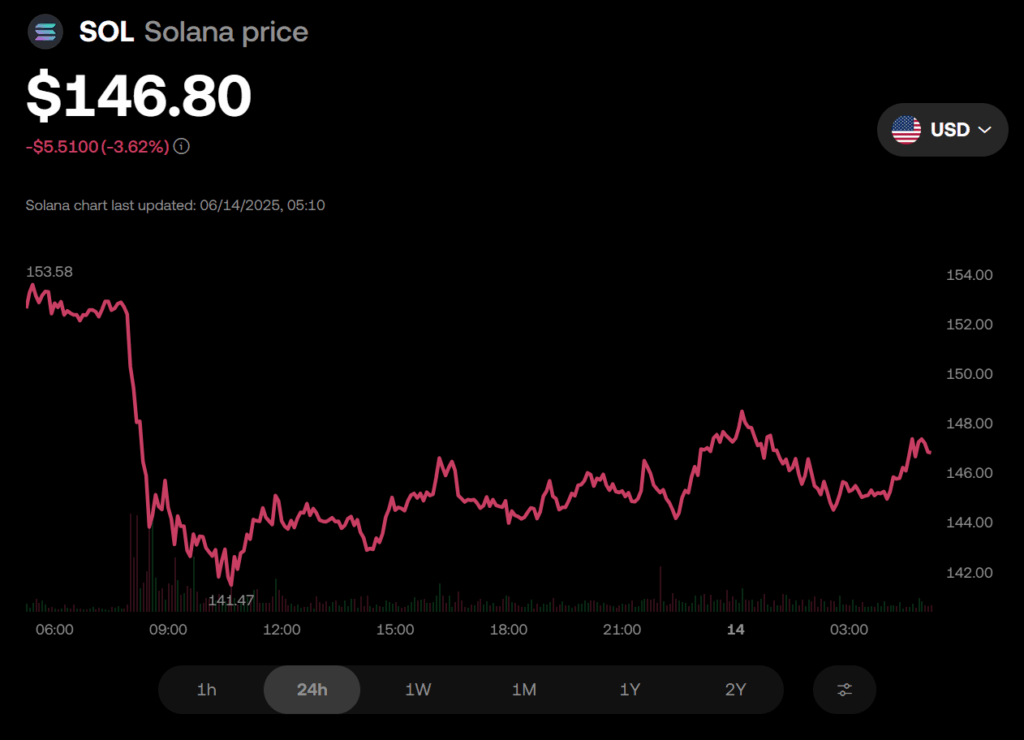

- Solana dropped nearly 12% intraday, with support forming near $143 and resistance capping gains at $150–$152.

- Standard Chartered maintains a bullish $275 year-end target, but current market conditions challenge that outlook.

- Consolidation and volume spikes suggest possible recovery, though a break above $152 is needed to confirm upside.

Solana’s SOL token dropped 7.87% over the past 24 hours, falling from an opening of $159.60 to a low of $142.13 before stabilizing above $147. The selloff reflects heightened volatility across the crypto market, with SOL now trading roughly 40% below its March highs. While volume spikes near support suggest some accumulation, the broader structure remains weak and fragile.

Bullish Forecast Faces Reality Check

The recent downturn puts fresh scrutiny on a bullish projection from Standard Chartered, which forecast a year-end price of $275 for Solana and a longer-term target of $500 by 2029. While the bank highlighted Solana’s speed and low fees as major strengths, it also noted the ecosystem’s reliance on memecoin-driven activity—something the market continues to discount heavily. The disparity between forecast and price action raises tough questions for long-term investors.

Market Sentiment Split Between Opportunity and Skepticism

SOL buyers defended support near $143, but resistance near $150 remains firm, limiting any real momentum. Analysts view SOL as a high-beta token, meaning it’s likely to surge in bullish retail-led cycles—but the current climate hasn’t offered the macro backdrop for such a move. The near-term trend depends heavily on whether risk appetite returns across crypto and whether Solana usage diversifies beyond speculative assets.

Technical Patterns Hint at Potential Rebound

From a technical perspective, SOL formed a tight consolidation band between $143.50 and $146.50, with higher lows since 02:00 UTC suggesting potential bullish divergence. Volume surged at key intervals, with 43.4K SOL traded at 13:39 UTC, indicating buyers are active at current levels. A breakout above $152 could flip the short-term trend, but momentum remains fragile.