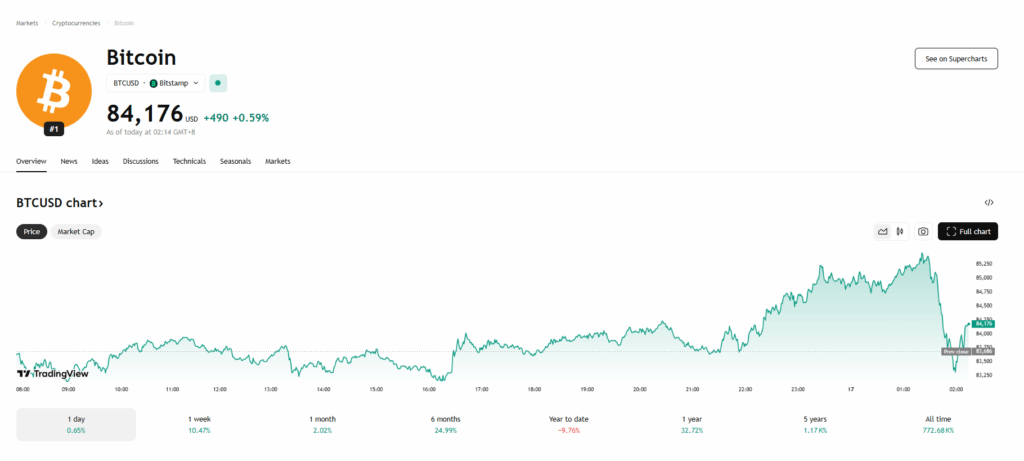

- Bitcoin’s rally toward $86K reversed fast after Fed Chair Powell warned of inflation and slow growth from Trump’s tariffs.

- Powell said the U.S. could face stagflation, with inflation rising and the economy slowing at the same time.

- Following Powell’s remarks, Bitcoin dropped to around $83,700 and the Nasdaq slid 3.4% to session lows.

Bitcoin made a solid push toward the $86,000 mark earlier Wednesday, giving the market a bit of optimism—until Jerome Powell stepped up to the mic. The Fed chair, during a speech that landed right in the middle of U.S. afternoon trading, had some pretty sobering words about the economic path ahead, especially with President Trump’s latest round of tariffs kicking in.

“The size of the tariff hikes so far is… honestly a lot bigger than what anyone expected,” Powell said. “And yeah, the impact will be just as outsized—expect more inflation, slower growth, probably both.”

Yep, that old chestnut: stagflation. Flashbacks to the ‘70s are creeping in again, when high prices met low growth, and basically nobody was winning.

Powell didn’t sugarcoat it. “We might find ourselves in a spot where our two main goals—stable prices and max employment—are pulling in opposite directions,” he added.

And the markets felt it right away.

Bitcoin, which had been climbing nicely earlier in the day, dropped around 2.5% almost immediately after Powell’s comments hit the wires. Last we checked, BTC was floating around $83,700—still above recent lows but clearly losing steam, down about 1.5% over the past 24 hours.

Wall Street didn’t fare any better. Stocks that were just starting to bounce back got clipped hard. The Nasdaq sank 3.4% to hit its session low—not exactly the recovery folks were hoping for.

So yeah, one speech was all it took to swing sentiment. Again.