- SharpLink Gaming plans to raise $425 million to build a corporate Ethereum (ETH) treasury, with Consensys as the lead investor and Joseph Lubin (Ethereum co-founder) set to become chairman of the board once the deal closes.

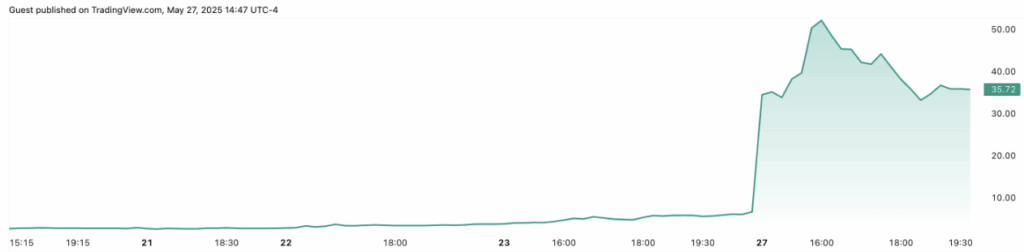

- The move mirrors Michael Saylor’s Bitcoin strategy, with major crypto VC firms like Pantera Capital and Galaxy Digital backing SharpLink’s ETH pivot—sending its stock price soaring over 430% on the news.

- This signals a growing trend of public companies adopting crypto treasuries beyond Bitcoin, as firms like Abraxas shift from BTC to ETH and others like Upexi pursue similar strategies with tokens like Solana.

In a move that’s got folks in the crypto world buzzing, Consensys founder and Ethereum co-creator Joseph Lubin is about to become the face of corporate ETH treasuries. And how? He’s stepping up as chairman of the board at SharpLink Gaming—a publicly traded company that’s planning to stockpile Ethereum like it’s going outta style.

On May 27, SharpLink, which does affiliate marketing for online casinos and sports betting sites, announced it’s planning to raise a chunky $425 million. The money’s going straight into building one of the first ETH-focused corporate treasuries. Big move. They’re selling over 69 million shares to do it—yeah, it’s got shades of that classic Saylor strategy from 2020.

ETH Treasuries: Saylor Walked, Lubin Runs?

Just like Saylor did with Bitcoin at MicroStrategy, SharpLink seems to be taking notes. Back in the day, Saylor flipped a business software firm into a BTC treasure chest. And now? Strategy (as it’s known now) holds 580,250 BTC, worth a wild $64 billion. That’s 2.74% of Bitcoin’s total supply. The latest? Saylor bought 4,020 more BTC for $427 million just a few days ago.

Now, Lubin’s bringing that same playbook—only with Ethereum. With Consensys leading the investment and crypto giants like Pantera Capital, Galaxy Digital, Hivemind, and others tagging along, this move isn’t just noise—it’s a full-on headline.

And yes, the market noticed. ETH pumped nearly 6% and is hanging out just under $2,700.

Ethereum, Meet Wall Street

This isn’t SharpLink’s first crypto rodeo, either. Back in February, they grabbed a 10% stake in a company behind a crypto casino. Fast forward to today—boom, they’re diving head-first into Ethereum. And markets? Well, they liked it. SharpLink’s stock exploded 430% on the news.

Lubin’s jazzed, too. In the press release, he called it “an exciting time for the Ethereum community,” saying he’s pumped to bring ETH into the public market spotlight. Once the deal’s done—likely around May 29—he’ll officially take the chair at SharpLink.

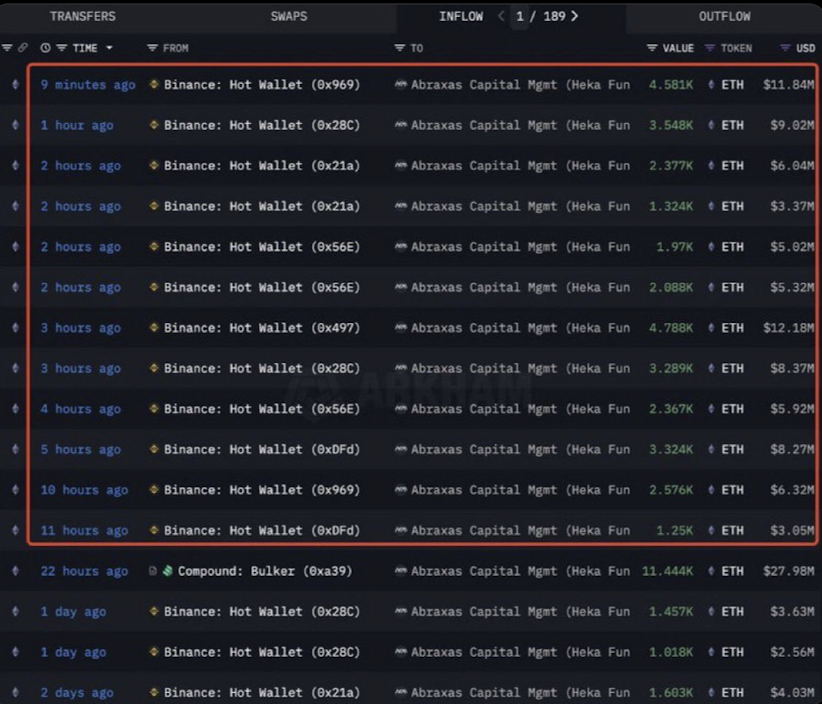

Oh, and let’s not forget Abraxas Capital. The private firm’s already sitting on nearly $1 billion in ETH. Earlier this month, they even dumped $150 million in BTC to go heavier on Ethereum. It’s not just a one-off, folks. These ETH treasury plays? They’re starting to feel like a trend.

And that other Nasdaq-traded company, Upexi? They’re dropping $100 million on SOL. So yeah, things are shifting.

Final Thought

SharpLink’s pivot into ETH, with Lubin at the helm, could be the beginning of something bigger. It’s not just about price speculation anymore—Ethereum is creeping into boardrooms. And if Lubin’s vision pans out, ETH might just be the next corporate darling. Buckle up.