- JPMorgan is set to let clients buy Bitcoin despite CEO Jamie Dimon’s skepticism about the asset.

- The bank’s shift follows its first public blockchain transaction, signaling growing acceptance of digital assets.

- Dimon still calls Bitcoin a “pet rock,” but says he supports clients’ right to invest in it.

One of the world’s largest investment banks, JPMorgan, is set to make a major leap into the cryptocurrency sector. CEO Jamie Dimon has confirmed that the bank will soon allow clients to buy Bitcoin, marking a significant shift in the bank’s approach. Despite Dimon’s personal skepticism about the digital asset, the decision aligns with the growing mainstream acceptance of cryptocurrencies.

The Journey to Bitcoin Acceptance

This change of stance didn’t just happen overnight. Earlier this year, JPMorgan made headlines when it completed its first public transaction of tokenized treasuries. The deal, executed with the help of Chainlink and Ondo Finance, marked a substantial move towards integrating blockchain technology into traditional finance. Now, allowing clients to purchase Bitcoin is the next logical step in this evolving strategy.

Dimon’s Skepticism Remains

Even as JPMorgan embraces Bitcoin for its clients, Jamie Dimon’s personal view of the asset remains unchanged. He has consistently labeled Bitcoin as a “Ponzi scheme” and even referred to it as a “pet rock.” However, Dimon maintains a pragmatic stance, saying that while he doesn’t believe in Bitcoin himself, he supports the right of others to invest in it.

A Strategic Expansion

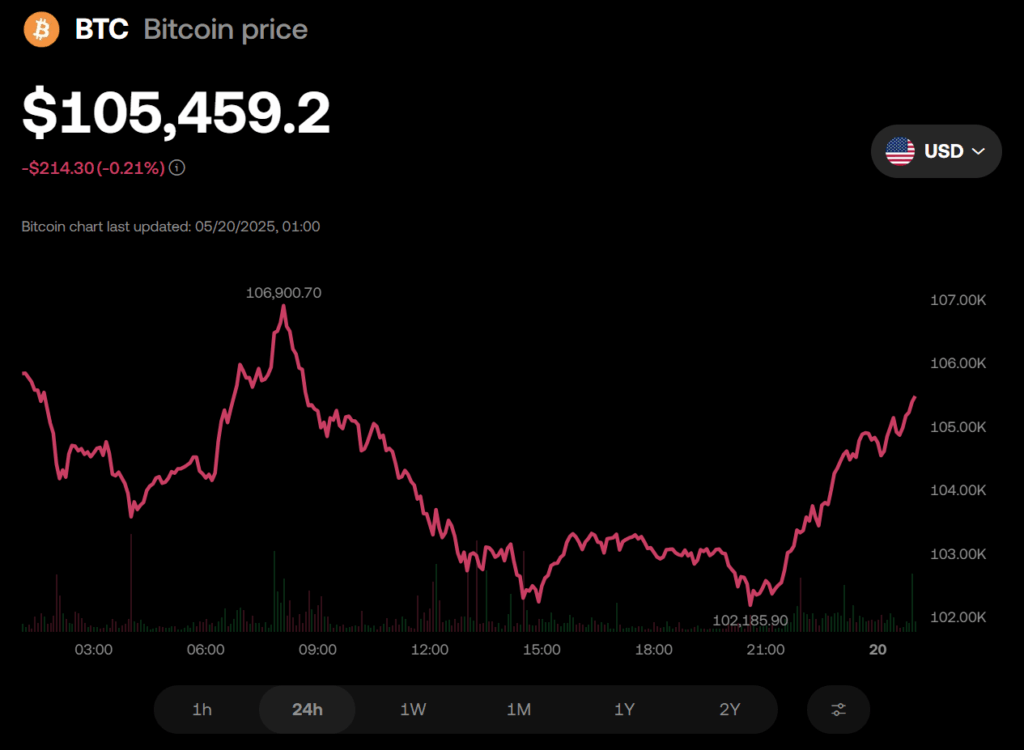

Despite his reservations, Dimon’s acknowledgment of client demand for Bitcoin signals a strategic expansion for JPMorgan. As the digital asset continues to approach new all-time highs in 2025, the bank’s move could attract more institutional and retail investors eager to explore the crypto space.