- CoinShares has filed with the SEC to launch a spot Solana ETF, joining seven other firms in the race.

- The ETF would track the CME CF Solana-Dollar rate and include cold storage custody, with possible staking rewards.

- Approval odds sit around 70%, but analysts don’t expect a decision before Q4 2025.

CoinShares, one of Europe’s top digital asset managers, just threw its hat into the ring in the U.S. Solana ETF race. The firm filed an S-1 with the SEC on June 13, aiming to launch a spot Solana (SOL) exchange-traded fund on Nasdaq—another major push from institutional players trying to get direct exposure to this fast-moving blockchain ecosystem.

The proposed ETF would track the CME CF Solana–Dollar Reference Rate, giving investors a clean, regulated way to tap into SOL without the hassle of direct custody. Speaking of which, Coinbase Custody Trust and BitGo have been tapped to keep the assets locked away in cold storage. Interestingly, some of the holdings might also be staked through chosen providers to generate passive rewards, the filing noted.

Eight Firms in the Race – But When Will the SEC Blink?

This latest filing adds CoinShares to a growing list of asset managers going all in on Solana. VanEck started the wave earlier this year, and now big names like Fidelity, 21Shares, Grayscale, Franklin Templeton, Bitwise, and Canary Capital have followed. That brings the total to eight contenders, according to Bloomberg ETF expert Eric Balchunas.

Still, while the interest is heating up, the SEC isn’t rushing anything. Regulators have reportedly asked issuers to clarify how they’ll manage in-kind redemptions—a core feature for ETF functionality—and although there’s been some openness toward staking, there’s no green light just yet.

Approval Odds at 70%—But You Might Be Waiting a Bit

James Seyffart from Bloomberg thinks approval will come—but not right away. His latest forecast pegs the odds around 70%, with the first possible green light coming no earlier than late June or early July. More realistically? Probably sometime in Q4 this year.

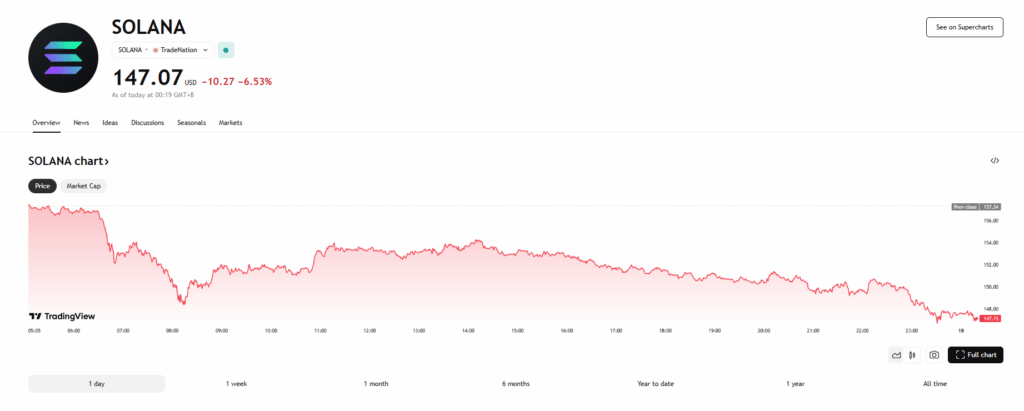

Solana’s appeal is obvious: it’s fast, scalable, and a lot cheaper to use than Ethereum. Developers love it, and institutional interest is clearly ramping up. That said, concerns around volatility, security hiccups, and regulatory clarity still hover overhead.

Even so, CoinShares’ filing is just one more sign of where the market is heading. As the SEC sifts through this fresh batch of ETF proposals, everyone—from hedge funds to retail traders—is waiting to see what doors might open next in the regulated crypto investment world.