- Mantra CEO John Mullin said OM token recovery is the team’s main focus, with a buyback plan still in the works.

- He denied claims that the team controls 90% of OM’s supply and pointed to public transparency reports.

- Mullin explained that recent large token movements were tied to ended Binance staking and collateral liquidations by an exchange.

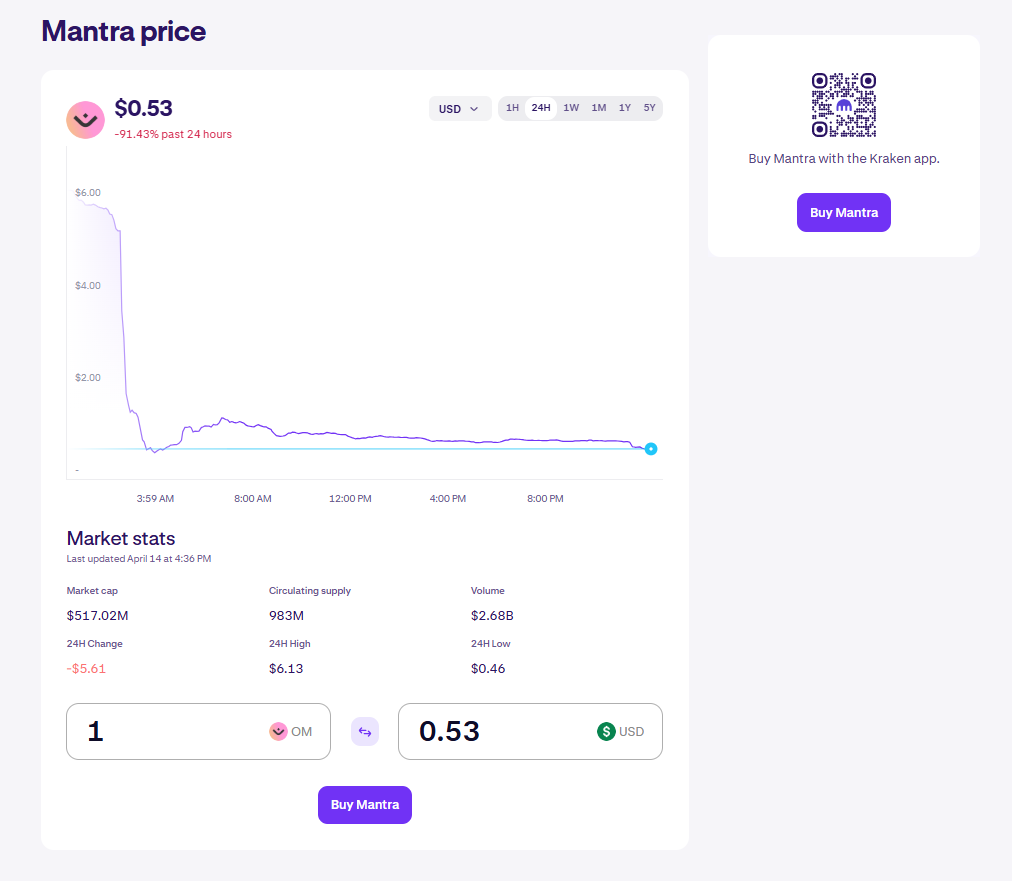

In a live AMA on April 14 hosted by Cointelegraph, Mantra CEO John Mullin tackled the elephant in the room: the sharp plunge in OM token prices that spooked investors and rattled the broader community.

“We’re still in early talks… but supporting OM’s recovery is our top focus right now,” Mullin said, responding to questions around possible token buybacks and burns. “It’s our preeminent concern—like, full stop.”

At the time of the AMA, OM was trading around $0.73—up slightly from its low of $0.52 on April 13, according to CoinGecko. But that rebound hasn’t calmed all nerves.

Clearing the Air on ‘Baseless’ Claims

Mullin didn’t hold back when it came to clearing up rumors—specifically the claims that the Mantra team had offloaded OM tokens right before the collapse, and that they secretly control 90% of the supply.

“That’s baseless,” he said bluntly. “We posted a transparency report. It breaks down wallet holdings—it’s all there.”

He pointed out that OM exists across two sides—Ethereum and the Mantra mainnet—with the Ethereum-based supply hard-capped since August 2020. The largest known holder on-chain? Binance, not the Mantra team.

That said, the top wallet currently belongs to OKX, holding about 14% of OM’s circulating supply—roughly 130 million tokens, based on Etherscan data.

Where’s the $109M Fund Going?

Mullin also provided updates on the Mantra Ecosystem Fund (MEF), a $109 million pool launched earlier this month with backing from heavy hitters like Laser Digital, Shorooq, and Brevan Howard Digital.

Contrary to online speculation, Mullin said the fund isn’t built entirely from OM tokens.

“There’s dollar contributions in there, not just tokens,” he explained. “And we’ll keep using it to back the ecosystem and get things back on track.”

Binance Transfers & Liquidation Woes

A few eyebrow-raising on-chain transfers stirred up more fear, including a 38 million OM transaction to a Binance cold wallet on April 14. Mullin clarified that this move was simply related to the end of a staking program.

“That was Binance just returning OM from staking—nothing more to it,” he said.

He also shed light on what triggered the crash in the first place, blaming cascading liquidations tied to collateral on an unnamed exchange.

“Once those tokens were no longer collateralized, the exchange started offloading ’em—and boom, more sell pressure, more liquidations,” Mullin said.

He emphasized that Mantra isn’t ducking the fallout.

“We’re not hiding,” he added. “It’s an unfortunate situation, but we’re facing it head-on—with full transparency.”