- BlackRock added $539.7 million in Bitcoin over two days, now holding 53.6% of the U.S. Bitcoin ETF market.

- Bitcoin ETFs are absorbing way more BTC than miners are producing, pushing prices up.

- Fidelity jumped in too, buying both Bitcoin and Ethereum, signaling continued institutional demand.

In a move that’s got crypto watchers buzzing, BlackRock has doubled down—hard—on Bitcoin. On May 15, the financial titan snagged $409.7 million worth of BTC through its iShares Bitcoin ETF (IBIT), then followed up with another $130 million buy the very next day. That’s a two-day BTC binge totaling 5,181 coins, which now pushes IBIT’s total holdings to a whopping 631,962 BTC. For perspective, that’s more than half of the market share among all U.S.-listed Bitcoin ETFs—specifically, 53.6%.

Bitcoin ETFs Absorb More Than the Market Can Produce

Zooming out, the U.S. spot Bitcoin ETFs as a whole saw net inflows of $114.9 million on May 15 and a stronger $260.2 million the day after. That kind of momentum shows one thing: big money is still piling into Bitcoin, full speed ahead. While Bitcoin ETF managers bought up 26,700 BTC in the first half of May, miners only produced 7,200 BTC in the same stretch—meaning demand is outpacing supply by more than 3 to 1. That imbalance could fuel even more bullish action in the coming weeks.

Ethereum Trails, But Fidelity’s Not Ignoring It

Meanwhile, Ethereum ETFs have been on a bumpier ride. They saw a decent net outflow of $39.8 million on May 15, then bounced back with $22.2 million in inflows the following day. Fidelity, for its part, showed it’s not just here for Bitcoin. On May 17, it threw down $70 million on BTC and also scooped up $13.8 million worth of ETH. That makes it clear: TradFi players are still exploring both ends of the crypto spectrum.

Record-Setting Momentum for Bitcoin ETFs

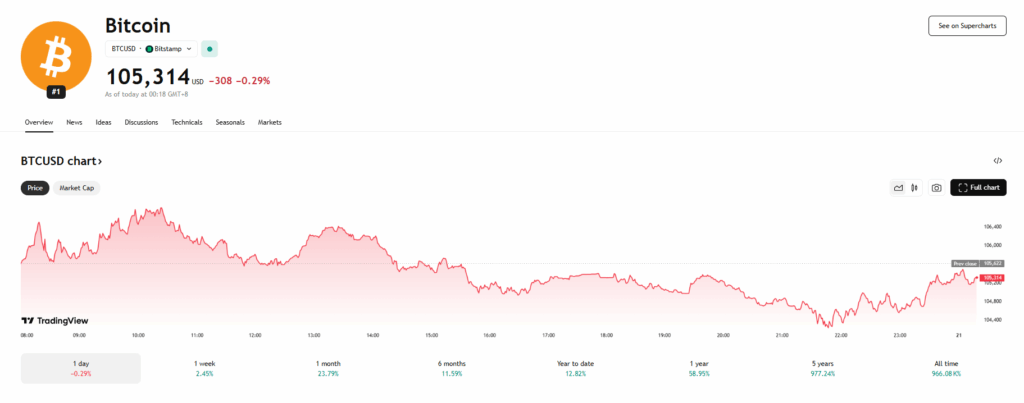

Since their launch in January 2024, Bitcoin ETFs have pulled in a staggering $41.489 billion in net inflows. That’s not just good—it’s record-breaking. Institutional interest seems to be hitting new highs monthly, with $2.97 billion flowing in during April alone and $2.64 billion already tallied for May. It’s no wonder Bitcoin is hovering around $102,700, showing the kind of strength that makes skeptics squirm.

Traditional Finance Can’t Ignore Crypto Anymore

With BlackRock throwing hundreds of millions at BTC in back-to-back buys, and Fidelity right behind them, it’s clear that crypto is no longer just a curiosity for Wall Street. It’s becoming part of the portfolio playbook. The broader message here? The gap between old-school finance and the crypto world is closing fast—and it’s not slowing down anytime soon.