- JPMorgan completes its first public blockchain transaction of tokenized treasuries using Chainlink and Ondo Finance.

- The move signals a shift from JPMorgan’s private blockchain network to integrating public DeFi infrastructure.

- With Bank of America planning a stablecoin, major financial institutions are increasingly aligning with blockchain amid evolving US regulations.

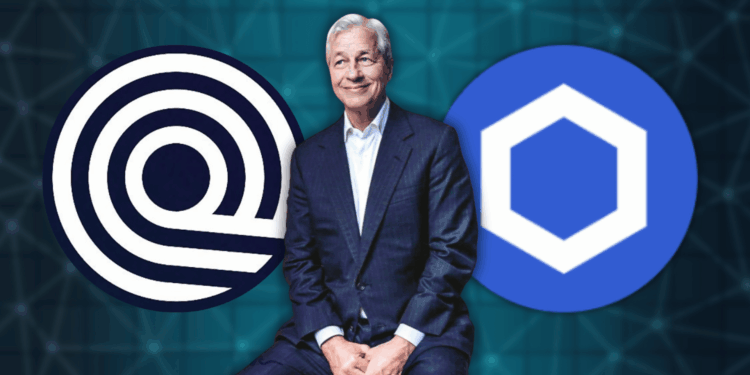

In a significant move for both the finance sector and blockchain adoption, JPMorgan has officially completed its first public transaction of tokenized treasuries. The $4 trillion asset manager partnered with Chainlink and Ondo Finance to settle the transaction, stepping beyond its private blockchain network for the first time. The development marks a crucial shift for JPMorgan, which had previously confined its blockchain activities to a “walled garden” approach. Now, by integrating public blockchain infrastructure, the bank is signaling a broader embrace of decentralized finance (DeFi) technology.

Blockchain Breakthrough – A New Era for JPMorgan

JPMorgan’s blockchain division, Kinexys, executed the transaction by transferring funds between two accounts on its private network before using Chainlink as a communication bridge to finalize the tokenized treasury on Ondo. Chainlink co-founder Sergey Nasarov emphasized the importance of the move, calling it “the beginning of something big.” The transaction isn’t just a one-off test – it’s a tangible step towards using public blockchain networks to facilitate traditional financial assets, a development that could pave the way for other financial institutions to follow suit.

Crypto Adoption Gains Momentum in Traditional Finance

JPMorgan’s shift comes amid a broader trend of major financial institutions embracing blockchain technology. Bank of America CEO Brian Moynihan recently confirmed that the bank is preparing to launch its own stablecoin, pending regulatory approval. With the US now under the first pro-crypto administration in its history, the regulatory landscape appears to be shifting toward more favorable conditions for digital assets. As institutions like JPMorgan and Bank of America increasingly dip their toes into blockchain waters, the line between traditional finance and crypto continues to blur.

The Bigger Picture – Will More Banks Follow?

While JPMorgan’s entry into public blockchain transactions is a groundbreaking move, it raises questions about what comes next. Will other financial giants follow suit? And if so, how quickly? Sergey Nasarov believes this is just the beginning, suggesting that the use of public blockchain networks could soon become the norm rather than the exception.

As regulatory clarity improves and more financial products are tokenized, JPMorgan’s latest transaction could serve as a template for how legacy financial institutions integrate blockchain – a potential tipping point for broader DeFi adoption.