- Solana breaks below key support following U.S. strike on Iran; price down 20% from May highs.

- A completed Head and Shoulders pattern points to a possible move toward $106.

- SOL must reclaim $149 to shift short-term structure—until then, bears stay in control.

Solana’s taken a hard hit—there’s no sugarcoating it. After news broke of a U.S. military strike on Iranian nuclear sites, the market spiraled into chaos. And altcoins? Yeah, they felt it the worst. Solana, which had been trading near $185 not too long ago, tumbled fast—now hovering around $148, a full 20% drop from its May high.

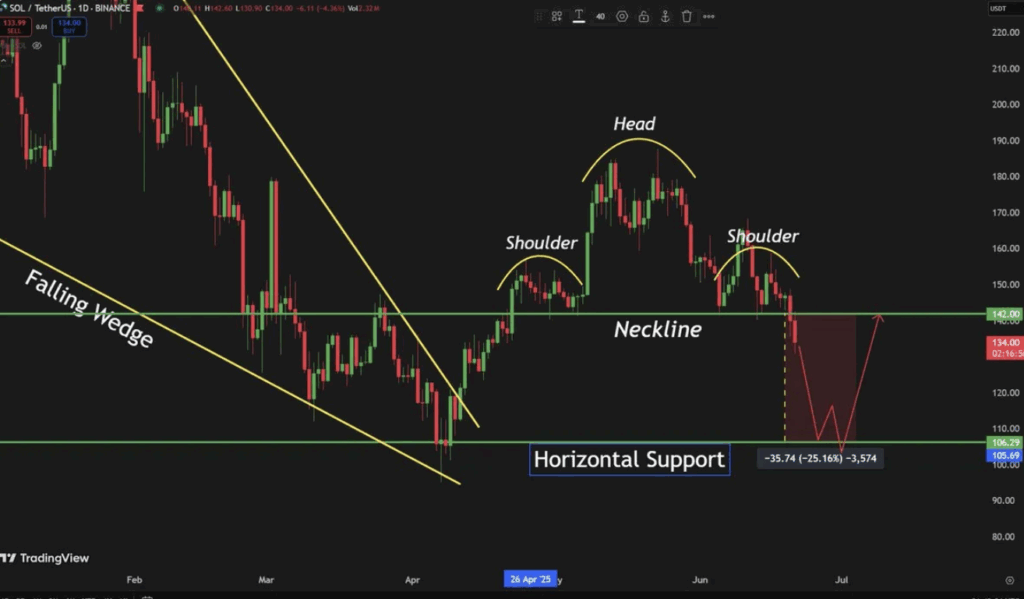

This breakdown pretty much confirms what many feared: Solana’s uptrend has lost steam. Top analyst Carl Runefelt flagged a Head and Shoulders formation on the chart—a bearish pattern that tends to spell trouble. The neckline? Broken. And when that cracks, more downside is usually just a matter of time.

Bulls on the Ropes as Support Evaporates

Every bounce has been met with rejection. Solana hasn’t been able to claw back to its earlier support levels, and momentum indicators are flashing red across the board. With broader sentiment shaky and macro tension ramping up, a fast recovery feels like a long shot—unless something major changes.

The bullish run from late 2024 is now a distant memory. Solana’s price action has shifted sharply. Lower highs, broken trendlines, fading confidence. It’s now trading over 50% below its all-time high, and the Head and Shoulders breakdown? That sets up a possible drop toward $106.30—a level we haven’t seen since February.

Market Rotates Away from Risk — SOL Caught in the Crossfire

This isn’t just a Solana problem. The entire altcoin market’s showing signs of weakness. Investors are pulling capital out of riskier plays and rotating into Bitcoin and stablecoins. That long-hoped-for altseason? Doesn’t look like it’s happening—not yet, at least.

Solana’s failure to set higher lows or reclaim key resistance zones shows a market losing its footing. Unless bulls mount a serious push, we’re looking at more consolidation… or worse, a deeper leg down.

SOL Price Dips Below 200-Day SMA — Not a Great Sign

Price just cracked below the 200-day SMA—around $149.54—which had been acting as dynamic support. That move signals a shift in momentum, and not in a good way. SOL’s currently trading near $135.99, down 3% on the day and sliding fast from its recent highs.

The rejection at the 100-day SMA didn’t help either. With price now under both the 50- and 200-day averages, and volume piling up on the red candles, it’s clear sellers are in control. This isn’t just noise—it’s conviction.

If the bleeding continues, eyes are on the $120–$125 range. That zone acted as support earlier this year, and might—might—offer a temporary floor. But the macro picture? Still messy. The geopolitical tension from the U.S.–Iran strike has added a thick layer of uncertainty, and in this environment, risk assets like Solana tend to take the hit.

What Needs to Happen Now?

A daily close above $149 would go a long way in calming things down and could shift sentiment back toward neutral. Until that happens, though, bears are holding the pen—and they’re still writing the story.