- Pump.fun’s Massive SOL Dump: Pump.fun deposited another 156,425 SOL (~$25.7M) onto Kraken, bringing its total to over 3.49 million SOL offloaded—suggesting a deliberate exit. Bearish sentiment has grown among both retail and smart money, aligning with a 5.63% price drop in SOL.

- Technical Breakdown Signals More Downside: SOL broke below a key ascending trendline and failed to hold above $179 resistance. With RSI in the oversold zone and no strong bullish triggers, a further dip toward the $140–$145 support range seems likely.

- Bearish Momentum Builds Across Metrics: Net outflows, negative funding rates, and lopsided long liquidations show traders are bracing for lower prices. Unless bullish momentum returns fast, SOL may continue its slide.

Looks like Pump.fun just made another massive move—this time, dropping 156,425 SOL onto Kraken, worth roughly $25.74 million. Yeah, that’s no small transfer. When you stack this with their previous dumps, it’s now a running total of 3.49 million SOL offloaded, which clocks in at over $640 million. That’s a whole lotta Solana.

Now, when this kind of thing happens repeatedly, it’s not just random. It kinda screams exit strategy. Market Prophit data isn’t helping the mood either—both regular folks and big-money traders are feeling bearish. It’s all syncing up with the recent dip in SOL’s price, which slid 5.63% in the last 24 hours. Currently sitting around $163.07, it’s not exactly exuding bullish vibes.

Trend Breakdown and Bearish Clouds

Technically speaking, things aren’t looking super pretty for SOL right now. The price slipped below an important ascending trendline after getting rejected hard from the $179 resistance. Not ideal. That zone between $140 and $145 is now acting like the safety net—but how strong is it, really?

The Stochastic RSI is camped out in the oversold territory, which usually screams “weak momentum” rather than “reversal incoming.” Unless something major flips the mood soon, chances are we’ll see more bleeding. The structure breaking down like this just adds to the gloom.

Whale Moves & Funding Flips

CoinGlass numbers show some concerning outflows on May 30—$273.26 million out versus just $241.56 million in. That $31.7 million gap isn’t just noise. It suggests whales are cashing out or at least stepping aside. Combine that with Pump.fun and other big entities dumping tokens, and you’ve got a lot of pressure on the sell side.

Even more telling? Funding rates turned negative again—sitting at –0.0015% as of now. That basically means traders are piling into short positions, expecting SOL to go lower. It’s a pretty clear shift in sentiment. If open interest doesn’t swing back around quickly, the downside pressure could only get worse.

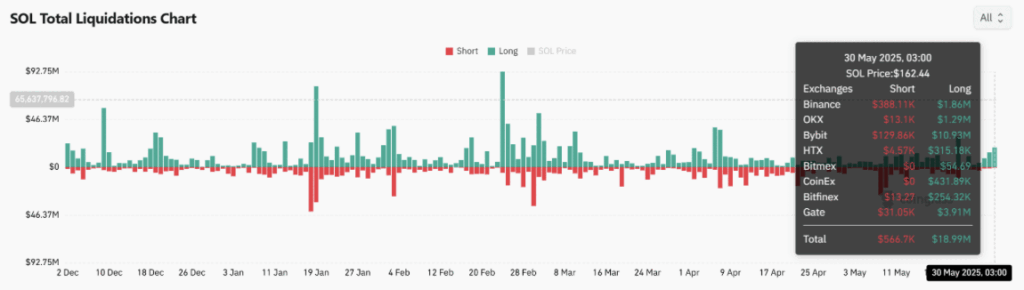

Longs Wrecked, Shorts Chill

To top it off, longs got smoked. Liquidations on May 30 showed almost $19 million in longs wiped out, compared to less than $600K in shorts. That’s brutal. Bybit took the hardest hit—over $10.9 million liquidated—followed by Binance and OKX. It’s a sign that bullish traders didn’t see the drop from $179 coming, and they paid the price.

So, all in all, SOL’s walking a tightrope. If it doesn’t find solid ground at the $140–$145 level, we might be looking at a deeper drop. And unless some bullish surprise enters the chat soon, the bears are probably not done yet.