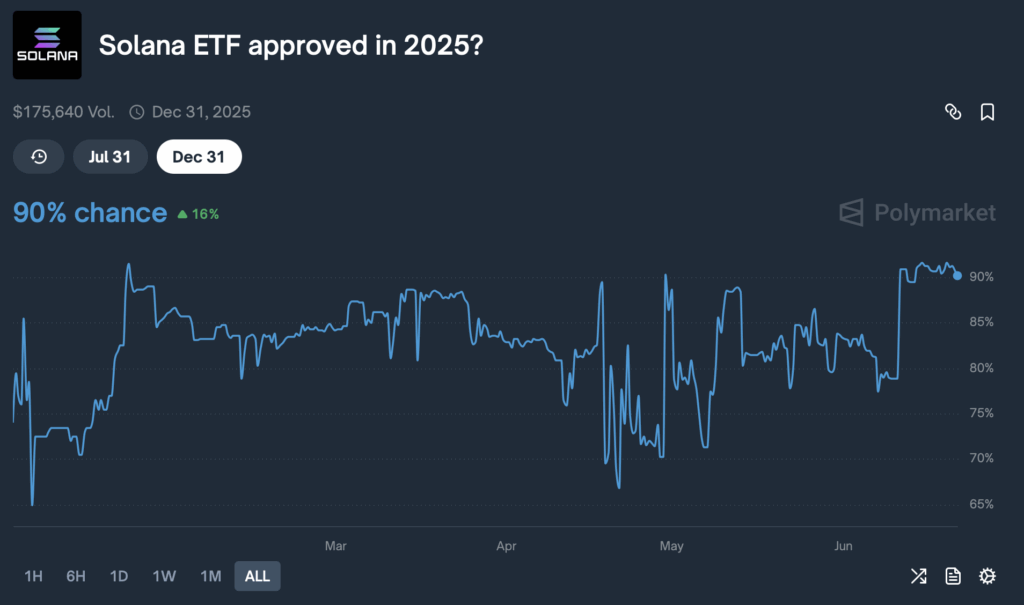

Solana’s ETF odds have been comfortably above 90% for days. Litecoin? Not quite there. It started gaining steam only after one of those Bloomberg updates. Right now, LTC’s odds sit at 83%, which—while not bad—is still a few steps behind. Part of it comes down to demand. Solana’s got the momentum, while Litecoin’s trailing just a bit on that front.

Solana Might Have the Edge—Here’s Why

With Gensler stepping down, the SEC’s tone has shifted. They’re showing signs they might play ball with more ETF approvals. And between Solana and Litecoin, there’s a noticeable tilt toward Solana. Why? For one, the Solana ETF proposal includes a staking feature—which is a pretty big structural change. That alone has folks intrigued.

Also, let’s talk trust funds. The Grayscale Solana Trust holds just 0.1% of the total supply. No discount history, minimal disruption risk. Meanwhile, the Litecoin trust holds 2.65% and trades at a discount… which could invite post-approval sell pressure. Not exactly ideal.

On top of that, Solana has more filings in front of the SEC than Litecoin does. Pair that with stronger adoption and clearer regulatory vibes, and well—it might be SOL’s race to lose.

Still, Nothing’s Guaranteed

As one user bluntly put it on X: “What use is there for a Litecoin ETF if the volume is minimal and the coin’s worth $6B? I’d be more excited if it was worth $100B+.” It’s a fair point. Litecoin’s solid, but is it big enough to carry an ETF right now?

So yeah, both SOL and LTC have decent odds of getting approved this year. But as with most things SEC-related—it’s anyone’s guess. Odds are cool, sure. But it’ll all come down to the SEC’s actual decision. Until then, we wait.