- PEPE dropped 17% in 24 hours, erasing most of its monthly gains, as selling pressure intensified across the derivatives market.

- Bearish signals dominate, with rising liquidations on long positions, falling open interest, and sellers paying premiums to maintain shorts.

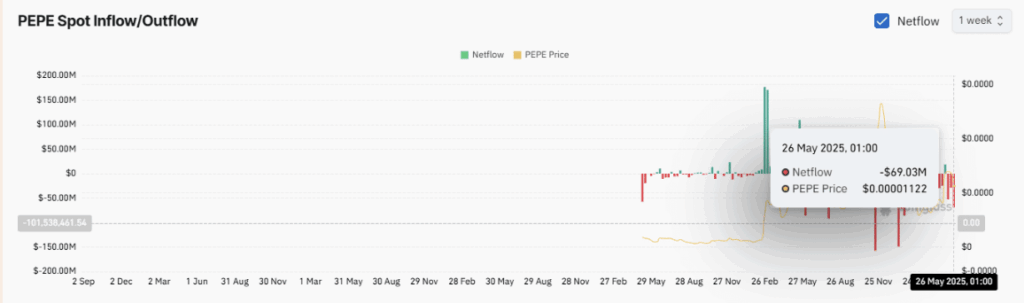

- Despite the drop, some buyers are accumulating, with over $69M in purchases this past week, though further downside toward $0.000008777 remains possible if bearish momentum continues.

So, yeah—Pepe [PEPE] just got hit hard. The memecoin shed a rough 17% in the last 24 hours alone, wiping out a good chunk of its recent gains. Oddly enough though, it’s still sitting on a decent 25% rise over the past month. Kinda messy, but that’s crypto for you. Right now? The vibe in the market says there’s room for even more downside. And sellers? Oh, they’re not letting up.

Selling Pressure’s Heating Up

Things are looking shaky. Sellers have the upper hand, that much is clear. About 50.77% of derivatives market volume is coming straight from sell-side activity—that’s not a small number. Plus, Open Interest (OI) has dipped 23%, which usually hints at traders bailing on their positions. Losses? Pretty brutal. In just one day, long traders lost $7.32 million out of $8.97 million total in liquidations. That’s a red flag. Longs are getting wrecked, and bearish momentum is clearly steering this ship.

Bears Are Paying to Keep the Momentum

Here’s something telling: Funding Rates have flipped negative, big time. At -0.0078%, sellers are literally paying to keep short positions open. That usually means the market’s leaning hard in their favor, with Futures prices lagging spot prices. So yeah, the trend is kinda clear. If that pattern keeps up—dropping OI, aggressive selling—PEPE might just keep slipping. And it could get uglier before it gets better.

Buyers Are Still Around—But It’s Risky

Weirdly, not everyone’s running for the hills. Some folks are still scooping up PEPE, especially in the spot market. Over $1.59 million in PEPE was snapped up just in the past day. And zooming out, around $69.3 million was accumulated in the past week. That’s not pocket change. Add to that: Bollinger Bands are flashing oversold territory. Every time PEPE dips below the red band, it’s bounced back big… historically at least. That said, it’s not all sunshine. If this selling spiral keeps spinning, we could see the price head toward $0.000008777. The chance is slim—but not zero.