- Solana Surges 17% Amid Institutional Inflows: Solana (SOL) climbed to $173 on May 9, fueled by increased institutional investments and a rise in memecoin activity, pushing the network’s total value locked (TVL) to over $8.7 billion.

- Short Squeeze Potential as Liquidations Mount: Solana’s leveraged market saw $31 million in net liquidations, while on-chain liquidations hit $47 million, raising the odds of a short squeeze that could drive SOL higher.

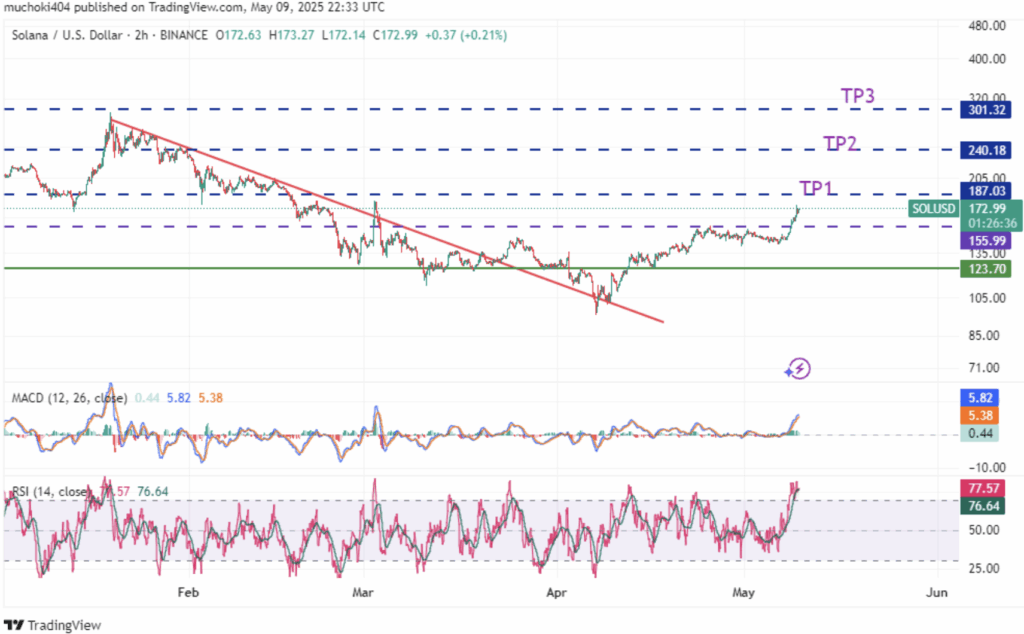

- Bullish Targets at $187 and $240: On the 2-hour chart, SOL’s MACD crossed above zero, and RSI pushed past 70, indicating bullish momentum, with key resistance at $187 and $240 if the 200-day SMA is cleared.

Solana (SOL) has been riding the wave alongside Bitcoin and Ethereum, gaining 17% over the past week to hit $173 on May 9 during the late North American trading session. The large-cap altcoin, with a fully diluted valuation near $89.8 billion and a 24-hour trading volume of around $8.8 billion, is catching eyes as volatility ramps up.

Short Squeeze Potential as Liquidations Spike

With the recent price surge, Solana’s leveraged market saw a net liquidation of $31 million in the past 24 hours. Meanwhile, native perpetual exchanges on Solana recorded over $47 million in on-chain liquidations, increasing the chances of a short squeeze. If bearish traders get caught offside, a sudden spike could push SOL higher in the near term.

Institutional Cash Inflows Boost Solana Network

It’s not just retail traders fueling Solana’s rise. Institutional investors have been pouring cash into the network, led by Sol Strategies, which has been aggressively increasing its SOL holdings over the past few quarters. The memecoin craze within the Solana ecosystem has also helped pump the network’s total value locked (TVL) to over $8.7 billion.

Meanwhile, the U.S. SEC under the Trump administration has taken a more crypto-friendly stance than in previous years, fast-tracking spot Solana ETF applications. If these ETFs get the green light, more institutional money could flow into Solana, further boosting its price action.

Technical Analysis – Eyeing $187 and $240

From a technical perspective, SOL is flashing bullish signals. On the 2-hour chart, SOL successfully rebounded from a falling logarithmic trendline, with the MACD line crossing above the zero mark and the RSI climbing over 70 — both classic bullish indicators.

With momentum building, the next key targets are $187 and $240. However, the bigger macro-bullish setup won’t be fully confirmed until SOL clears the 200-day Simple Moving Average (SMA), a level that could act as a launchpad for further gains.

For now, all eyes are on institutional flows and the potential for a short squeeze to see if Solana can maintain its upward trajectory.