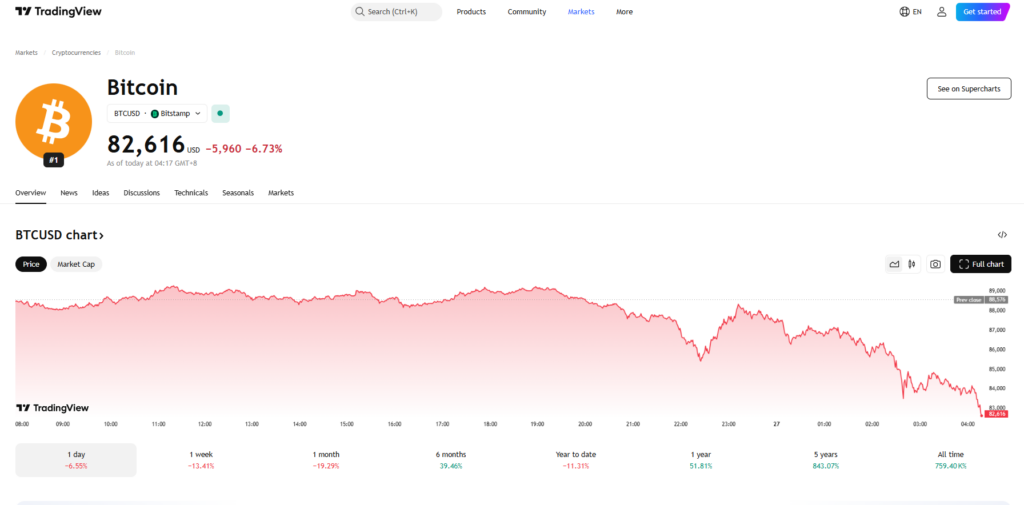

- Bitcoin dropped below $84K, down 12% on the week, while Ethereum hit a five-month low at $2,275.

- Over $600 million in liquidations wiped out leveraged positions, with Bitcoin leading at $335M.

- Macroeconomic uncertainty, Trump’s tariffs, and Nvidia’s earnings report are fueling risk-off sentiment in the market.

The crypto selloff isn’t slowing down—Bitcoin plunged to $83,724, its lowest price since early November, while Ethereum tanked to $2,275, marking its worst level since last September.

- Total liquidations in the past 24 hours? Over $600 million.

- Bitcoin is down 12% on the week, now 23% below its all-time high of $108,000.

- Ethereum has been hit even harder, still 53% below its 2021 peak of $4,878.

The broader market is down another 4%, fueled by inflation fears, Trump’s latest tariff threats, cooling meme coin momentum, and the $1.4 billion Bybit hack.

What’s Behind the Market Wipeout?

Traders are grappling with a storm of macroeconomic uncertainty:

- Trump’s expanding tariffs have raised concerns over global trade instability.

- Inflation worries and rate outlook confusion are keeping risk assets under pressure.

- Nvidia’s earnings report looms large, with markets watching closely—BTC’s volatility may be tied to traders positioning ahead of the results.

“These deep corrections are standard in BTC bull markets,” said Strahinja Savic of FRNT Financial. “We saw a big retracement in August before breaking $100K in November.”

Savic says the key level to watch now is Bitcoin’s 200-day moving average at $81,700—if BTC breaks below that, things could get worse.

Futures Liquidations Top $613M—Bitcoin Leads the Bloodbath

The liquidation numbers tell the story:

- $335 million in Bitcoin futures wiped out as leverage traders got caught off guard.

- Ethereum liquidations hit $115 million, adding to the selling pressure.

- Overall, $613 million in leveraged positions got erased in 24 hours, per CoinGlass data.

For now? Crypto is deep in risk-off mode—whether it’s a brutal but necessary correction or the start of something bigger remains to be seen.