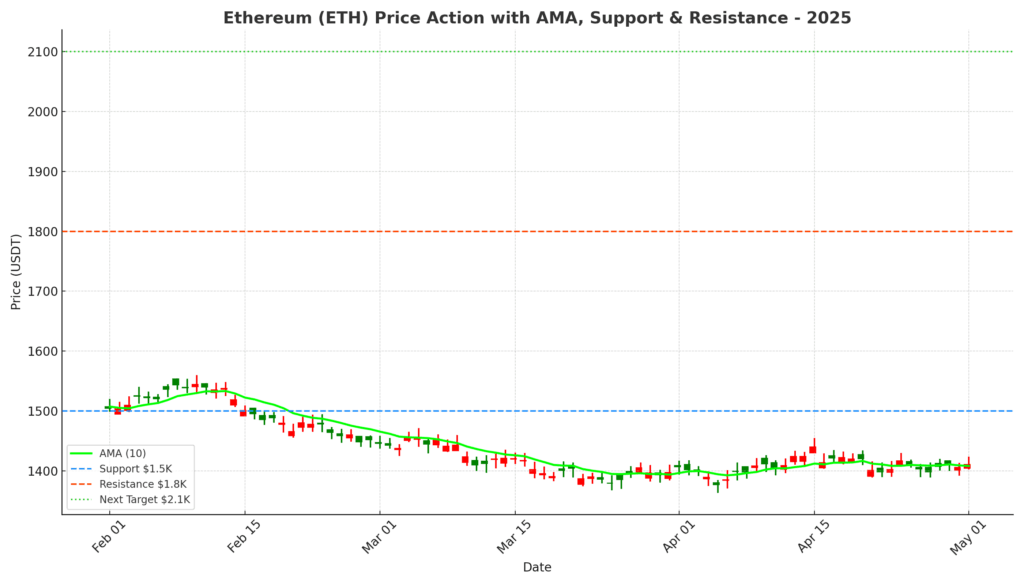

- Ethereum bounced hard from $1.5K support, now testing major resistance at $1.8K, with a breakout potentially targeting $2.1K next.

- Recent price surge was fueled mostly by spot market buying, with futures market funding rates still flat—showing cautious sentiment.

- Short-term consolidation likely around $1.8K, but if bulls push through, ETH could see a strong rally in the coming days.

Ethereum’s finally showing signs of life again after bouncing hard off that critical $1.5K support. Buyers came back swinging, and now ETH is pushing right up against a key wall at $1.8K. The big question now? Whether it’s strong enough to smash through—or if we’re about to see a little breather first.

Daily Chart: Critical Test at $1.8K Incoming

After weeks (seriously, it felt like forever) of just drifting sideways around $1.5K, Ethereum got a much-needed surge in buying pressure. That pop has sent the price straight toward $1.8K—which isn’t just some random number.

It’s an important order block zone, where smart money usually sets up shop. So yeah, breaking above this isn’t gonna be easy.

If bulls can finally shove ETH past $1.8K and hold it? That would probably confirm a major bullish reversal, and $2.1K could come into play pretty fast. But realistically, don’t be shocked if ETH chops sideways here a bit before making its next big move.

4-Hour Chart: Breakout Momentum Building

On the 4H chart, you can really see how that consolidation broke—ETH cracked out of its descending channel with a clean, impulsive move. Tons of buying came in at once, shoving the price right up to $1.8K.

Now, this area’s tricky. It matches up with previous swing lows, which means a lot of sellers are watching this level. Expect some short-term tug-of-war here. If ETH can build enough pressure and break through, it’s got a clear runway to $2.1K.

Sentiment Check: Funding Rates Stay Flat

Here’s where things get a little interesting. You’d expect that with ETH pumping, funding rates (which show how futures traders are betting) would spike higher. But… they haven’t.

Funding’s still kinda flat. That means this move is being driven mostly by spot market buyers—real, non-leveraged demand—which is usually a healthier setup early in a bull move.

Still, if funding doesn’t start picking up soon, it could hint that momentum might stall out. Ideally, you’d want to see rising funding rates soon, showing futures traders jumping on board too.

Ethereum’s made a strong comeback, but the real battle is happening now at $1.8K. Break it cleanly—and $2.1K could be next. Stall out? Could see a little cooling-off first.