- Nasdaq has filed a 19b-4 with the SEC to list the 21Shares SUI ETF, marking a major step toward US altcoin ETF approval.

- Sui boasts nearly $2B in DeFi TVL, $1.1B in stablecoins, and a swift recovery from a major DEX exploit.

- Analysts see Sui ETF filing as part of a broader “Altcoin ETF Summer,” though demand may vary across assets.

Sui might just be getting its moment in the spotlight. Nasdaq recently filed a 19b-4 form with the SEC to list the 21Shares SUI ETF, officially kicking off the review process for what could become one of the first spot ETFs tied to an altcoin—outside of Ethereum, that is. It’s a big step, especially considering how the SUI ecosystem has had to bounce back from some bumpy road patches lately.

According to the Sui Foundation, this marks the “formal” beginning of the ETF evaluation. It follows 21Shares’ earlier S-1 filing from April, signaling clear momentum toward institutional adoption. Globally, there’s already $300 million+ wrapped up in SUI-based ETPs via exchanges in Paris and Amsterdam. A US product? That could take things to a whole different level.

Strong Metrics Back the Bid

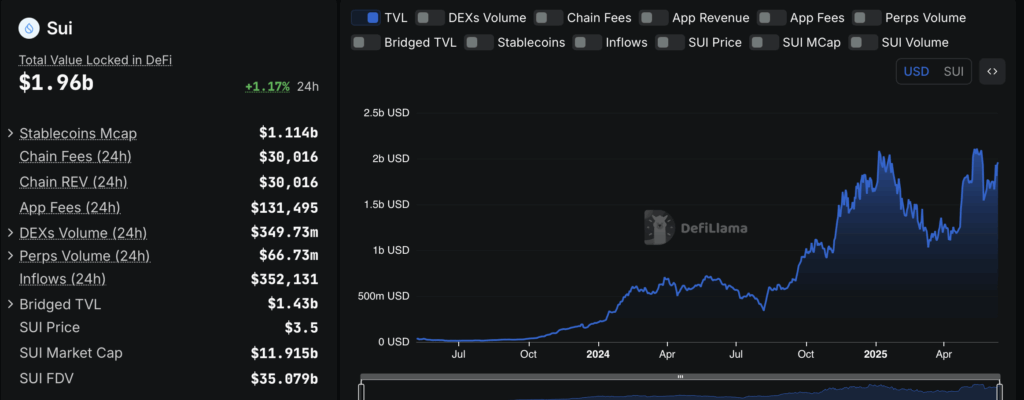

Sui’s not just riding hype—there’s some real data behind the buzz. Total value locked (TVL) across its DeFi protocols has reached nearly $1.94 billion, placing it eighth across all chains according to DeFiLlama. Stablecoins? Those are booming too. Market cap for SUI-based stablecoins has jumped 190% this year and recently crossed $1.1 billion. Transfer volume? Over $110 billion… just in May.

Tech-wise, Sui’s no slouch. Its horizontal scaling, object-based programming, and real-world tokenization capabilities make it attractive to developers building everything from games to DeFi platforms. It’s quickly cementing itself as a serious Layer-1 contender.

Cetus Hack Rocked the Ecosystem—But Recovery Was Fast

Things haven’t been all smooth sailing, though. Back in May, Sui took a hit when the Cetus DEX was exploited for $260 million. That shook investor confidence for a moment—especially since the response included a controversial $162 million recovery fund. Still, the network stabilized. TVL rebounded, and a $10 million security initiative was launched to support developers and improve risk protocols.

Cetus remains a key piece of Sui’s DeFi infrastructure, so its bounce-back gave traders a bit of reassurance. With the protocol back on track and SUI’s price up 18% since early June (trading at $3.47 at last check), momentum is cautiously building again.

What’s Next? Altcoin ETF Summer?

Mysten Labs President Kevin Boon called Nasdaq’s ETF filing a “powerful moment” for Sui. The move adds fuel to what analysts like Bloomberg’s Eric Balchunas are already calling “Altcoin ETF Summer.” Still, Balchunas warned not to expect every altcoin ETF to perform like Bitcoin’s: “the further away you get from BTC, the less assets there will be.”

Meanwhile, Osprey is pushing hard for a Solana ETF, which could force the SEC to speed up altcoin ETF decisions. The Commission, however, just delayed its ruling on the Hedera ETF, extending the comment window—again.

For now, optimism around the SUI ETF is strong. Whether or not it clears the SEC, it signals real interest in giving institutional investors easier exposure to the next wave of Layer-1 platforms.