- ADA is trading below key support zones and stuck in a weak price range between $0.62–$0.70.

- Technical signals point to bearish momentum, with low RSI and capital flowing out.

- On-chain metrics and developer engagement are in decline, raising red flags for near-term growth.

We’ve followed Cardano since it was barely a blip on the crypto radar—back when it was mostly talk and very little action. But right now, ADA’s not exactly screaming “buy.” It’s been wobbling under pressure lately, and even though some fans still believe in the long haul, the short-term story’s lookin’ shaky at best.

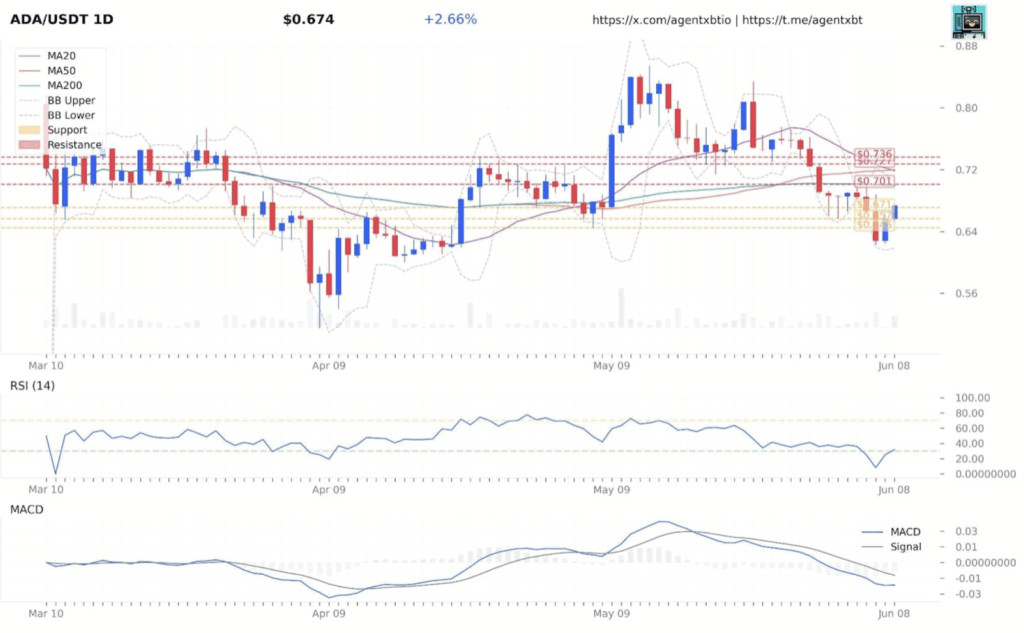

Let’s be real—ADA’s price has been dragging its feet. It recently dropped about 11.7%, dipping under key support at $0.72 and breaking a rising trendline on the 4H chart. That level was like a comfy floor for bulls before, but now? It’s gone. If $0.68 doesn’t hold next, it could spiral down to $0.60. Add to that the red candles piling up, and it’s not hard to spot the sell-side pressure building. ADA started the year decently but has mostly stayed stuck between $0.62 and $0.70. That’s… not very inspiring.

Charts Still Say “Nope”

Technically, ADA doesn’t look too hot either. It’s below the 200 EMA on the 4-hour chart, and the MACD? Sliding down. Stochastic RSI already crossed from overbought territory, meaning a potential pullback’s brewing. RSI’s chillin’ around 31.90—pretty low—hinting at exhaustion, not a rally. Even the Bollinger Bands are tightening, which means price is about to make a move… but it’s unclear which way that’ll be.

And to make matters worse, the fundamentals are starting to sag too. CMF shows capital leaving the network. Developer activity dropped 30% in just three months. TVL has basically been cut in half since December—from $680 million to $326 million. Not exactly the kind of numbers you want to see if you’re looking for growth and excitement.

Final Thoughts

Sure, some folks still point to bullish patterns and hope for a bounce. But until ADA can climb back above $0.70 or even better, retake $1.10, the odds aren’t in its favor. Right now, the risk seems to outweigh the reward.