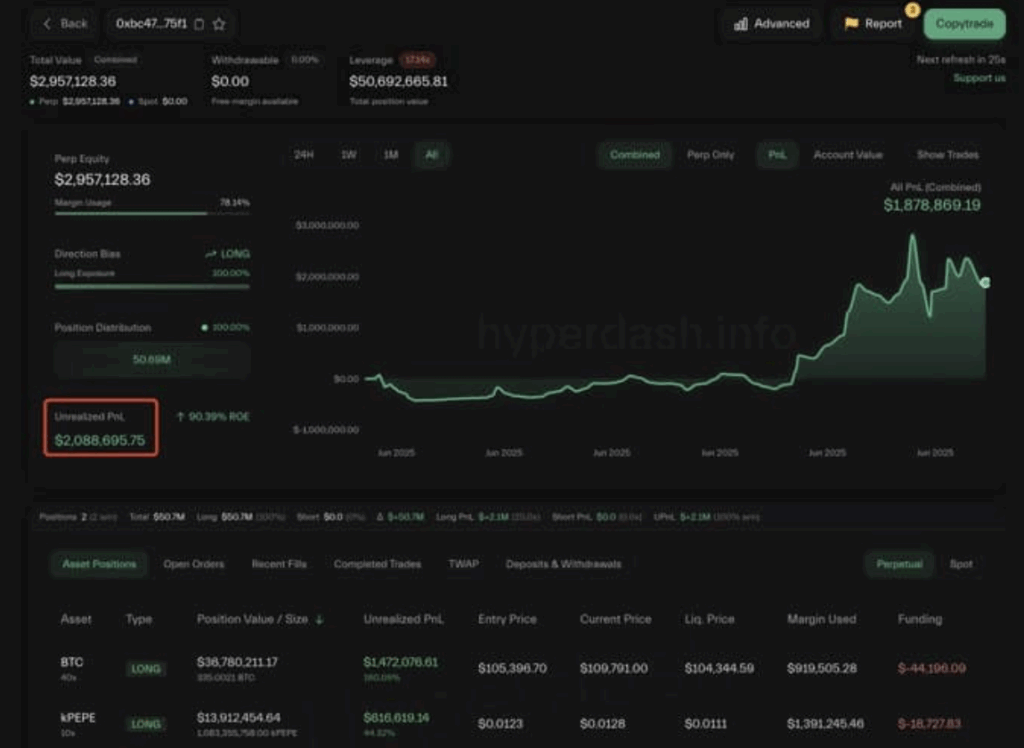

- Whale trader James Wynn re-entered PEPE with a $13.9M long, now sitting on over $600K in unrealized gains.

- Spot and futures markets show strong accumulation and bullish sentiment, with open interest funding rates supporting long positions.

- The memecoin sector has grown 5.8% this week, positioning PEPE for potential continuation if momentum holds.

Pepe’s been creeping upward, quietly at first—but now? It’s starting to grab attention. In just the past 25 hours, the memecoin posted a 2.15% gain, building on a steady climb over the last week. Momentum’s there, sure, but there’s a bit of tension in the air. The re-entry of a very bold—and very unlucky—whale has folks watching their charts a little closer.

James Wynn, the trader infamous for blowing $1 billion on a bad Bitcoin bet, is back at it. He’s jumped into PEPE again, opening a fresh $13.9 million long position after spinning up a brand-new wallet. So far, he’s up $616K. Not too shabby… yet. Just a few weeks back, he took a beating on both PEPE and BTC, so whether this latest move is redemption or round two is still up in the air.

Whales, Futures, and Fresh Optimism

Despite Wynn’s dicey track record, PEPE’s current trend is being supported by broader signs. The spot market has seen $35 million in buys over the past week. That’s not noise—that’s big money accumulating, suggesting that plenty of traders think these price levels are a bargain.

On the futures side, things look even more tilted in favor of bulls. At press time, the Open Interest Weighted Funding Rate sat at 0.0104%, a sign that traders are paying to hold long positions. That usually points to confidence, or at the very least, strong speculation that a bigger move might be coming.

So with whales buying, and derivatives leaning green, it’s no wonder folks are getting hopeful. Still, crypto doesn’t care about hope. It cares about liquidity and sentiment—and those can flip quick.

Memecoins Stage a Comeback

Zooming out, the memecoin sector has quietly been on a tear. Over the past week, it’s grown by 5.8%—outpacing not just Bitcoin-related tokens but also exchange tokens. That’s no small feat. PEPE, sitting right in the heart of that market, could keep riding the wave if this trend holds.

Traders tracking weighted averages and funding rates say the story’s still bullish, at least for now. But with a figure like Wynn involved, things can heat up—or implode—real fast. Watch the charts. Watch the whales.