- Peter Schiff Acknowledges Bitcoin Use Case: Bitcoin critic Peter Schiff surprisingly pointed to Jim Chanos using Bitcoin to hedge against his short position in MicroStrategy (MSTR), suggesting BTC might have a ‘real use case’ as a hedge against Saylor’s Bitcoin-heavy strategy.

- Chanos Calls Out MSTR’s Valuation: Chanos argued that MSTR stock is trading at a hefty premium to its actual Bitcoin holdings, stating, “Investors are paying $3 of stock price to gain $1 of Bitcoin exposure,” highlighting the perceived overvaluation.

- Bitcoin Consolidation and MSTR’s Risk: While MSTR stock is up 40% in 2025, Schiff warns that its gains are more tied to Bitcoin’s price action than real business growth, cautioning that a BTC drop could spell trouble for MSTR – a sentiment echoed by some as BTC consolidates between $100,678 and $105,700.

Peter Schiff, the gold guy who’s always trashed Bitcoin, just admitted there might – just might – be a use case for BTC. Yeah, you heard that right. Schiff, who’s never missed a chance to slam crypto, pointed to a strategy by investment manager Jim Chanos as a possible ‘real use case’ for Bitcoin. But it’s not what Bitcoin fans would expect.

Chanos Uses Bitcoin to Hedge Against MicroStrategy

According to Schiff’s post on X, Bitcoin’s use case isn’t what the crypto crowd’s been touting. He highlighted how Chanos, a well-known short-seller, bought Bitcoin to hedge against his short position in MicroStrategy (MSTR). Why? Because MSTR, led by Michael Saylor, keeps piling on Bitcoin – they’re sitting on nearly 570,000 BTC now – and it’s made the stock almost a proxy for Bitcoin with extra corporate risk.

Schiff sarcastically said Saylor has ‘accidentally created a real use case for Bitcoin,’ suggesting investors like Chanos are using BTC to protect themselves from MSTR’s volatile, Bitcoin-heavy strategy.

Chanos Calls Out MicroStrategy’s Valuation

Chanos isn’t mincing words. In another post, he argued that MSTR’s stock is trading at a premium that’s way out of whack with the actual value of its Bitcoin holdings. He put it bluntly: ‘Investors are paying $3 of stock price to gain $1 of Bitcoin exposure.’

By holding Bitcoin while shorting MSTR, Chanos is essentially betting that MSTR’s stock will drop, but Bitcoin will either hold steady or rise – cushioning his potential losses. It’s a pretty wild strategy, and it speaks to how extreme MSTR’s valuation has gotten.

Schiff Doubles Down – Is MSTR Really a Bitcoin ETF?

Peter Schiff, never one to pass up a chance to slam Saylor, took aim at MSTR’s entire business model, arguing that it’s more of a Bitcoin-holding entity now than a software company. He said, ‘If you want to buy Bitcoin, then buy Bitcoin. If you want to invest in the stock market, buy a company with an actual business.’

Meanwhile, Michael Saylor keeps doubling down on Bitcoin, recently adding 13,390 BTC for $1.34 billion. Schiff says it’s a risky move – if BTC tanks, those paper gains could turn into real financial pain.

MSTR Stock Surges – But Can It Last?

MSTR’s stock is up nearly 40% in 2025, mirroring Bitcoin’s surge. But Schiff’s not convinced. He thinks the rally is tied more to BTC price action than any real business growth. And if Bitcoin takes a dive? MSTR’s stock could go right with it.

Still, some see Saylor’s strategy as visionary. Pro-XRP lawyer John Deaton compared Saylor’s long-term Bitcoin play to Warren Buffett’s approach with Berkshire Hathaway. According to Deaton, Saylor could be aiming to control up to 5% of all Bitcoin in circulation – a massive bet, especially with BTC consolidating between $100,678 and $105,700.

Bitcoin’s Big Picture – Breakout or Breakdown?

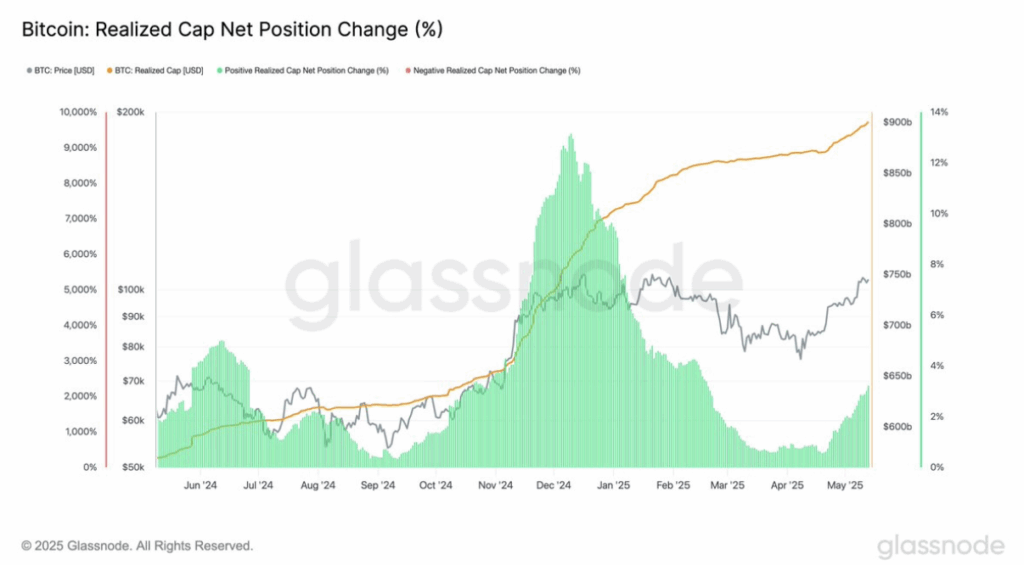

While all this drama plays out with MSTR, Bitcoin itself is stuck in a tight range. Analysts are watching key levels as BTC’s realized cap has climbed $30 billion since April 20, signaling fresh money is flowing in. If Bitcoin can hold above current support, a bullish breakout could be in the cards. But as always in crypto, nothing’s set in stone.